- United States

- /

- Machinery

- /

- NYSE:CYD

Spotlighting November 2024's Undiscovered Gems in the United States

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it boasts a remarkable 31% increase over the past year with earnings projected to grow by 15% annually. In such an environment, identifying stocks that combine strong fundamentals with growth potential can uncover promising opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| AirJoule Technologies | NA | nan | 127.67% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that supplies nuclear fuel components and services to the nuclear power industry across the United States, Belgium, Japan, and other international markets, with a market cap of approximately $1.23 billion.

Operations: Centrus Energy generates revenue primarily from its Low-Enriched Uranium (LEU) segment, contributing $315.10 million, and Technical Solutions segment, adding $83.90 million. The company's financial performance is impacted by a segment adjustment of -$5 million.

Centrus Energy, a nimble player in the energy sector, has been making waves with its strategic moves. The company recently announced plans to resume centrifuge manufacturing and expand capacity in Oak Ridge, investing an additional US$60 million over 18 months. This follows securing over US$2 billion in contingent purchase commitments for Low-Enriched Uranium production. Despite a net loss of US$5 million in the latest quarter compared to last year's net income of US$8.2 million, Centrus is trading at 52% below fair value estimates and boasts high-quality earnings with recent growth outpacing industry averages by 58%.

- Take a closer look at Centrus Energy's potential here in our health report.

Gain insights into Centrus Energy's past trends and performance with our Past report.

China Yuchai International (NYSE:CYD)

Simply Wall St Value Rating: ★★★★★☆

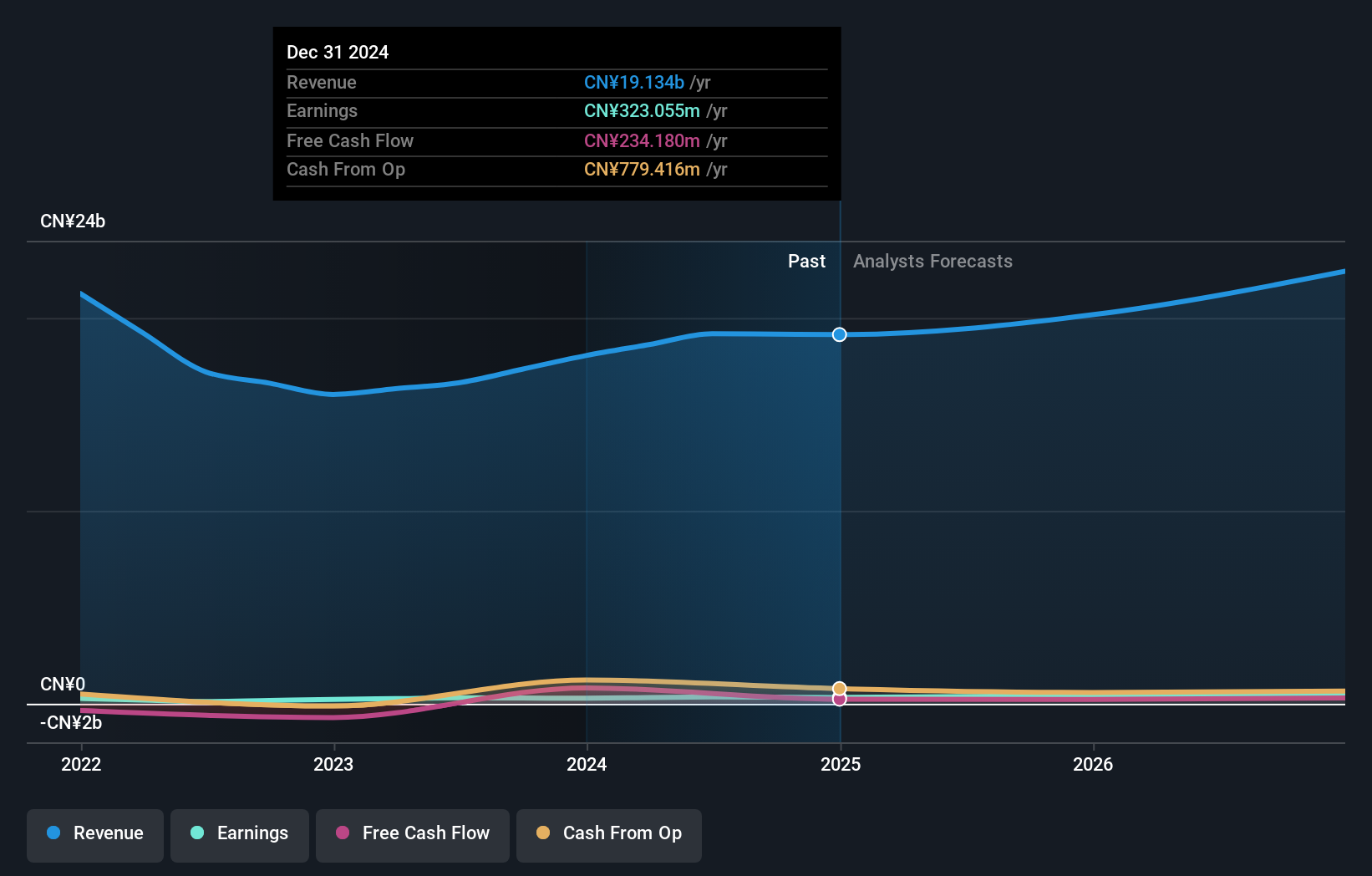

Overview: China Yuchai International Limited, with a market cap of $344.33 million, is engaged in the manufacturing, assembly, and sale of diesel and natural gas engines for various applications including trucks, buses, passenger vehicles, marine vessels, industrial machinery, construction equipment, agriculture machinery, and generator sets both within China and internationally.

Operations: China Yuchai generates revenue primarily from the sale of diesel and natural gas engines across various sectors. The company's financial performance is influenced by its cost structure, which includes manufacturing and assembly expenses. Notably, its net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

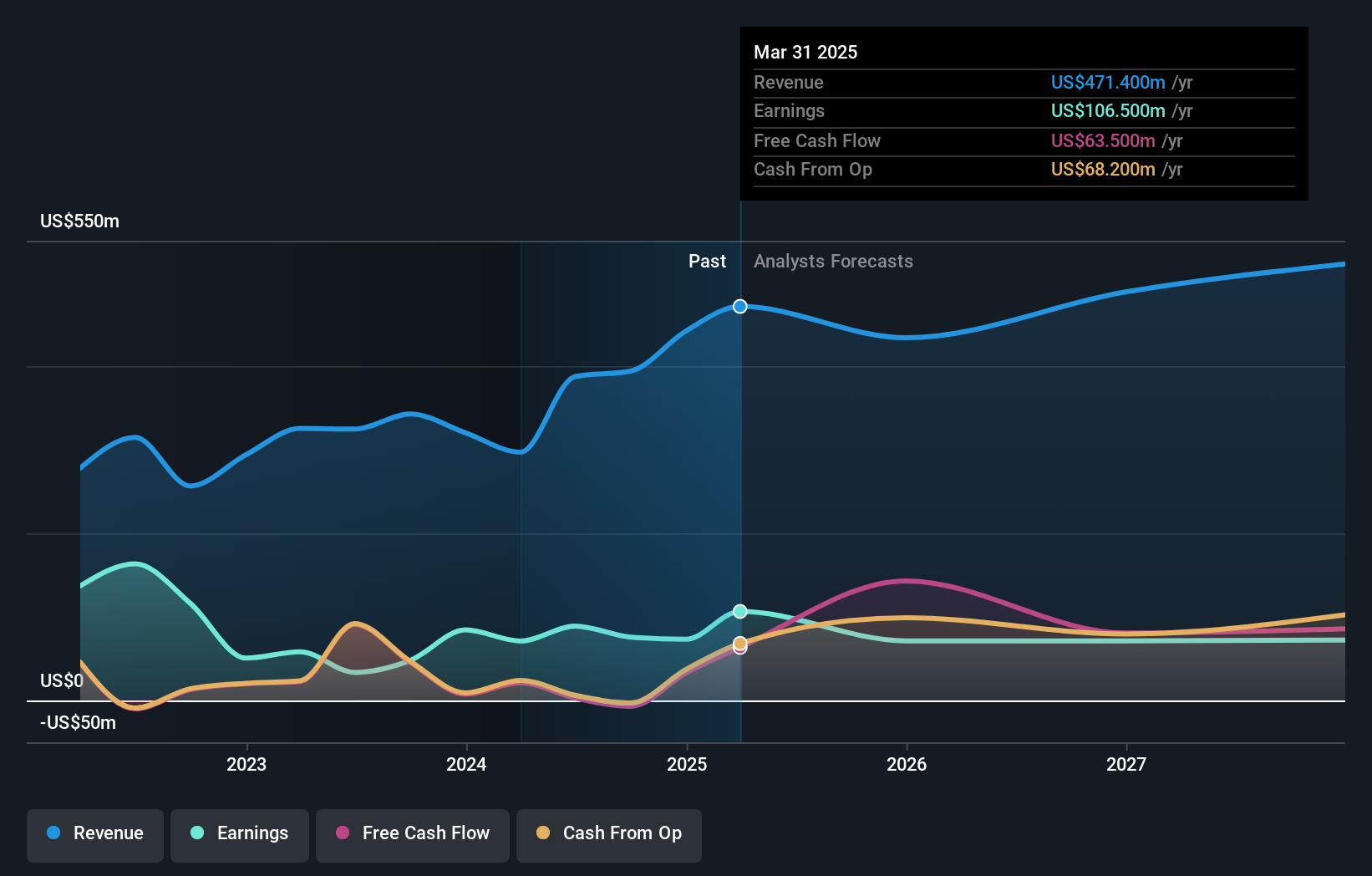

China Yuchai International, a small player in the machinery sector, has been making notable strides. Its earnings growth of 14.6% over the past year outpaced the industry average of 11.5%, highlighting its competitive edge. The company is trading at a significant discount, approximately 61% below estimated fair value, suggesting potential upside for investors. Despite an increase in its debt-to-equity ratio from 18.1% to 21.3% over five years, CYD's financial health remains robust with more cash than total debt and interest payments well-covered by profits. Recently, it completed a buyback of over three million shares for US$39.83 million, reflecting confidence in its future prospects.

- Navigate through the intricacies of China Yuchai International with our comprehensive health report here.

Learn about China Yuchai International's historical performance.

Tennant (NYSE:TNC)

Simply Wall St Value Rating: ★★★★★★

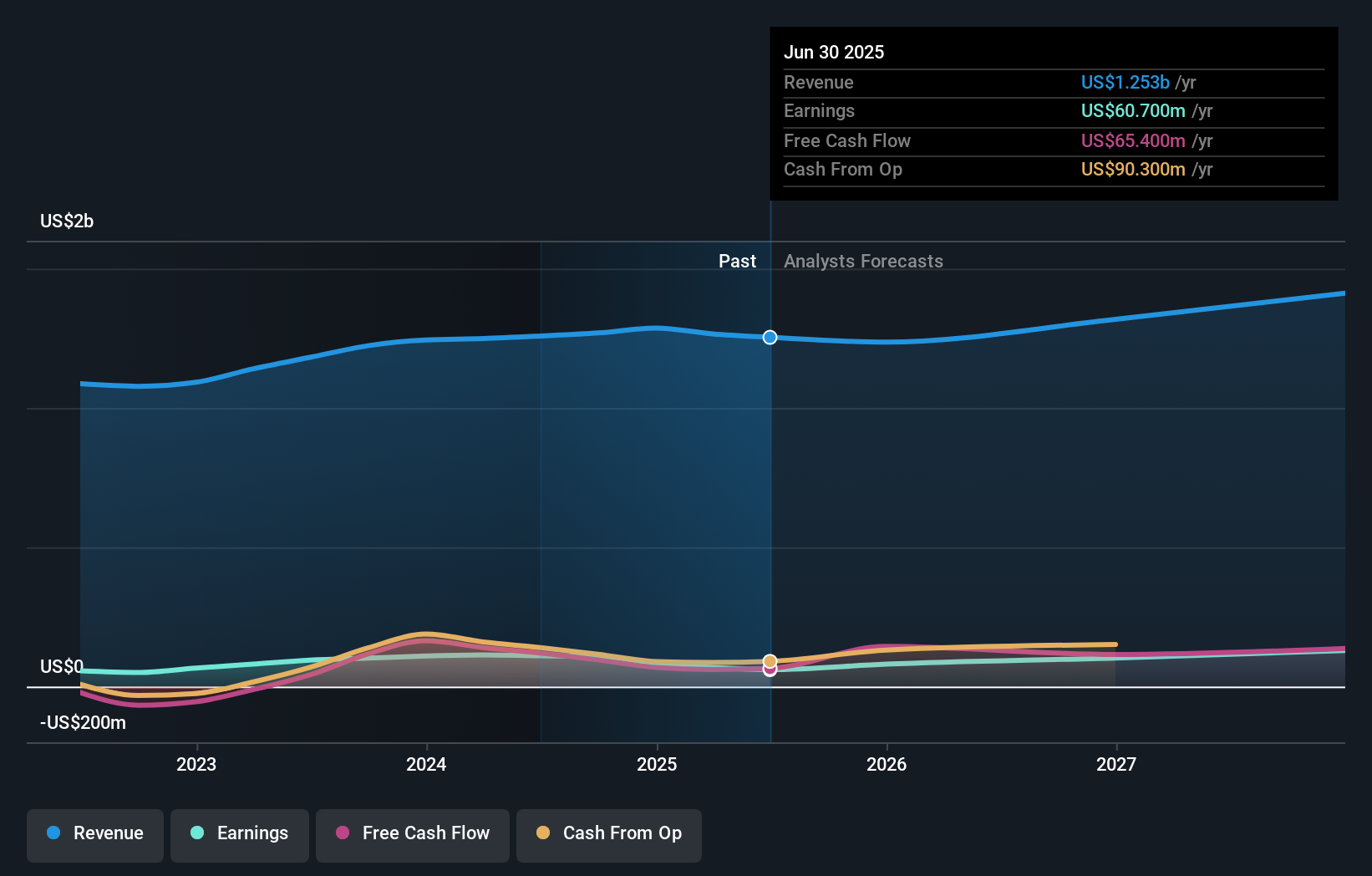

Overview: Tennant Company, along with its subsidiaries, is engaged in designing, manufacturing, and marketing floor cleaning equipment across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $1.62 billion.

Operations: Tennant generates revenue primarily from the design, manufacture, and sale of products used in maintaining nonresidential surfaces, totaling $1.27 billion.

Tennant, a smaller player in the machinery sector, exhibits strong financial health with its debt to equity ratio dropping from 100.7% to 32.3% over five years and a net debt to equity ratio of 18.2%, which is satisfactory. The company has made significant strides in earnings growth, averaging 23.2% annually over the past five years despite recent underperformance against industry peers. Tennant's strategic initiatives include share repurchases totaling $31 million and a dividend increase of 5.4%. While challenges exist in certain markets, its innovative products and ERP modernization could bolster future performance amidst modest revenue growth forecasts.

Key Takeaways

- Discover the full array of 229 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYD

China Yuchai International

Through its subsidiaries, manufactures, assembles, and sells diesel and natural gas engines for trucks, buses and passenger vehicles, marine, industrial, construction, agriculture, and generator set applications in the People’s Republic of China and internationally.

Excellent balance sheet with proven track record.