- United States

- /

- Electrical

- /

- NYSE:RRX

Regal Rexnord (RRX): Valuation Check After New $2.35 Billion Credit Facilities Boost Financial Flexibility

Reviewed by Simply Wall St

Regal Rexnord (RRX) just overhauled its main credit facilities, locking in an $850 million unsecured delayed draw term loan and a $1.5 billion unsecured revolver. The move is aimed squarely at liquidity and acquisition firepower.

See our latest analysis for Regal Rexnord.

The refreshed credit lines land at a time when Regal Rexnord’s share price of $145.63 reflects mixed sentiment, with a solid 1 month share price return but a weaker 1 year total shareholder return. This suggests near term momentum is stabilising even as the longer term story remains intact.

If this kind of balance sheet repositioning has your attention, it could be a good moment to scan for other industrial names via fast growing stocks with high insider ownership.

With earnings still growing, a fresh multibillion-dollar credit cushion and the shares trading at a double-digit discount to analyst targets, investors now face a key question: Is Regal Rexnord attractively valued, or is future growth already priced in?

Most Popular Narrative Narrative: 18.1% Undervalued

Compared with Regal Rexnord’s last close at $145.63, the most followed narrative sees fair value materially higher, anchoring that view on accelerating earnings power.

The accelerating adoption of energy-efficient and electrification solutions across industrial and commercial sectors continues to drive incremental demand for high-efficiency motors, subsystem solutions, and customized powertrain products, segments where Regal Rexnord is gaining traction, supported by regulatory tailwinds and sustainability initiatives. This positions the company for outsized revenue growth and improved pricing power over the medium and long term.

Want to see what kind of revenue runway and margin lift this assumes, and how far profits might stretch beyond today’s base? The full narrative unpacks the earnings trajectory, the profit mix shift, and the valuation multiple that have to come together for this upside case to hold.

Result: Fair Value of $177.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weakness in core end markets and ongoing integration challenges from past acquisitions could easily derail the positive narrative around growth and margins.

Find out about the key risks to this Regal Rexnord narrative.

Another Take on Valuation

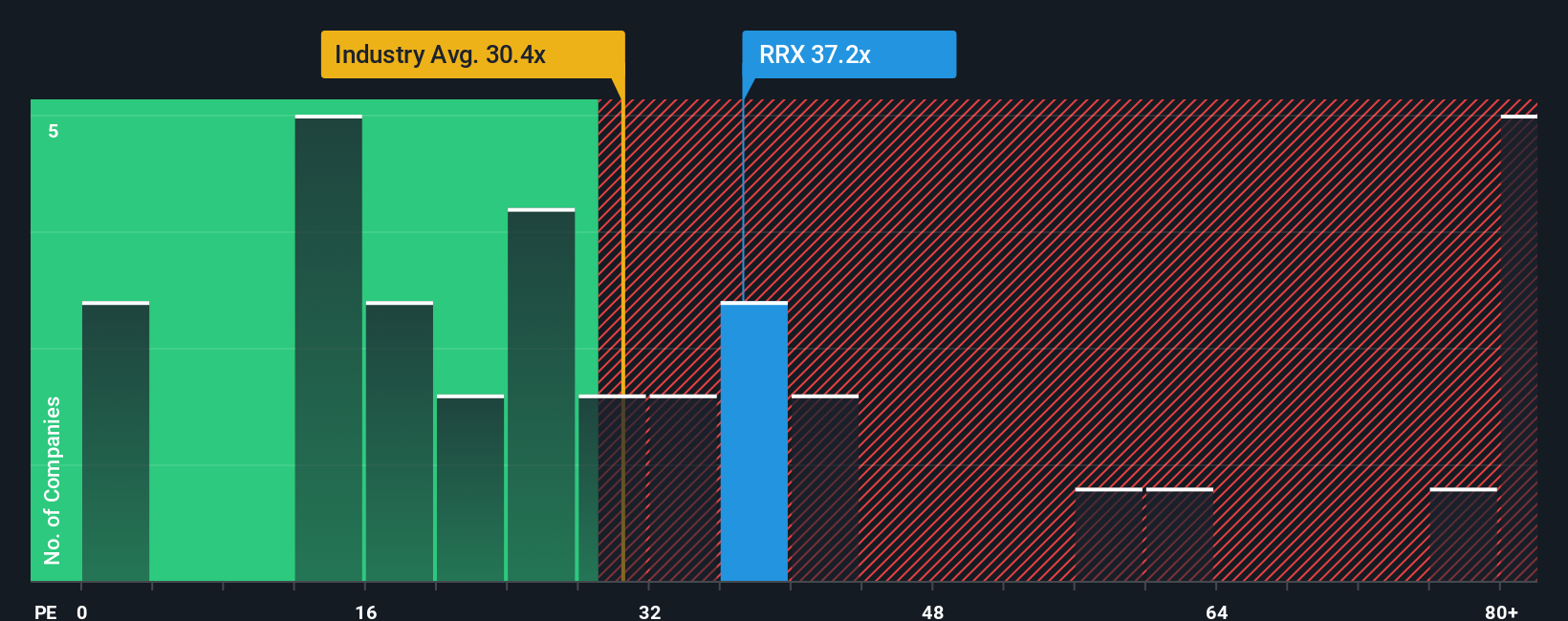

On an earnings-based valuation, Regal Rexnord screens as pricey, with a P E ratio of 37.6 times versus 31.3 times for the US Electrical industry and 33.5 times for peers. Yet our fair ratio suggests 41.2 times could be justified. Is this a margin of safety or a valuation trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regal Rexnord Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

This can be a useful time to widen your opportunity set, and the Simply Wall St Screener can surface stocks you would almost certainly overlook otherwise.

- Explore potential mispriced quality by scanning these 902 undervalued stocks based on cash flows that pair solid fundamentals with attractive valuations before wider market interest develops.

- Consider the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of intelligent automation and data-driven disruption.

- Review income-focused opportunities with these 15 dividend stocks with yields > 3% that may help strengthen your portfolio’s cash flow while others remain cautious.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)