- United States

- /

- Machinery

- /

- NYSE:WAB

Is Wabtec (WAB) Still Undervalued After Its Recent Share Price Strength?

Reviewed by Simply Wall St

Westinghouse Air Brake Technologies (WAB) has quietly turned into a long term compounder, and the recent move in the stock is a good excuse to revisit how its fundamentals stack up.

See our latest analysis for Westinghouse Air Brake Technologies.

The latest move to a share price of $208.38 caps a steady run, with a roughly mid single digit 90 day share price return and a triple digit three year total shareholder return. This signals that the long term momentum story is still very much intact.

If WabTech’s trajectory has you thinking about where else durable growth might be hiding, this could be a good moment to explore aerospace and defense stocks as potential next candidates.

With double digit earnings growth and the share price brushing up against analyst targets, the key question now is whether WabTech still trades below its true worth or if the market has already priced in years of expansion.

Most Popular Narrative Narrative: 10.9% Undervalued

Against a last close of $208.38, the most followed valuation narrative points to a higher fair value, framing today’s price as a relative discount.

Strategic, accretive acquisitions (Inspection Technologies, Frauscher, DeLiner Couplers) are expanding Wabtec's technological capabilities and global market share, with management expecting both immediate and substantial incremental EBITDA, margin expansion, and realization of cost/growth synergies to drive improved net margins and free cash flow over the next several years.

Want to see the math behind this upside call, from revenue runway to margin lift and future earnings power, and how it all compounds? The full narrative unpacks the growth curve, the profitability reset, and the valuation multiple that has to hold for this price to make sense.

Result: Fair Value of $233.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer North American freight demand, along with heavier reliance on acquisitions and leverage, could easily derail the current margin and growth assumptions.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.

Another Way to Look at Value

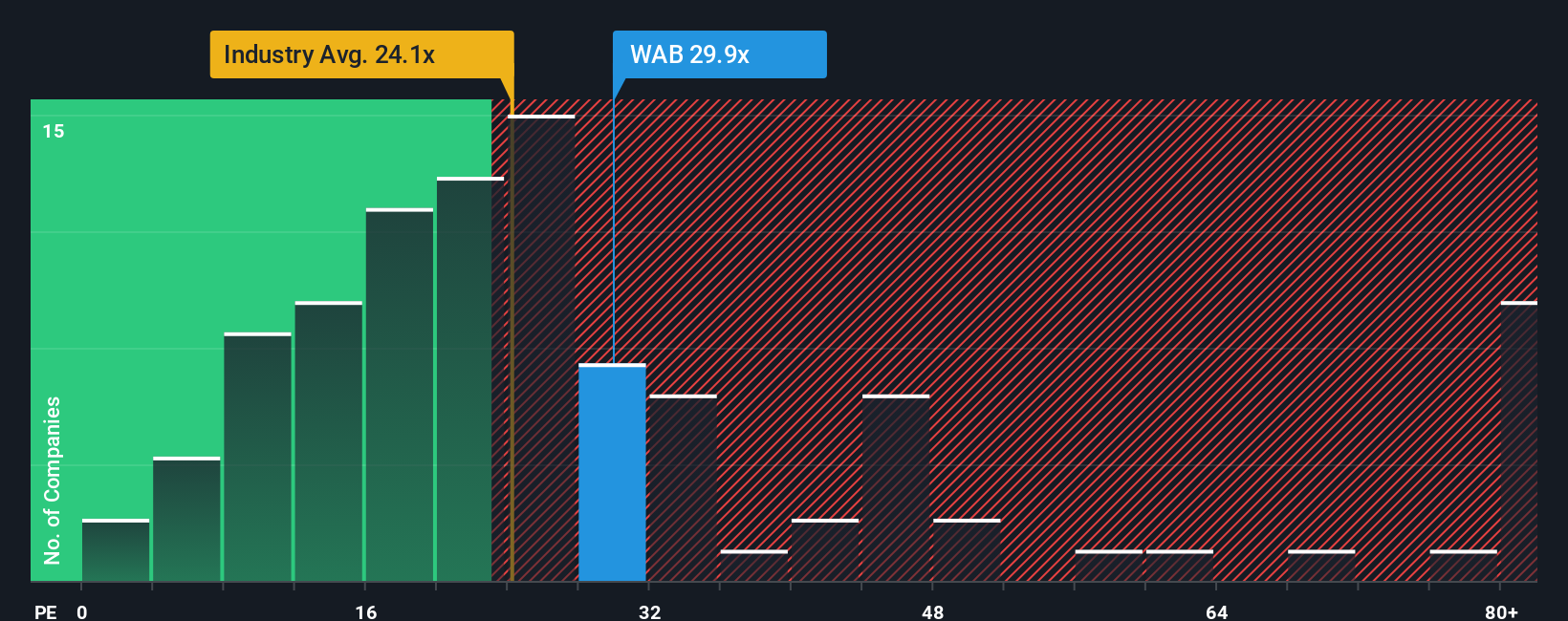

On earnings, WabTech looks stretched, trading on a 30.3x price to earnings ratio versus 24.5x for the US Machinery industry and 17.3x for peers. Yet our fair ratio sits close at 30.5x, hinting that the premium might be fragile rather than excessive. So what happens if growth cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you see the story differently or want to stress test the assumptions yourself, you can use the tools to build a custom view in minutes: Do it your way

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St Screener to pinpoint focused, data backed ideas that match your strategy.

- Capture potential value upside by hunting for stocks that look mispriced based on future cash flows using these 927 undervalued stocks based on cash flows.

- Ride powerful innovation trends by targeting companies at the front line of machine learning and automation with these 24 AI penny stocks.

- Strengthen your income stream by zeroing in on mature businesses offering reliable payouts through these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026