- United States

- /

- Machinery

- /

- NYSE:WAB

Westinghouse Air Brake Technologies (NYSE:WAB) Announces Quarterly Dividend of US$0.25 Per Share

Reviewed by Simply Wall St

Westinghouse Air Brake Technologies (NYSE:WAB) made headlines this month with its Board's decision to maintain a quarterly dividend of 25 cents per share, demonstrating the company's commitment to shareholder returns. The stock's 18% rise during the month aligns with broader market trends, where indexes marked gains amid positive economic indicators and trade developments. The company's strong quarterly earnings performance, with increased revenue and net income, further reinforced investor confidence. The reaffirmation of its earnings guidance for 2025 added to this upward momentum, while market trends showed resilience, posting significant index growth, contributing to the stock’s positive move.

We've identified 1 weakness for Westinghouse Air Brake Technologies that you should be aware of.

The recent decision by Westinghouse Air Brake Technologies to maintain its quarterly dividend amidst rising share prices reflects the company’s focus on solidifying shareholder returns. This announcement aligns with the company's longer-term performance, where total shareholder return was 267.91% over the past five years, underscoring strong historical growth and investor confidence. Over the past year, WAB's share performance exceeded both the US Market, which returned 10.6%, and the US Machinery industry, which returned 1.6%.

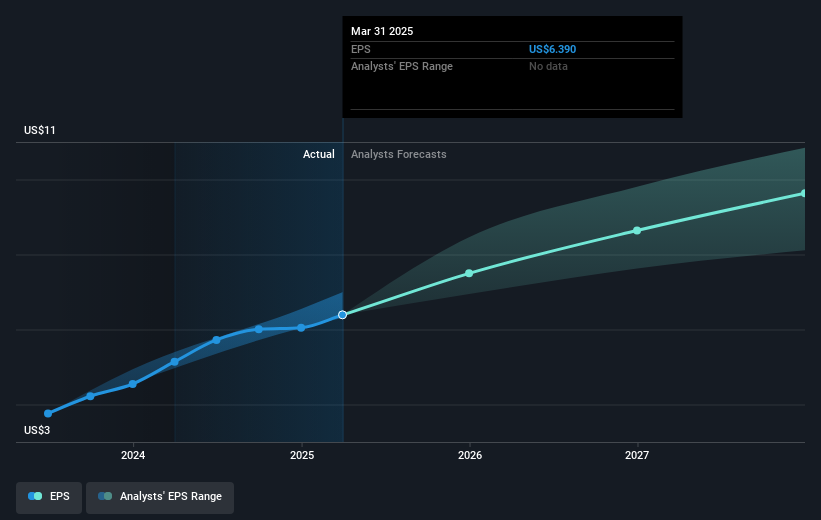

The company's reaffirmed earnings guidance and strategic market positioning are set to propel its revenue and earnings forecasts. With the global demand for locomotives and digital technologies driving future growth, the maintained dividend and positive earnings expectations can reinforce investor sentiment. Analysts anticipate earnings to grow from US$1.1 billion to an estimated US$1.7 billion by 2028, further solidifying the company’s growth trajectory.

With WAB's current share price relatively close to the consensus analyst price target of US$211.36, the 18% recent rise in stock value is notable. The stock price sits at a 10% discount to this target, suggesting room for potential appreciation, given the favorable revenue and earnings outlook. Investors are encouraged to evaluate these projections against their assumptions to assess potential investment risks and opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives