- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

With A 25% Price Drop For LegalZoom.com, Inc. (NASDAQ:LZ) You'll Still Get What You Pay For

LegalZoom.com, Inc. (NASDAQ:LZ) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

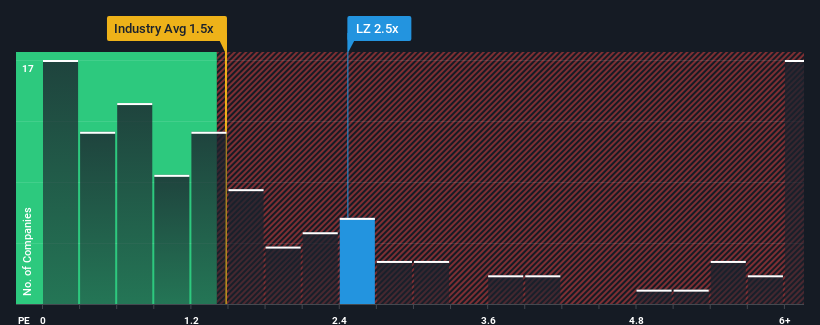

In spite of the heavy fall in price, you could still be forgiven for thinking LegalZoom.com is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in the United States' Professional Services industry have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for LegalZoom.com

How Has LegalZoom.com Performed Recently?

With revenue growth that's inferior to most other companies of late, LegalZoom.com has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LegalZoom.com.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like LegalZoom.com's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.1%. Pleasingly, revenue has also lifted 34% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the seven analysts watching the company. With the industry only predicted to deliver 7.2% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that LegalZoom.com's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Despite the recent share price weakness, LegalZoom.com's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of LegalZoom.com's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for LegalZoom.com with six simple checks on some of these key factors.

If you're unsure about the strength of LegalZoom.com's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives