- United States

- /

- Machinery

- /

- NYSE:TKR

Timken's (NYSE:TKR) five-year earnings growth trails the 14% YoY shareholder returns

While The Timken Company (NYSE:TKR) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 13% in the last quarter. On the bright side the share price is up over the last half decade. In that time, it is up 74%, which isn't bad, but is below the market return of 107%. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 22% decline over the last twelve months.

Since the stock has added US$454m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

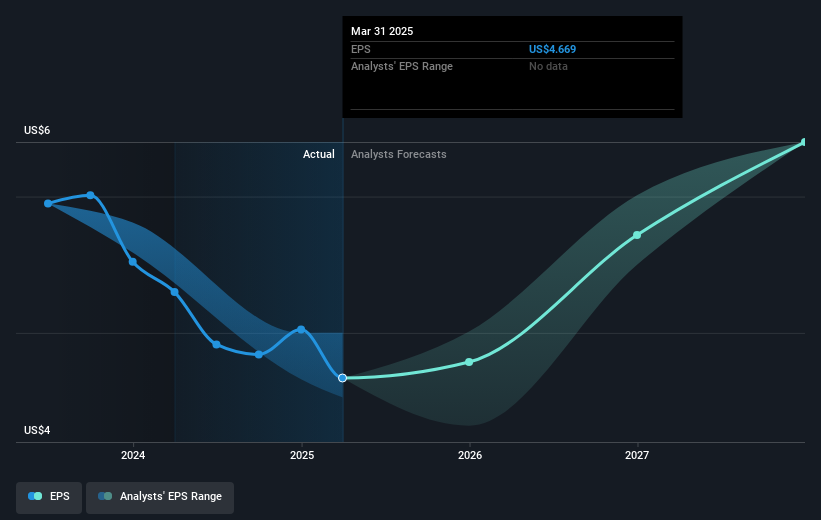

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Timken managed to grow its earnings per share at 0.2% a year. This EPS growth is slower than the share price growth of 12% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Timken's key metrics by checking this interactive graph of Timken's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Timken, it has a TSR of 91% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Timken shareholders are down 21% for the year (even including dividends), but the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 14% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Timken better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Timken you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Timken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TKR

Timken

Designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives