- United States

- /

- Professional Services

- /

- NasdaqGS:FA

First Advantage Corporation's (NASDAQ:FA) P/S Is Still On The Mark Following 31% Share Price Bounce

First Advantage Corporation (NASDAQ:FA) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

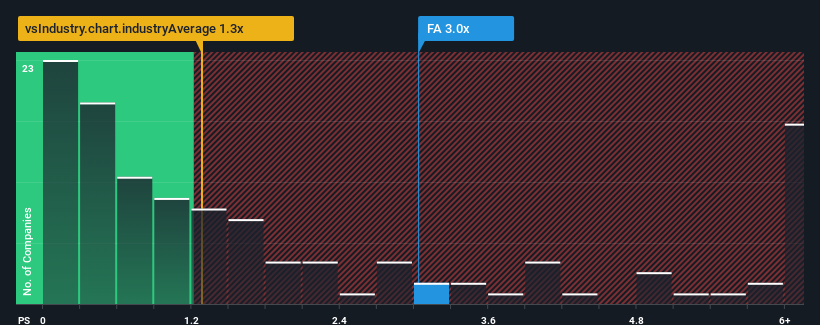

Following the firm bounce in price, you could be forgiven for thinking First Advantage is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in the United States' Professional Services industry have P/S ratios below 1.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We've discovered 2 warning signs about First Advantage. View them for free.See our latest analysis for First Advantage

How Has First Advantage Performed Recently?

First Advantage certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think First Advantage's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

First Advantage's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 38%. The strong recent performance means it was also able to grow revenue by 36% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 49% over the next year. With the industry only predicted to deliver 7.6%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why First Advantage's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On First Advantage's P/S

The large bounce in First Advantage's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that First Advantage maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Professional Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for First Advantage you should be aware of, and 1 of them shouldn't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FA

First Advantage

Provides employment background screening, identity, and verification solutions worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives