- United States

- /

- Machinery

- /

- NYSE:TWI

Investors Continue Waiting On Sidelines For Titan International, Inc. (NYSE:TWI)

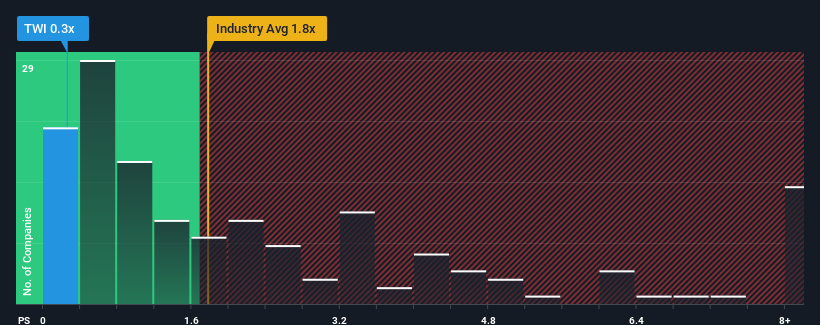

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Titan International, Inc. (NYSE:TWI) is a stock worth checking out, seeing as almost half of all the Machinery companies in the United States have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Titan International

How Titan International Has Been Performing

Titan International could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Titan International will help you uncover what's on the horizon.How Is Titan International's Revenue Growth Trending?

In order to justify its P/S ratio, Titan International would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.6%. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 1.4% during the coming year according to the three analysts following the company. With the rest of the industry predicted to shrink by 0.8%, it's set to post a similar result.

With this in consideration, we find it intriguing but understandable that Titan International's P/S falls short of its industry peers. We think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Titan International's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Titan International currently trades on a lower than expected P/S since its revenue forecast is matching the struggling industry but its P/S is struggling to keep up. There could be some further unobserved threats to revenue stability preventing the P/S ratio from matching the outlook. Perhaps there is some hesitation about the company's ability to resist further pain to its business from the broader industry turmoil. It appears some are indeed anticipating revenue instability, because the company's current prospects should typically see a P/S closer to the industry average.

You always need to take note of risks, for example - Titan International has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Titan International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TWI

Titan International

Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives