- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

LegalZoom (LZ): Evaluating Valuation After User Growth Outpaces Monetization and Free Cash Margin Expands

Reviewed by Kshitija Bhandaru

LegalZoom.com (LZ) just posted an annual boost in subscription units to 1.96 million, along with a marked improvement in free cash flow margin. These trends highlight the company’s focus on growing its core user base and operational efficiency.

See our latest analysis for LegalZoom.com.

LegalZoom.com’s steady expansion in subscription units and improved cash flow margin have caught investor attention. However, the latest 1-year total shareholder return of just 0.55% suggests that the market is still waiting to see sustained momentum. While efficiency gains are noteworthy, share price performance has been modest, which hints that investors want to see stronger evidence of long-term value creation.

If you’re tracking companies building momentum through growth and operational focus, it’s a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With LegalZoom.com showing both solid operational improvement and muted shareholder returns, the key question is whether these fundamentals are already priced in or if there could be a genuine buying opportunity as its growth story unfolds.

Most Popular Narrative: 13.4% Undervalued

Compared to its recent closing price of $10.08, the most widely followed narrative pins LegalZoom.com's fair value at $11.64. This suggests the market is yet to fully reflect anticipated growth and margin gains, setting the stage for one of the core reasons driving this higher valuation.

Growth in high-margin subscription products, bundled solutions, and successful acquisitions is increasing predictable revenues, customer retention, and driving strategic investment flexibility. Advances in AI, increased competition, cost pressures, declining retention, and regulatory risks collectively threaten LegalZoom's growth, margins, and long-term market position.

What could unlock this fair value? Behind this bullish price target are bold projections for margin expansion, earnings acceleration, and a profit multiple rivaling industry leaders. Want to see the numbers that power this forecast? Dig into the full narrative for the detailed financial playbook fueling LegalZoom.com’s potential upside.

Result: Fair Value of $11.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price competition and the threat from rapidly advancing AI solutions could reduce LegalZoom.com’s long-term growth and challenge the optimistic outlook for the stock.

Find out about the key risks to this LegalZoom.com narrative.

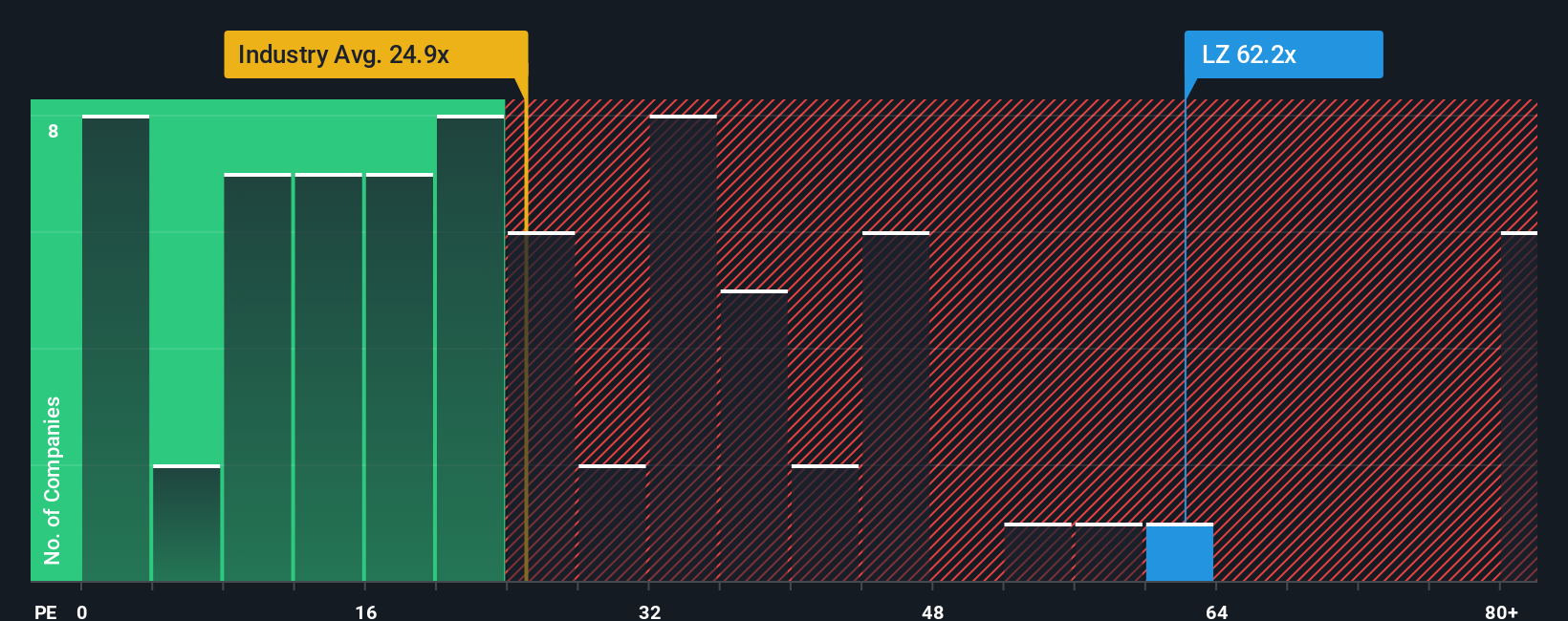

Another View: What Do Valuation Ratios Say?

While the fair value estimate points to LegalZoom.com being undervalued, its current price-to-earnings ratio sits at 63.2x. That is nearly double the industry average of 26.8x and far above its fair ratio of 33.3x. This wide pricing gap highlights a valuation risk if investor optimism fades. Are markets overpaying for growth, or do the numbers reflect a unique story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LegalZoom.com Narrative

If you want to investigate the numbers behind LegalZoom.com and form your own perspective, you can craft a personalized story using our tools in just a few minutes. Do it your way

A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Position yourself ahead of the crowd by expanding your watchlist with unique opportunities you simply can’t afford to overlook in today’s fast-moving markets.

- Uncover potential high-flyers by targeting these 3574 penny stocks with strong financials with stronger fundamentals and compelling growth stories you might have missed.

- Power up your tech portfolio by focusing on the innovators driving progress, and get direct access to these 25 AI penny stocks transforming the digital landscape.

- Boost your pursuit of stable passive income with these 19 dividend stocks with yields > 3% featuring companies with dividend yields above 3% for reliable long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives