- United States

- /

- Electrical

- /

- NYSE:ROK

Is There Still Upside in Rockwell Automation After a 31% Share Price Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if Rockwell Automation’s soaring stock price is justified, or if there’s hidden value to uncover? You’re not alone. Let’s break down what’s really going on with ROK.

- Shares have risen by 31.1% so far this year, with a strong 40.5% gain over the past 12 months and a recent boost of 5.1% just this past week.

- Part of this momentum has been driven by market optimism around industrial automation and robust demand for digital transformation solutions. Recent headlines highlight Rockwell Automation’s collaborations in artificial intelligence and new product launches aimed at expanding their reach in smart manufacturing, which has added to the positive sentiment.

- Despite the excitement, Rockwell Automation scores 0 out of 6 on our valuation checks, suggesting there’s more to the story than price alone. We’ll walk through the popular ways the market values ROK, but stick around for an even smarter perspective at the end.

Rockwell Automation scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rockwell Automation Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates a company's valuation by projecting its future cash flows and discounting them back to today’s value. This approach helps estimate what Rockwell Automation could be worth based on its ability to generate cash in the future, rather than relying solely on current earnings or assets.

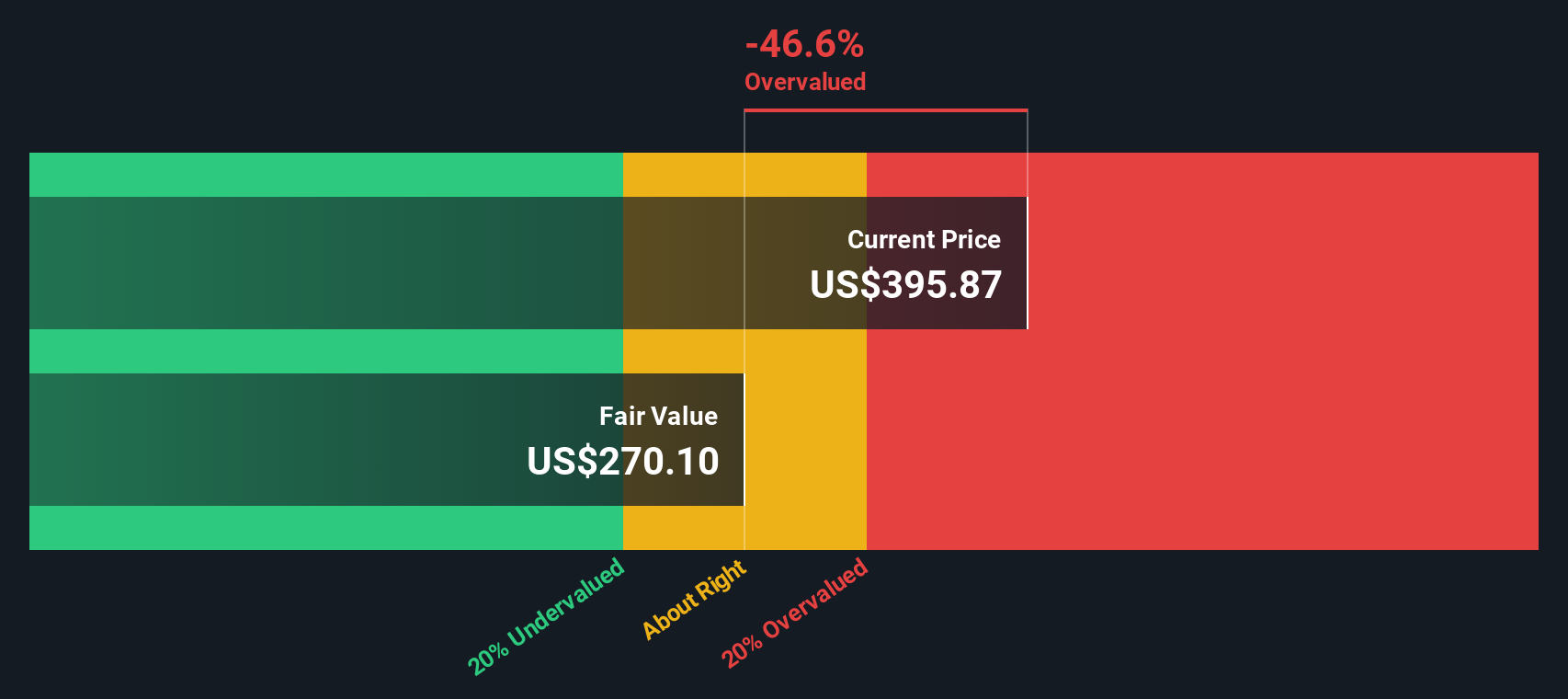

Rockwell Automation currently produces an annual Free Cash Flow of $1.34 billion. Analyst estimates suggest cash flow will grow steadily over the next five years, reaching $1.56 billion by 2028. Beyond these analyst projections, Simply Wall St extrapolates additional growth and forecasts Free Cash Flow approaching $2.15 billion in ten years with moderate annual increases.

Using these projections, the DCF model produces an estimated intrinsic value of $227.79 per share. Comparing this figure with the current market price, the stock appears 61.6% overvalued based on projected cash flows. This means the market is assigning a higher value to Rockwell Automation than its discounted future cash generation currently supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rockwell Automation may be overvalued by 61.6%. Discover 854 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rockwell Automation Price vs Earnings

The price-to-earnings (PE) ratio is a widely-used metric for valuing profitable companies like Rockwell Automation, because it directly compares a company's stock price to its bottom-line profits. This makes it a great way to gauge whether investors are paying a premium for future growth and stability.

Growth expectations and company-specific risks play a big role in what constitutes a "normal" or "fair" PE ratio. Fast-growing, stable companies often command higher multiples, while those with uncertain outlooks usually trade at lower ones.

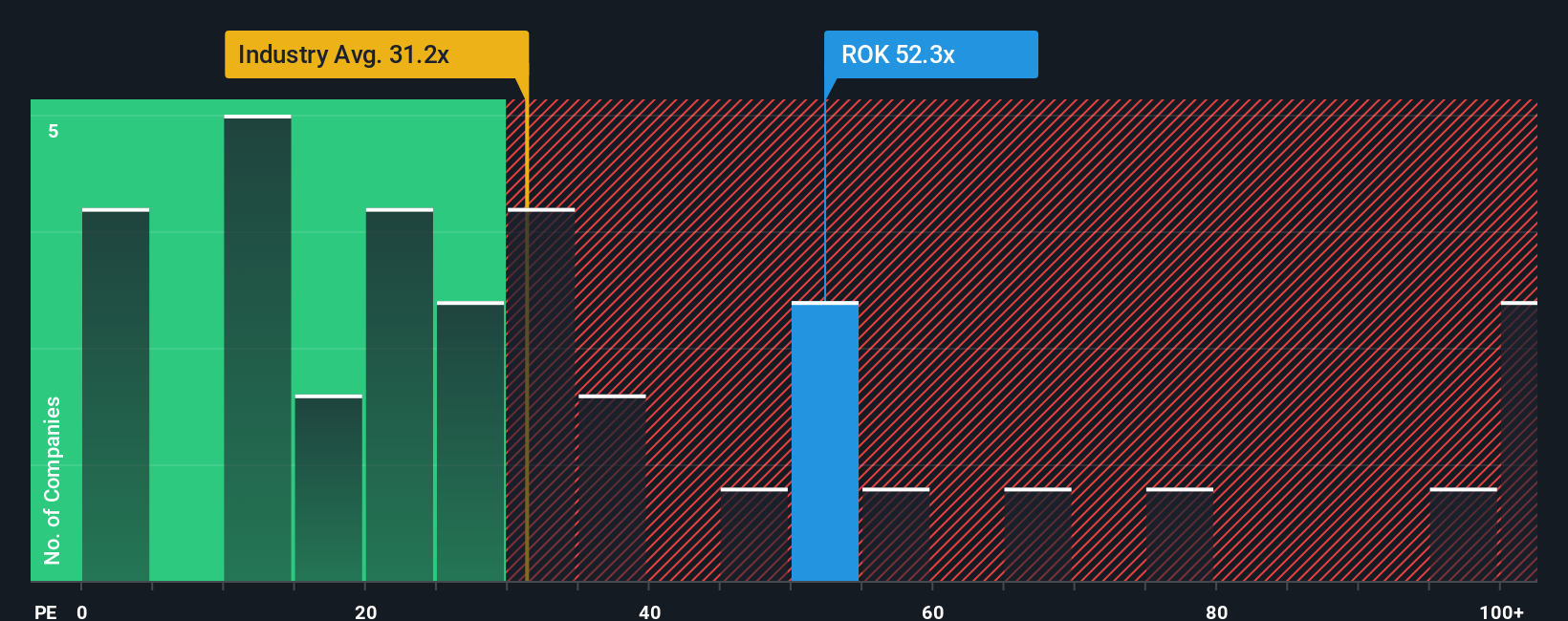

Currently, Rockwell Automation has a PE ratio of 42.8x. For context, its industry average is 29.4x, and its closest peers trade at an average PE of 41.8x. This positions Rockwell Automation at a premium compared to its industry, and just above its peer group.

Simply Wall St’s proprietary “Fair Ratio” goes beyond simple market or industry averages and instead tailors the PE multiple expected for the company by considering Rockwell Automation’s specific earnings growth, profit margins, sector, size, and risk profile. This more holistic measure gives a fair PE of 30.9x for Rockwell, which is much lower than both its actual PE and the industry benchmark.

Looking at the numbers, Rockwell Automation’s current valuation is elevated relative to what would be considered fair, taking its growth and unique qualities into account. Investors appear to be paying a significant premium for this dominant automation player.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1395 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rockwell Automation Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are your opportunity to combine your own outlook on a company, like Rockwell Automation, with both numbers and future assumptions, building a story that connects where the business is heading to its financial value today.

Instead of only relying on static metrics such as PE ratios or price targets, Narratives let you define the drivers behind growth and risks, estimate future revenue, earnings, and profit margins, and ultimately arrive at your own idea of what is "fair value" for a stock.

This approach is simple and interactive, available right on the Simply Wall St Community page. Millions of investors publish their Narratives and compare perspectives every day.

With Narratives, you can see the direct link between your forecast and fair value, making it clear whether the current share price suits your scenario or if it’s time to consider buying or selling. Even better, Narratives are updated automatically when new facts, earnings, or news headlines are released, so your valuation stays relevant over time.

For example, on Rockwell Automation, some investors buy in because their Narrative expects robust digital growth and margin expansion (targeting a fair value as high as $410), while others anticipate risk from delayed investments and global uncertainty (assigning a far lower fair value, down to $229).

Do you think there's more to the story for Rockwell Automation? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROK

Rockwell Automation

Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)