- United States

- /

- Machinery

- /

- NYSE:WAB

Does the Strong Five Year Run Make Wabtec Shares Risky for 2025 Investors?

Reviewed by Bailey Pemberton

If you’re sitting on the fence about Westinghouse Air Brake Technologies stock, you’re definitely not alone. With the shares closing at $197.13 recently, the story here is anything but boring. Some investors might be tempted to cash in after seeing the stock cruise upwards more than 226% over the past five years, riding powerful trends in the transportation sector and the company’s own strategic moves. Yet, it would be hard not to notice the mixed momentum of late: a slight dip of -1.2% over the past week, but still a healthy 4.7% climb for the month and just over 4% in both the year-to-date and last twelve months.

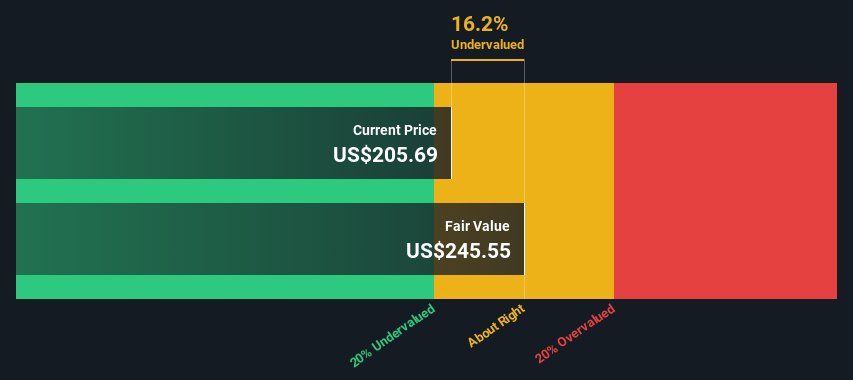

Anytime a stock posts this kind of long-term growth, the big question comes back to value: Are you getting in at a smart price, or are you paying for yesterday’s wins? Our deep-dive valuation score, a simple tally out of six major methods for spotting undervalued companies, lands at zero for Westinghouse Air Brake Technologies. That means it’s currently not considered undervalued by any of the approaches we track.

Before you make your next move, let’s break down these valuation checks to understand what’s driving that score, how they stack up for the company right now, and whether there’s a smarter way to think about value behind the scenes. Keep reading for a closer look at the numbers, and then an insight that might change the way you judge a stock’s true worth.

Westinghouse Air Brake Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Westinghouse Air Brake Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This helps investors gauge whether a stock’s current price reflects its long-term cash-generating power.

For Westinghouse Air Brake Technologies, the DCF model uses a 2 Stage Free Cash Flow to Equity approach. The company reported trailing twelve-month Free Cash Flow of approximately $1.46 billion. Analyst estimates for annual Free Cash Flow reach $1.82 billion by 2028, and projections are extrapolated even further to just over $2.06 billion by 2035. The projections after 2028 are based on a gradual growth assumption, since analysts only forecast out to five years. All numbers are expressed in US dollars.

According to this model, the estimated fair value for Westinghouse Air Brake Technologies comes out to about $175.10 per share. With the stock trading recently at $197.13, this suggests shares are currently 12.6% overvalued based on expected future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Westinghouse Air Brake Technologies may be overvalued by 12.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Westinghouse Air Brake Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it lets investors see how much they are paying for each dollar of the company’s earnings. Generally, faster-growing and less risky companies command a higher PE ratio, while slower growth or greater risk tends to keep valuations lower. In essence, the “right” PE depends on expectations for future profits, industry trends, and the company’s unique risk profile.

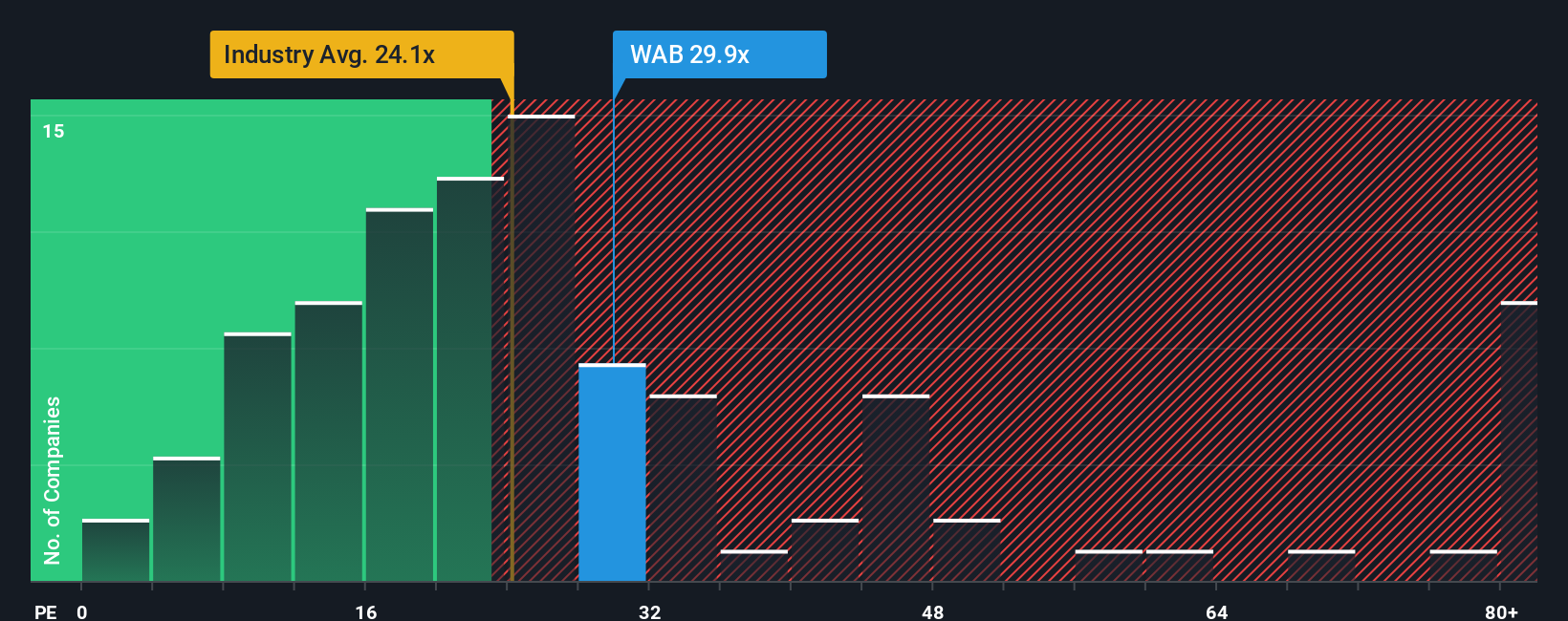

Right now, Westinghouse Air Brake Technologies is trading at a PE ratio of 29.3x. For context, the Machinery industry average sits at 23.8x, while the average among close peers is around 20.5x. This puts the company’s valuation well above both of these benchmarks, suggesting that investors are paying a premium for its earnings compared to similar firms.

Simply Wall St’s “Fair Ratio” is a more custom-fit approach than simply comparing against industry or peer averages. The Fair Ratio for Westinghouse Air Brake Technologies is calculated as 27.5x, factoring in everything from the company’s future growth prospects and profit margins to its level of risk, market cap, and where it sits within its sector. This tailored metric is designed to account for real differences that broad averages might overlook, giving a clearer sense of whether the stock’s price is truly stretched.

Compared to the Fair Ratio, the company’s current PE ratio is only modestly higher. The difference is small, signaling that shares are priced almost exactly where you’d expect based on its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Westinghouse Air Brake Technologies Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story behind a company, linking what you know or believe about its future, such as expected growth, market shifts, or evolving risks, to concrete financial forecasts and, ultimately, to your own calculation of fair value.

