- United States

- /

- Machinery

- /

- NYSE:WAB

Westinghouse Air Brake Technologies (NYSE:WAB) Sees Growth in Digital Sales and International Orders

Reviewed by Simply Wall St

Westinghouse Air Brake Technologies (NYSE:WAB) has recently demonstrated strong earnings growth, with a 39.7% increase over the past year, bolstered by a 4.5% rise in sales driven by both Freight and Transit segments. However, the company faces challenges such as a low Return on Equity and a high Price-To-Earnings Ratio, which may impact its attractiveness to certain investors. This report will explore Wabtec's market position, internal limitations, emerging opportunities, and competitive pressures.

Unique Capabilities Enhancing Westinghouse Air Brake Technologies's Market Position

Wabtec's recent performance has been marked by impressive earnings growth, with a 39.7% increase over the past year, surpassing its five-year average of 22.7% per year. This growth is supported by strong sales figures, as highlighted by CEO Rafael Santana, who noted a 4.5% increase in sales to $2.7 billion, driven by both Freight and Transit segments. The company's backlog, which has grown to $7.6 billion, and strong cash flow of $542 million, further underscore its financial health. These elements, coupled with a forecasted earnings growth of 15.94% annually, position Wabtec favorably in the market.

Internal Limitations Hindering Westinghouse Air Brake Technologies's Growth

Wabtec faces challenges such as a low Return on Equity of 10.4%, which falls below the industry threshold of 20%. Additionally, its revenue growth forecast of 5.7% per year lags behind the US market average of 9.1%. The company's Price-To-Earnings Ratio of 34x, significantly higher than the industry average of 24.8x, suggests a premium valuation. This high valuation, while indicative of investor confidence, may also limit its appeal to value-focused investors. Furthermore, Wabtec's dividend yield of 0.39% is notably lower than the top 25% of US market dividend payers, which could deter income-focused investors.

Emerging Markets Or Trends for Westinghouse Air Brake Technologies

The international market presents significant opportunities for Wabtec. As Santana mentioned, investments in infrastructure expansion and upgrades are fueling a strong pipeline for international locomotive orders, marking the strongest demand in five years. The company's focus on digital and technological advancements, such as the 12.7% increase in Digital Intelligence sales, positions it to capitalize on trends in automation and digitalization. These initiatives could enhance Wabtec's market position and drive future growth, aligning its revenue growth more closely with market averages.

Competitive Pressures and Market Risks Facing Westinghouse Air Brake Technologies

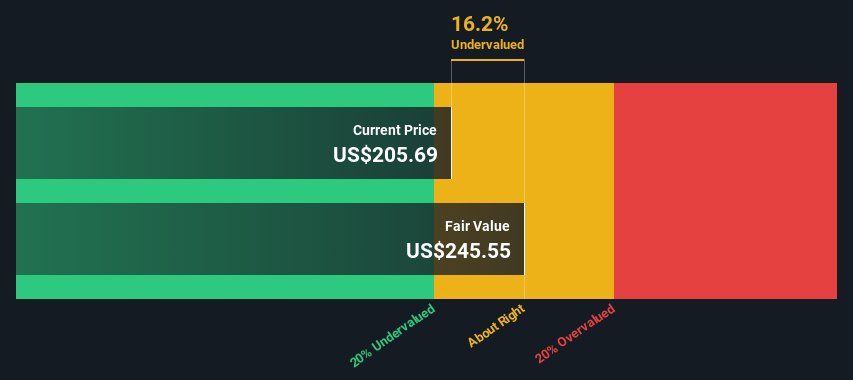

Regulatory and environmental challenges pose significant threats, as highlighted by Santana's comments on the push for decarbonization and sustainable transportation solutions. These pressures necessitate strategic adaptation and innovation. Additionally, economic uncertainties and market volatility, as noted by CFO John Olin, could impact growth trajectories, requiring cautious planning and risk management. While Wabtec is trading above its estimated fair value of $199.86, the limited upside potential indicated by the target price suggests that market conditions could constrain its stock performance.

Conclusion

Westinghouse Air Brake Technologies (Wabtec) is strategically positioned for growth, supported by strong earnings and a solid sales performance, which have resulted in a notable increase in its backlog and cash flow. However, the company's low Return on Equity and a revenue growth forecast that lags behind the US market average indicate potential areas for improvement. The high Price-To-Earnings Ratio of 34x, significantly above industry and peer averages, reflects strong investor confidence but may limit appeal to value-focused investors. Despite these challenges, Wabtec's investments in digital technology and international markets present significant growth opportunities, particularly in automation and infrastructure expansion. The company's ability to navigate regulatory and environmental pressures will be crucial in maintaining its market position and achieving sustainable growth in the face of economic uncertainties.

Taking Advantage

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Westinghouse Air Brake Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives