- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Innodata (NasdaqGM:INOD) Jumps 38% As Q4 Sales Soar To US$59M

Reviewed by Simply Wall St

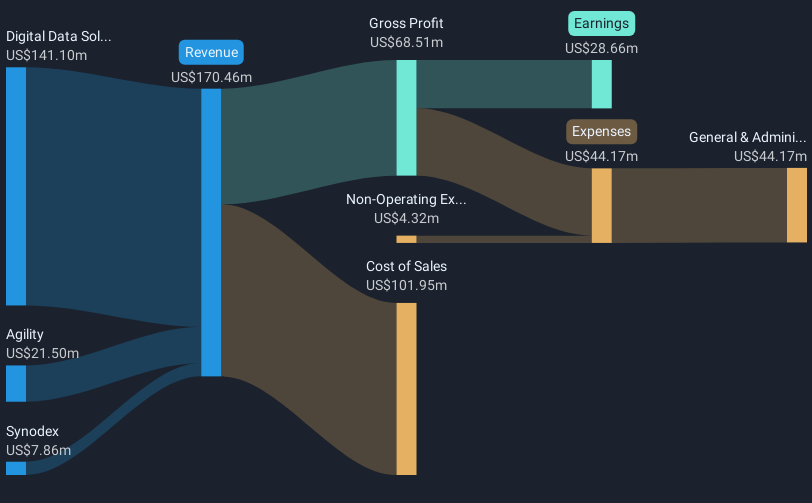

Innodata (NasdaqGM:INOD) experienced a significant price increase of nearly 38% over the past month, coinciding with positive corporate news. The company recently released its fourth-quarter earnings, reporting a remarkable growth in sales and net income compared to last year, reflecting a robust financial performance. With sales leaping to $59 million from $26 million and net income soaring to $10 million from $1.6 million, expectations have been heightened by the company’s guidance forecasting a 40% or more revenue growth for 2025. Despite broader market volatility, with the Dow Jones and S&P 500 experiencing mixed responses to tariff news, Innodata has shown resilience and captured investor attention. While the wider market has seen a recent dip and a 13% rise over the past year, Innodata's strong financial results and growth prospects seem to have driven the stock's impressive upward movement, setting it apart from broader economic concerns.

Navigate through the intricacies of Innodata with our comprehensive report here.

Over the past five years, Innodata's total shareholder return soared to a very large figure, highlighting a dramatic increase that has outpaced the broader market. This remarkable trajectory was supported by several key developments. One significant factor was the company becoming profitable, with earnings growing by 36.3% annually. This financial health is underscored by its strong return on equity, now at an outstanding 45.2%. Another contributing element was its aggressive growth strategy, as evidenced by the completion of a stock repurchase program in September 2024, reducing the share count by 5.8% and enhancing shareholder value.

Moreover, Innodata secured large-scale customer contracts in June 2024, expected to generate approximately US$44 million annually, providing a robust foundation for sustained revenue growth. Its entry into the Russell 2000 index further solidified its market position and confirmed its stability and growth potential. Despite legal challenges like the class-action lawsuit in February 2024, the company strategically capitalized on technological advancements, launching innovative products such as Intelligent Insights, reinforcing its competitive advantage in specialized data services.

- Learn how Innodata's intrinsic value compares to its market price with our detailed valuation report.

- Uncover the uncertainties that could impact Innodata's future growth—read our risk evaluation here.

- Got skin in the game with Innodata? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Innodata, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with proven track record.