Narratives empower you to see beyond the numbers by allowing you to lay out your assumptions for future revenue, earnings, and margins, connect them to real business and industry developments, and use them as a foundation for your investing decisions. On Simply Wall St’s Community page, millions of investors easily create and compare Narratives for any stock, updating their stories quickly as news or earnings change the outlook.

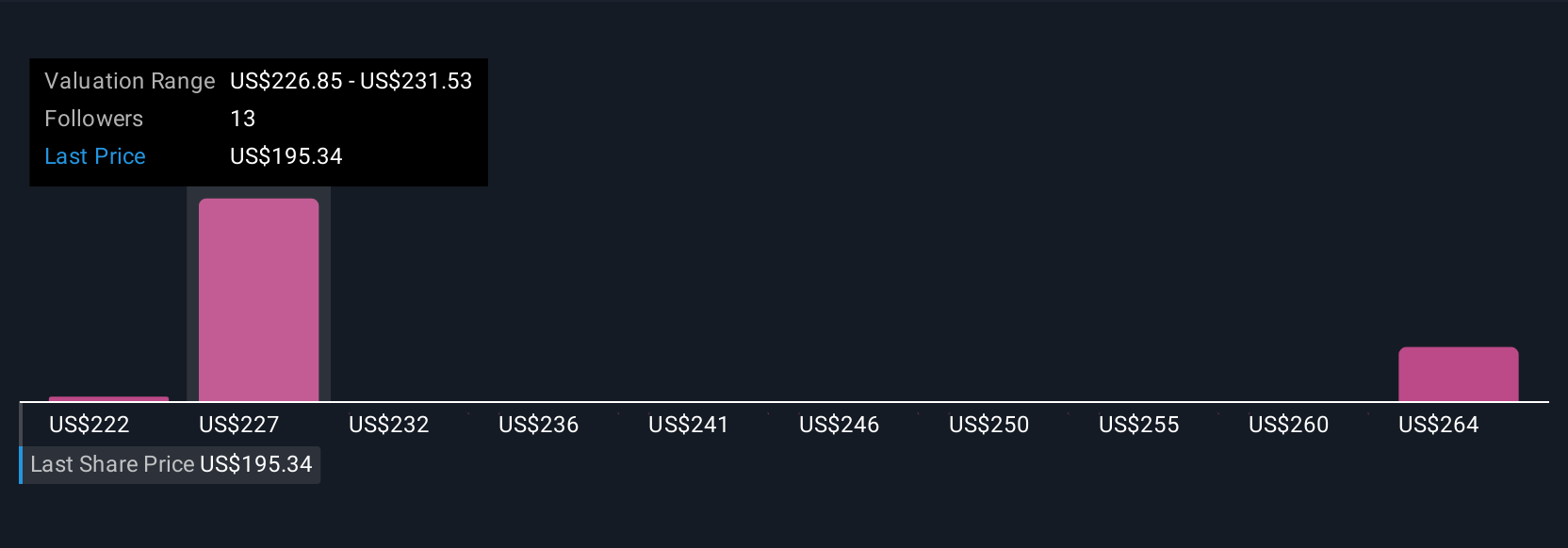

By tracking Narratives, you get a dynamic “snapshot” of what you think a stock is worth, which lets you spot when prices look attractive or overvalued as circumstances shift. For example, with Westinghouse Air Brake Technologies, one investor might see global rail modernization and decarbonization as driving substantial growth, justifying a fair value up to $250 per share. Another investor might worry about slowing North American demand and set their value closer to $200.

This approach helps you make more confident buy or sell decisions by comparing your Narrative-based fair value to the current market price, all grounded in your own logic and the latest, most relevant information.

Do you think there's more to the story for Westinghouse Air Brake Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives