- United States

- /

- Professional Services

- /

- NasdaqGS:FA

First Advantage (FA): Exploring Valuation Following Global Recognition for Trustworthiness

Reviewed by Kshitija Bhandaru

First Advantage (FA) has been named to a prominent global list for trustworthiness, following independent surveys that measure how investors, customers, and employees view the company. This recognition highlights its reputation for integrity and transparency in HR technology.

See our latest analysis for First Advantage.

Despite being recognized for its global trustworthiness, First Advantage's recent momentum has been under pressure, with a 1-year total shareholder return of -29.1% and a year-to-date share price return of -22%. However, looking further back, its three-year total shareholder return stands at 16.7%, showing longer-term investors have still seen net gains. While the latest award spotlights the company’s reputation, the market seems cautious, at least for now, as investors await signs of a turnaround or stronger growth.

If you want to see which other companies are building positive momentum, now’s the time to discover fast growing stocks with high insider ownership

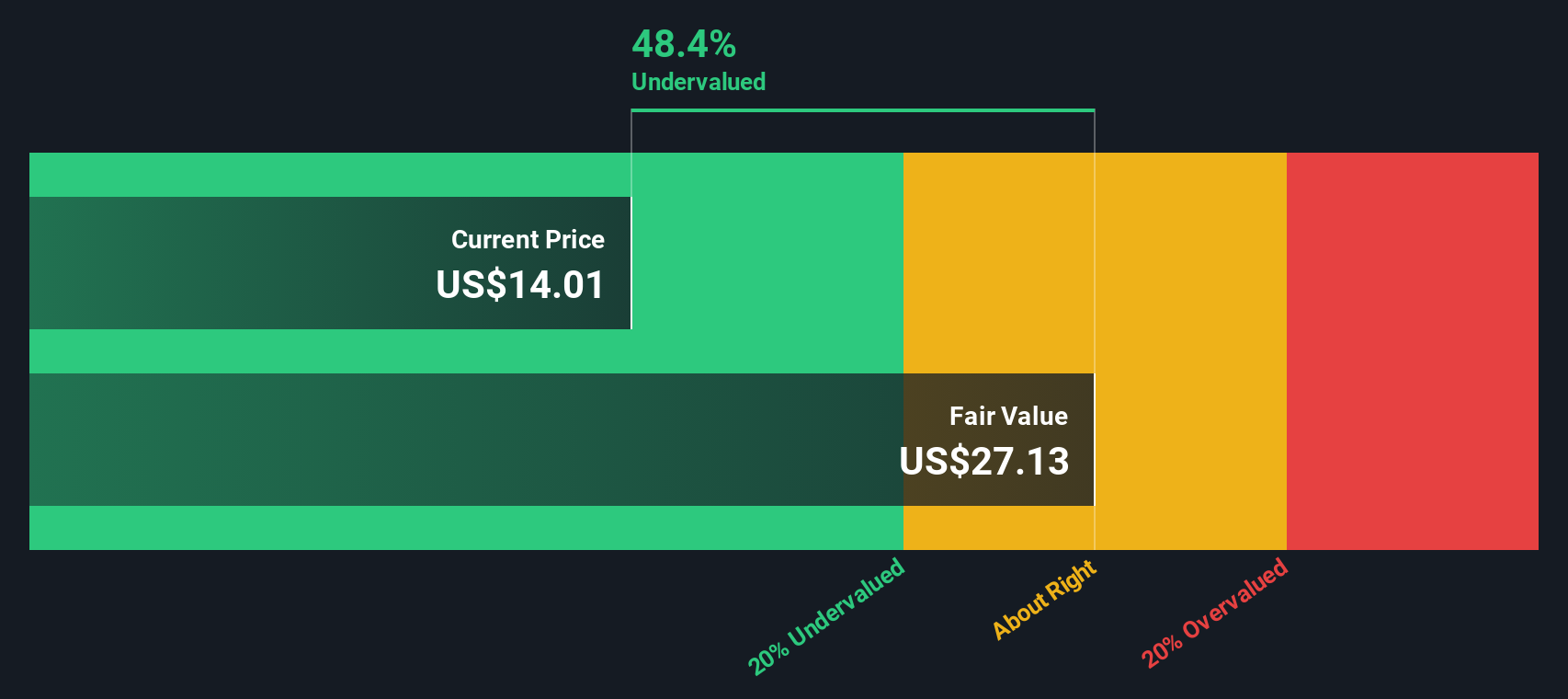

With shares currently trading at a sizable discount to analyst price targets and intrinsic estimates, investors may be wondering: Is First Advantage undervalued at these levels, or is the market already pricing in the company’s future growth?

Most Popular Narrative: 25% Undervalued

First Advantage’s most popular narrative forecasts a fair value price that’s a step above its latest closing price. With shares trading at $14.35 and narrative-driven fair value set at $19.14, the current market discount stands out, setting the stage for a deeper look at the outlook behind this valuation.

Ongoing investments in proprietary AI-enabled technology, automation, and integrated platforms (particularly following the Sterling acquisition) are unlocking operational efficiencies and enabling more high-margin value-added services, creating potential for margin expansion and higher net earnings.

What’s fueling that valuation? Here’s a teaser: the growth runway in this forecast isn’t just about higher sales. There is a bold call on how margins and future earnings power are expected to transform the company’s profile. Ready to discover what numbers could drive First Advantage to narrative fair value?

Result: Fair Value of $19.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if hiring volumes weaken further or the new Digital Identity segment underperforms, First Advantage's bullish narrative could quickly come under pressure.

Find out about the key risks to this First Advantage narrative.

Another View: Is the Discount as Big as It Seems?

While the narrative-driven fair value uses growth assumptions to set a target price, our DCF model takes a different approach by focusing on projected cash flows. Using this method, First Advantage may be even more undervalued, with shares trading well below the estimated fair value of $27.25. If both models point to opportunity, why is the market still holding back?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Advantage Narrative

If the numbers or outlook above don't align with your perspective, dive into the data firsthand and craft your unique view in just a few minutes. Do it your way

A great starting point for your First Advantage research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Investing isn’t just about one opportunity, so don’t let this be where your search ends. Supercharge your portfolio by tapping into investment angles you might be missing:

- Uncover fresh growth with these 24 AI penny stocks, which are reshaping industries and setting new standards for innovation and efficiency across global markets.

- Secure steady income by checking out these 18 dividend stocks with yields > 3%, featuring companies with yields above 3% and a strong track record of rewarding shareholders.

- Catch the next wave in digital finance by evaluating these 79 cryptocurrency and blockchain stocks as blockchain technology opens doors to remarkable new investment frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FA

First Advantage

Provides employment background screening, identity, and verification solutions worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives