- United States

- /

- Machinery

- /

- NYSE:XYL

Xylem (NYSE:XYL) Projects $8.5B Revenue for 2024 Amidst Strong Earnings and Strategic Leadership

Reviewed by Simply Wall St

Navigate through the intricacies of Xylem with our comprehensive report here.

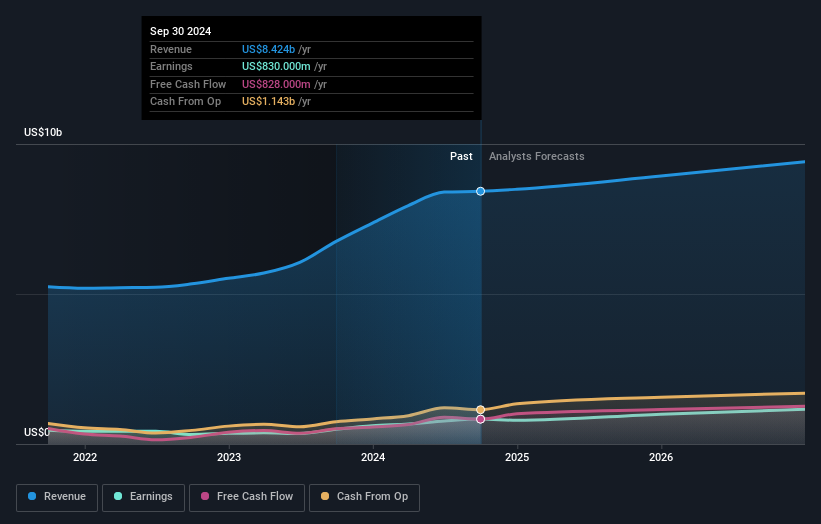

Competitive Advantages That Elevate Xylem

With strong financial health, Xylem has demonstrated significant earnings growth of 68.7% over the past year, and an impressive 15.9% annual growth over five years. The company maintains a low net debt to equity ratio of 9.5%, showcasing financial stability. Its dividend payments have been stable over the past decade, reflecting reliability. Leadership, led by Matthew Pine, has effectively steered the company towards a 15% revenue increase in the latest quarter, driven by innovative products and strong demand. The strategic guidance update, projecting $8.5 billion in revenue for 2024, highlights confidence in sustained growth.

Strategic Gaps That Could Affect Xylem

Xylem's valuation poses challenges. The Price-To-Earnings Ratio stands at 35.8x, higher than both peer and industry averages, indicating a potential overvaluation. Return on Equity is at 7.8%, below the desired threshold, which could signal inefficiencies. The earnings growth forecast of 14.1% lags behind the US market's 15.2%, suggesting potential underperformance. Additionally, operational costs have risen by 10%, impacting margins despite revenue growth, as noted in the latest earnings call.

Future Prospects for Xylem in the Market

Opportunities abound as Xylem trades below its estimated fair value, with analysts predicting a target price over 20% higher than the current share price. The company's focus on smart water management solutions, evidenced by the recent North Battleford project, positions it well for future growth. Strategic alliances with municipalities have resulted in long-term contracts, ensuring stable revenue streams. The appointment of Meredith Emmerich as Senior VP and President of Applied Water is expected to enhance strategic direction in industrial and commercial markets.

Regulatory Challenges Facing Xylem

External threats include economic uncertainties and regulatory hurdles that could affect operations and cost structures. The company is vigilant about new regulations, which could impact financial performance. Supply chain disruptions have also been noted, affecting timely demand fulfillment. These challenges require strategic planning to mitigate risks and sustain growth momentum.

See what the latest analyst reports say about Xylem's future prospects and potential market movements.Conclusion

Xylem's financial health, marked by a 68.7% earnings growth over the past year and a low net debt to equity ratio of 9.5%, underscores its financial stability and reliability in dividend payments. However, its Price-To-Earnings Ratio of 35.8x suggests it's trading higher than industry norms, indicating a premium on its current earnings, yet analysts see potential for a 20% share price increase based on future cash flows. While its Return on Equity of 7.8% points to potential inefficiencies, the company's strategic focus on smart water management and long-term municipal contracts positions it for sustained growth. Despite rising operational costs and regulatory challenges, strategic leadership changes and innovative projects could enhance its market position, supporting a confident revenue projection of $8.5 billion by 2024.

Key Takeaways

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives