- United States

- /

- Metals and Mining

- /

- OTCPK:XTGR.F

3 Promising Penny Stocks With Under $200M Market Cap

Reviewed by Simply Wall St

As the U.S. stock market experiences modest gains, with investors closely monitoring the banking sector and geopolitical developments, attention is turning to potential opportunities within smaller investments. Penny stocks, often perceived as relics of past market eras, continue to offer intriguing possibilities for those seeking affordable entry points coupled with growth potential. These stocks typically represent smaller or newer companies that may provide a unique blend of financial strength and opportunity for investors willing to explore beyond the major indices.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.82 | $398.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $672.69M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.56 | $275.75M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $5.00 | $843M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.905 | $55.9M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $22.88M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.17 | $559.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.98 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.54 | $81.79M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 362 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fuel Tech (FTEK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fuel Tech, Inc. focuses on developing and commercializing technologies for air pollution control, process optimization, and water treatment, with a market cap of $96.95 million.

Operations: The company generates revenue from two main segments: Fuel Chem, contributing $16.29 million, and Air Pollution Control, accounting for $8.78 million.

Market Cap: $96.95M

Fuel Tech, Inc., with a market cap of US$96.95 million, focuses on air pollution control and process optimization technologies. Despite being unprofitable, the company has reduced losses by 30.5% annually over five years and maintains a strong cash position with sufficient runway for more than three years. Recent orders totaling US$3.2 million from diverse regions highlight its expanding client base but revenue guidance for 2025 was adjusted down to US$28-29 million due to lowered sales expectations. The seasoned management team and absence of debt provide stability amidst challenges in achieving profitability, while earnings are forecasted to grow significantly at 73.36% annually according to consensus estimates.

- Unlock comprehensive insights into our analysis of Fuel Tech stock in this financial health report.

- Learn about Fuel Tech's future growth trajectory here.

Investview (INVU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Investview, Inc. is a financial technology services company operating both in the United States and internationally, with a market cap of $51.16 million.

Operations: The company generates revenue from international operations amounting to $34.4 million and domestic activities in the United States totaling $9.3 million.

Market Cap: $51.16M

Investview, Inc., with a market cap of US$51.16 million, operates in financial technology services. The company has shown improvement by reducing losses annually over the past five years and achieving positive shareholder equity from negative levels. Despite being unprofitable with a negative return on equity of -7.31%, Investview's short-term assets exceed both short and long-term liabilities, indicating solid financial management. Recent earnings reports show declining sales and revenue compared to the previous year, alongside a net loss for the first half of 2025. The company completed a share buyback program, repurchasing over 5 million shares for US$0.08 million, reflecting strategic capital allocation efforts amidst volatility in its share price and operations.

- Click here to discover the nuances of Investview with our detailed analytical financial health report.

- Gain insights into Investview's past trends and performance with our report on the company's historical track record.

Xtra-Gold Resources (XTGR.F)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xtra-Gold Resources Corp. is involved in the exploration and development of gold properties, with a market cap of $100.62 million.

Operations: Xtra-Gold Resources Corp. does not have reported revenue segments.

Market Cap: $100.62M

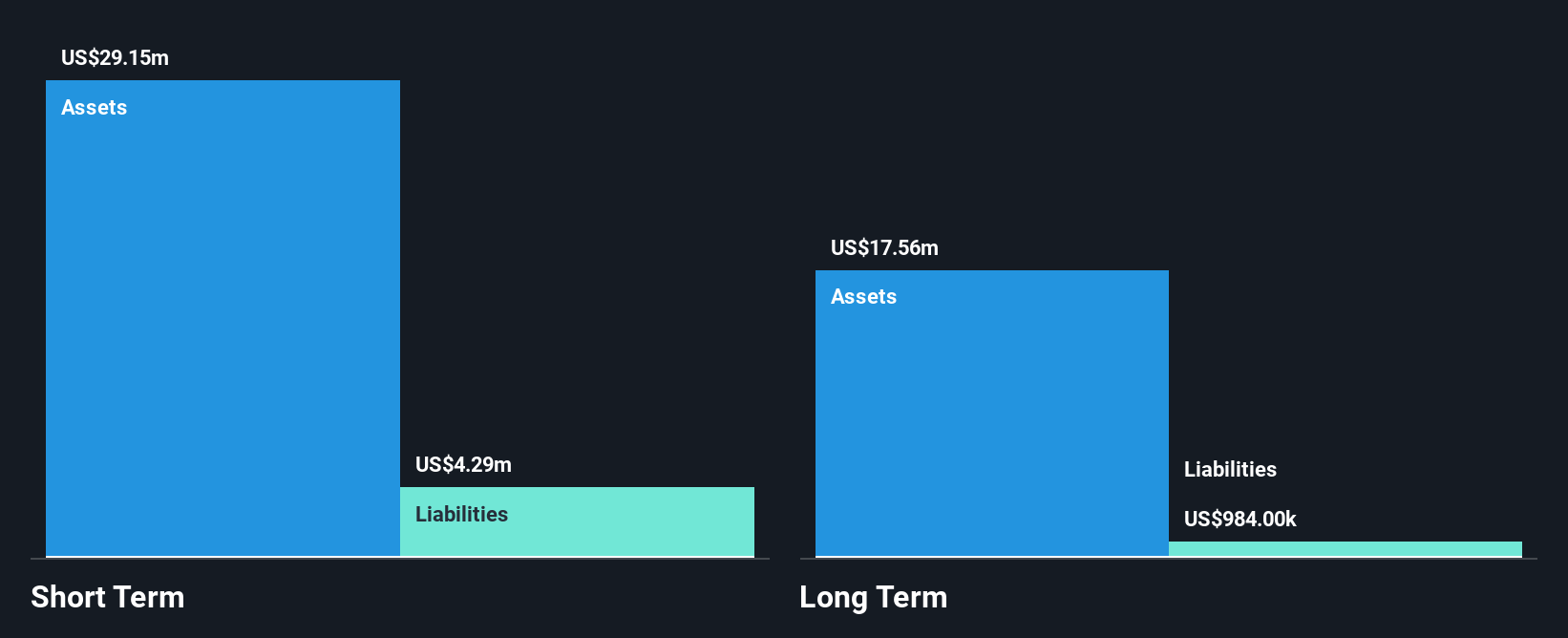

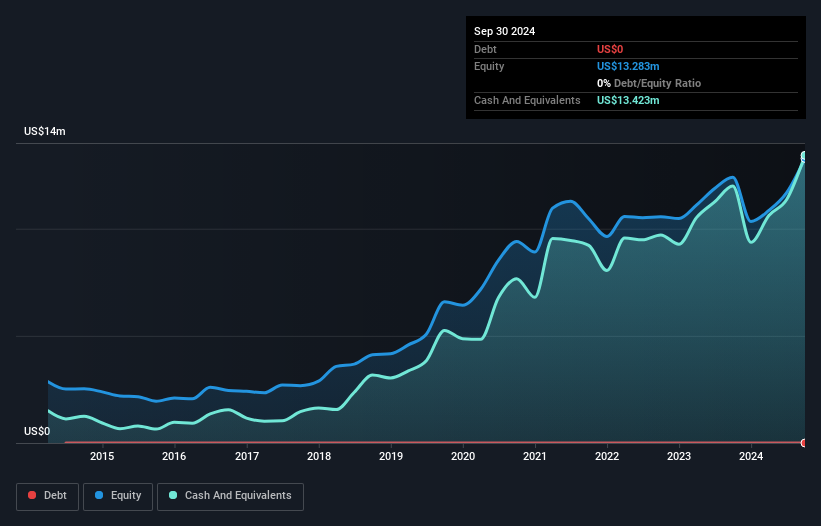

Xtra-Gold Resources Corp., with a market cap of US$100.62 million, is pre-revenue and has recently turned profitable, reporting net income of US$1.98 million for the first half of 2025. The company operates debt-free and possesses high-quality earnings, with short-term assets significantly exceeding liabilities. Recent strategic moves include acquiring a fourth diamond drill rig to accelerate exploration at its Kibi Gold Project in Ghana and announcing a private placement to raise US$1.5 million for further development efforts. Positive assay results from ongoing drilling programs suggest potential expansion of gold mineralization zones, enhancing resource growth prospects.

- Jump into the full analysis health report here for a deeper understanding of Xtra-Gold Resources.

- Assess Xtra-Gold Resources' previous results with our detailed historical performance reports.

Next Steps

- Dive into all 362 of the US Penny Stocks we have identified here.

- Want To Explore Some Alternatives? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:XTGR.F

Xtra-Gold Resources

Engages in the exploration and development of gold properties.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives