- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

Some Confidence Is Lacking In LegalZoom.com, Inc.'s (NASDAQ:LZ) P/S

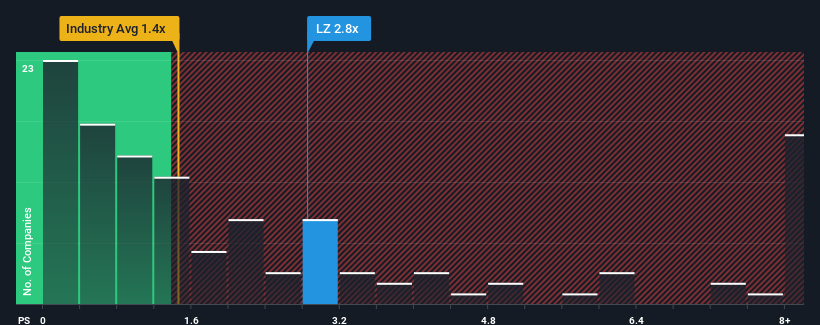

LegalZoom.com, Inc.'s (NASDAQ:LZ) price-to-sales (or "P/S") ratio of 2.8x may not look like an appealing investment opportunity when you consider close to half the companies in the Professional Services industry in the United States have P/S ratios below 1.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for LegalZoom.com

How Has LegalZoom.com Performed Recently?

With revenue growth that's inferior to most other companies of late, LegalZoom.com has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LegalZoom.com.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like LegalZoom.com's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.4% gain to the company's revenues. Pleasingly, revenue has also lifted 38% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.0% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.6%, which is not materially different.

With this in consideration, we find it intriguing that LegalZoom.com's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given LegalZoom.com's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for LegalZoom.com with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives