- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

Will CSG Systems International’s (CSGS) F1 Sponsorship Shift Its Competitive Position in Customer Engagement?

Reviewed by Sasha Jovanovic

- The MoneyGram Haas F1 Team recently announced a partnership with CSG Systems International, debuting their collaboration at the 2025 Formula 1 United States Grand Prix in Austin, Texas, to showcase shared values of innovation and agility.

- This partnership brings CSG’s customer engagement expertise into the global spotlight, linking its brand to the fast-paced and high-profile world of Formula 1 racing.

- We’ll examine how the Formula 1 tie-up positions CSG for greater brand visibility and diversification within its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CSG Systems International Investment Narrative Recap

Owning shares in CSG Systems International means believing in the company's ability to diversify beyond its telecom base and drive contract growth, especially through advanced customer engagement platforms. The recent Formula 1 partnership enhances global brand visibility but does not have a material near-term effect on primary catalysts such as client wins in high-growth verticals or on the chief risk involving revenue concentration with Charter and Comcast. This news primarily adds momentum to CSG’s efforts to reposition itself as an agile, innovative technology partner, rather than changing its overall risk profile or short-term earnings outlook.

Among recent corporate announcements, the September 2025 long-term contract renewal with Charter Communications stands out as most relevant. This multi-year extension is directly tied to the company's catalyst of deepening SaaS adoption with key clients, reinforcing revenue stability at a time when customer concentration risks remain high despite CSG’s push for diversification. For investors, the link between strengthening large client relationships and continued expansion into new sectors could drive longer-term growth, while also exposing the business to familiar concentration challenges if a major contract is lost or renegotiated.

By contrast, investors should also consider how concentration among top clients can quickly shift the risk profile if...

Read the full narrative on CSG Systems International (it's free!)

CSG Systems International's narrative projects $1.2 billion in revenue and $120.4 million in earnings by 2028. This requires a 0.3% annual revenue decline and a $38.4 million earnings increase from current earnings of $82.0 million.

Uncover how CSG Systems International's forecasts yield a $77.29 fair value, a 19% upside to its current price.

Exploring Other Perspectives

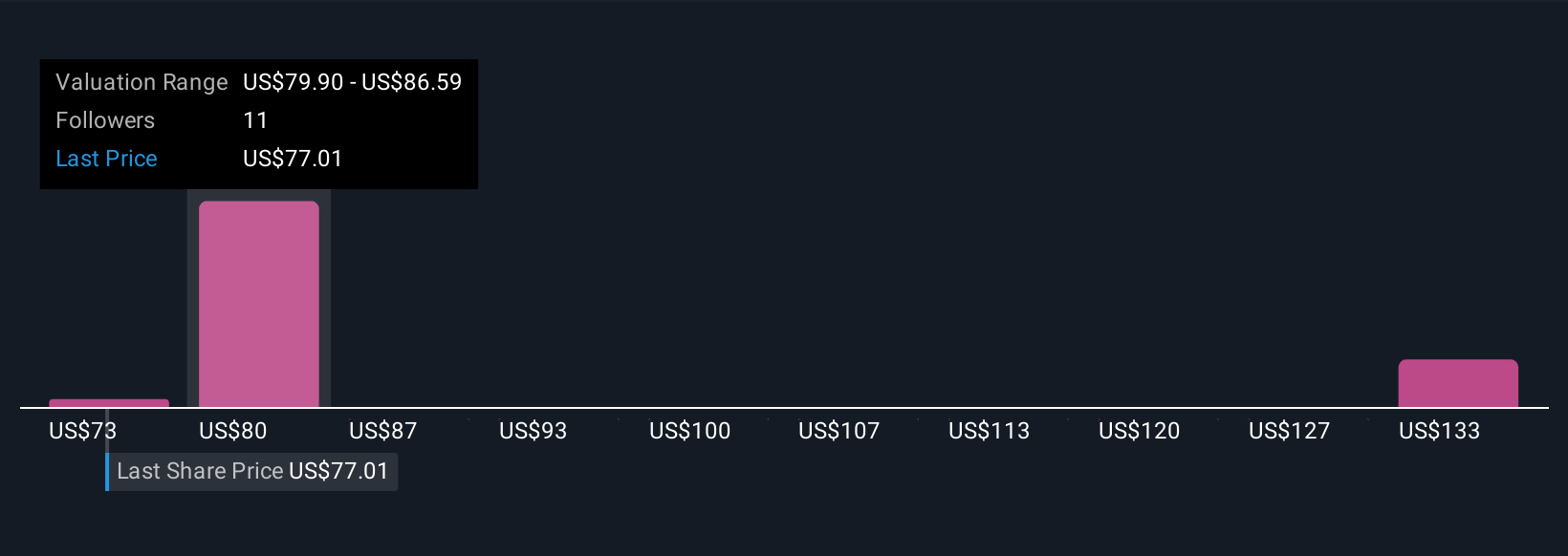

Three Simply Wall St Community valuations for CSG Systems International range from US$73.20 to US$136.14 per share. Yet, many still focus on revenue concentration risk which could quickly change growth expectations, see how different investors weigh these factors.

Explore 3 other fair value estimates on CSG Systems International - why the stock might be worth just $73.20!

Build Your Own CSG Systems International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSG Systems International research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSG Systems International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSG Systems International's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives