- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Innodata (INOD): Evaluating Valuation as Generative AI and Federal Defense Growth Strengthen Fundamentals

Reviewed by Simply Wall St

Innodata (INOD) is leaning hard into its new role as a generative AI data engineering partner, and the early payoff is showing up in both its expanding tech relationships and improving profitability metrics.

See our latest analysis for Innodata.

The buzz around Innodata’s new generative AI and federal defense work comes against a choppier backdrop, with a 1 year total shareholder return of 35.08 percent but a weaker recent share price trend that suggests momentum is cooling after a powerful multi year run.

If Innodata’s shift toward mission critical AI work has caught your attention, this could be a good moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With Innodata shares still up strongly over one and three years but trading at a steep discount to analyst targets, the key question now is whether the recent pullback signals a fresh buying opportunity or reflects efficient pricing of future growth.

Most Popular Narrative: 45.9% Undervalued

With Innodata last closing at $50.75 against a fair value estimate of $93.75, the most followed narrative frames the gap as a sizable upside opportunity.

Increasing adoption of AI across industries requires curated and high quality datasets, and Innodata's evolving role from simple data provider to strategic partner (sitting "at the table" with clients' data scientists) is likely to support premium pricing, recurring contracts, and market share gains, with positive impact on both revenue stability and net margins.

Want to see how ambitious growth, shifting margins, and a punchy future earnings multiple all combine into that target price? The full narrative unpacks every assumption.

Result: Fair Value of $93.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a handful of big tech clients and rising automation in data annotation could quickly undermine the bullish, long-term growth story.

Find out about the key risks to this Innodata narrative.

Another Perspective on Valuation

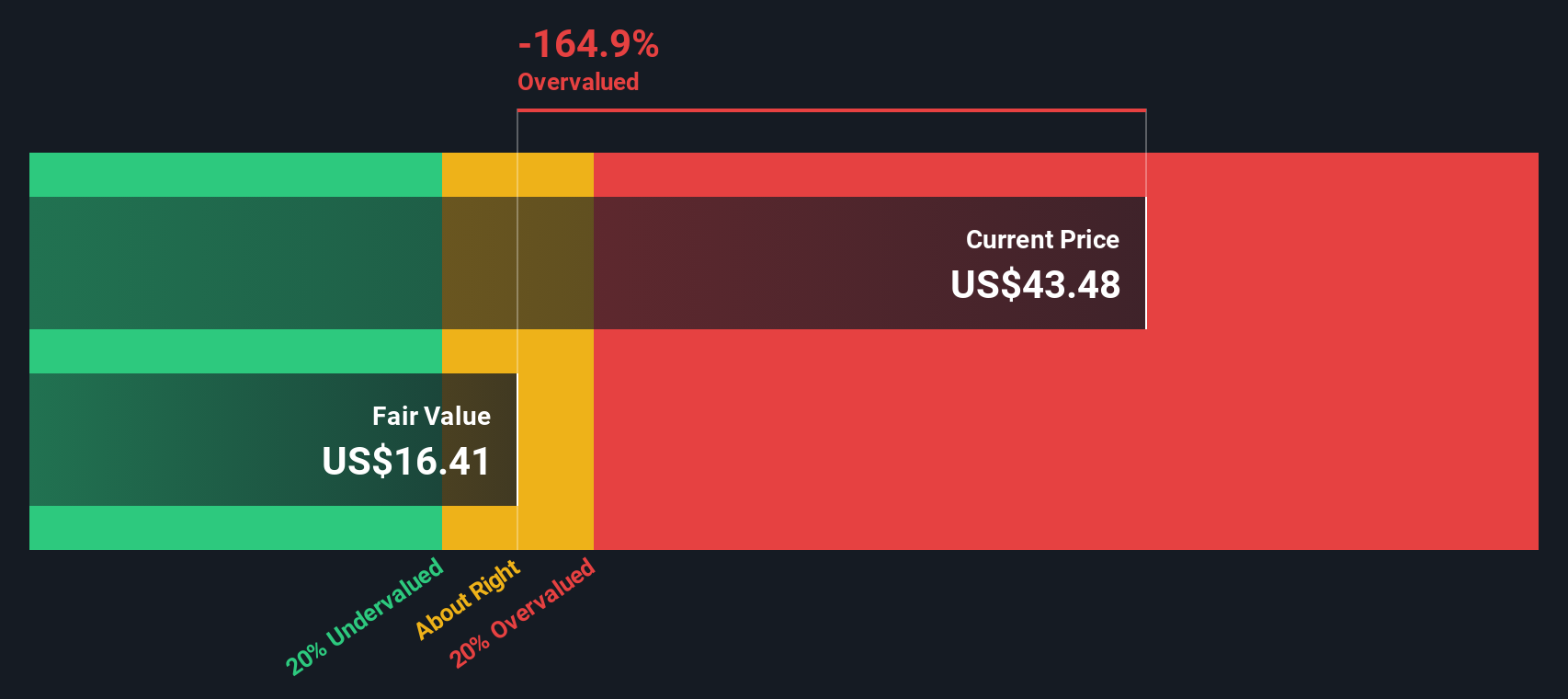

While the narrative model suggests Innodata is significantly undervalued, our DCF model paints a starkly different picture, indicating the shares may be overvalued at current prices. That kind of gap raises a simple question: which future cash flow path do you really believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Innodata Narrative

If you would rather challenge these assumptions and dig through the numbers yourself, you can quickly build a custom Innodata outlook in under three minutes: Do it your way.

A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next steps and explore fresh stock opportunities with targeted screeners that can refine your watchlist and support your portfolio decisions.

- Look for potential double digit movers by scanning these 3625 penny stocks with strong financials that pair low share prices with resilient balance sheets.

- Explore the next wave of automation by focusing on these 30 healthcare AI stocks applying machine learning to improve patient outcomes and clinical workflows.

- Identify cash flow potential by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)