- United States

- /

- Machinery

- /

- NYSE:TRN

Should Trinity Industries' (TRN) ESOP Shelf Registration Prompt Action From Investors?

Reviewed by Simply Wall St

- Earlier this month, Trinity Industries filed a shelf registration to offer up to US$114.44 million of common stock tied to its Employee Stock Ownership Plan (ESOP), with a maximum of 4,000,000 shares available.

- This type of ESOP-related equity offering often draws investor attention due to its potential effects on share dilution and employee engagement strategy.

- We'll examine how this ESOP-related shelf registration could shape Trinity Industries' investment outlook and capital structure going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Trinity Industries Investment Narrative Recap

To be a shareholder in Trinity Industries, you need to believe in a recovery in key cyclical end markets and steady replacement demand in the railcar sector. The recent ESOP-related equity shelf registration, while catching investor attention for potential dilution, does not appear material enough to alter the core short-term catalyst, an expected industry-wide rebound in railcar orders, or the primary risk of prolonged customer order delays.

The company’s continued track record of regular dividend payments, including its 246th consecutive payout, underscores a focus on stable returns to shareholders. This steady dividend history invites confidence, but the underlying growth hinges on realized order volumes and the pace of recovery in capital expenditures across Trinity’s end markets.

By contrast, it is important for investors to remain mindful of the ongoing risk that a sharp downturn in the energy or agriculture sectors could...

Read the full narrative on Trinity Industries (it's free!)

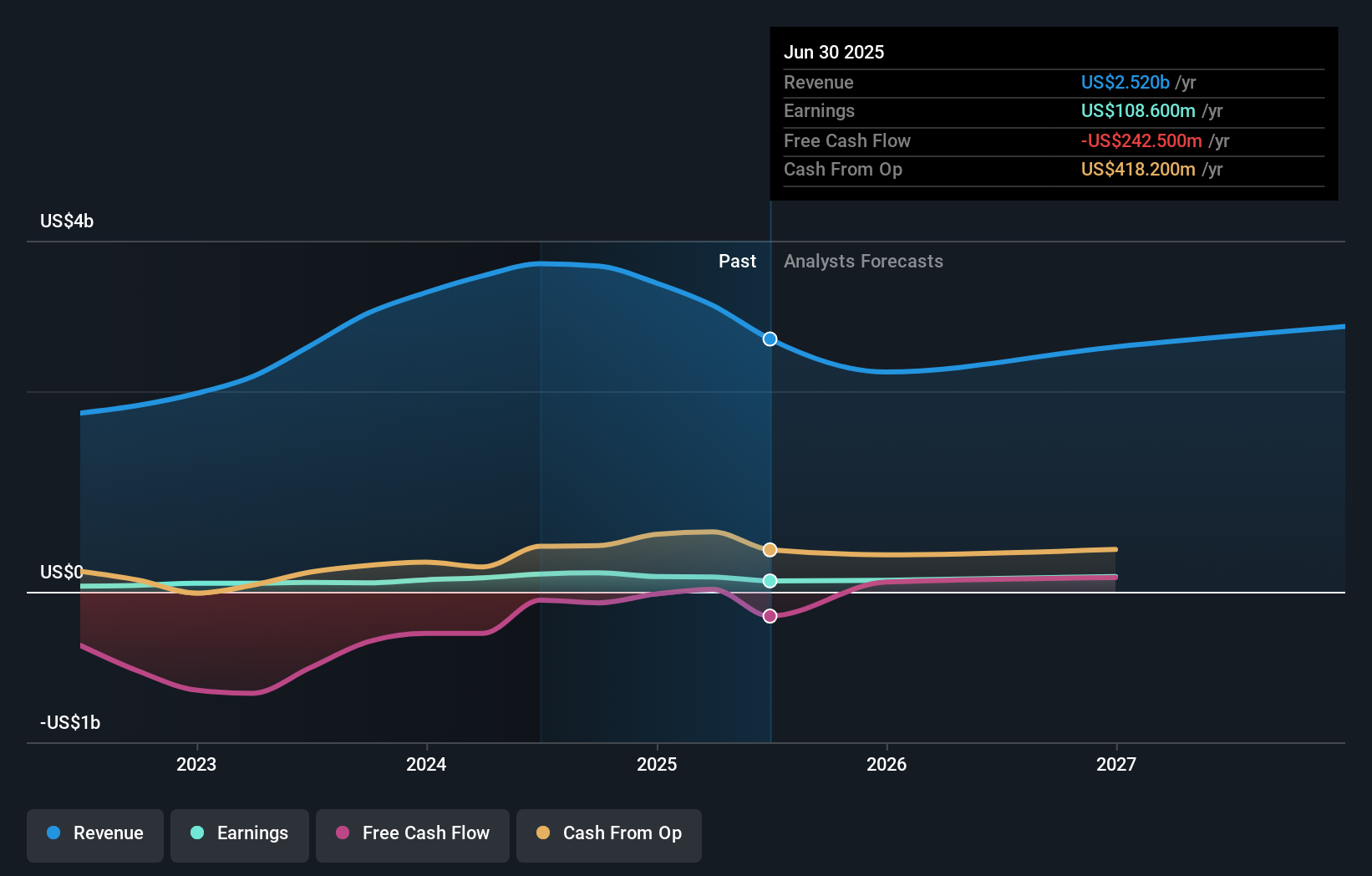

Trinity Industries' outlook anticipates $2.6 billion in revenue and $207.4 million in earnings by 2028. This scenario relies on an annual revenue growth rate of 1.3% and represents a $98.8 million increase in earnings from the current $108.6 million.

Uncover how Trinity Industries' forecasts yield a $28.50 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Trinity Industries range widely from US$28.50 to US$94.49, with just 2 perspectives included. While many see significant earnings growth ahead, opinions on future performance differ sharply, consider these views as you assess where the company could go next.

Explore 2 other fair value estimates on Trinity Industries - why the stock might be worth just $28.50!

Build Your Own Trinity Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Industries research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Trinity Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRN

Trinity Industries

Provides railcar products and services under the TrinityRail trade name in North America.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives