- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (RDW): Assessing Valuation After DARPA Otter VLEO Win and Edge Autonomy Acquisition

Reviewed by Simply Wall St

Redwire (RDW) has jumped back into focus after winning a $44 million DARPA contract for its Otter VLEO mission and closing the Edge Autonomy acquisition, sharpening its profile in defense focused space infrastructure.

See our latest analysis for Redwire.

Those wins are arriving after a bruising stretch, with the share price down sharply year to date despite a strong recent rebound and a powerful three year total shareholder return that suggests long term momentum is still intact.

If Redwire's contract driven story has caught your eye, it can be worth scanning other aerospace and defense names using aerospace and defense stocks for fresh ideas in the same lane.

With the shares still down heavily this year but trading at a steep discount to analyst targets, the real puzzle is whether Redwire is quietly undervalued or if the market is already discounting the growth story ahead.

Most Popular Narrative: 44.9% Undervalued

With Redwire last closing at $7.29 against a narrative fair value near $13.22, the storyline leans decisively toward substantial upside potential.

The rapid proliferation of commercial satellites and upcoming public/private low Earth orbit projects continues to build demand for Redwire's advanced in space manufacturing, deployable structures, and subsystems, supporting multi year visibility on high margin product sales and recurring earnings.

Curious how fast growing space revenues, margin expansion, and a premium future earnings multiple combine into that valuation call? The full narrative reveals the bold growth math behind this upside case.

Result: Fair Value of $13.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent government contracting delays and cost overruns on complex fixed price programs could derail that upside path and further pressure margins.

Find out about the key risks to this Redwire narrative.

Another Angle on Valuation

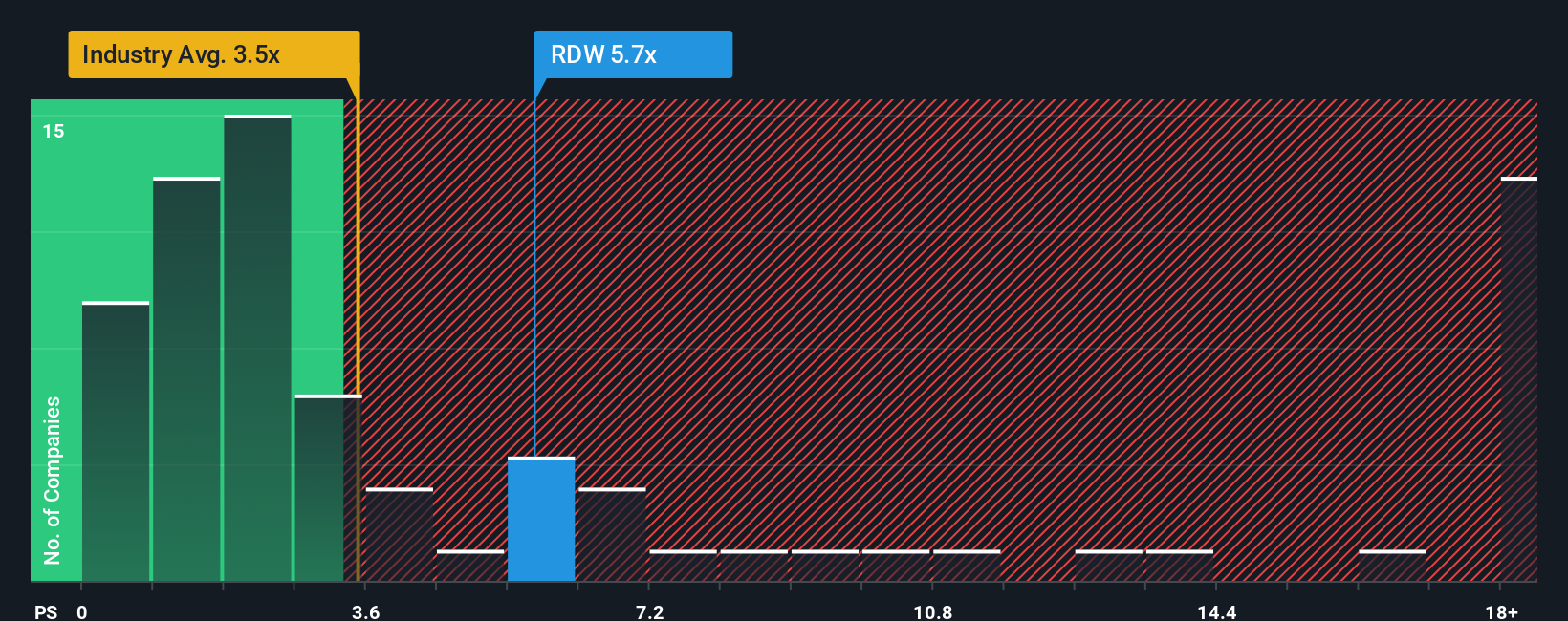

While the narrative fair value points to upside, the market message from sales based metrics is far tougher. At a 4.1x price to sales ratio versus 3.1x for the US Aerospace and Defense group and a fair ratio of 1.7x, Redwire looks richly priced on current revenues, raising the question of how much growth is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redwire Narrative

If you see the numbers differently or prefer to dig through the details yourself, you can shape a personalized view in just minutes: Do it your way.

A great starting point for your Redwire research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart move by scanning targeted stock ideas from the Simply Wall St screener so potential opportunities do not slip past you.

- Uncover potential market mispricings with these 903 undervalued stocks based on cash flows that could help position your portfolio ahead of the crowd.

- Explore emerging innovation by checking out these 26 AI penny stocks at the forefront of artificial intelligence powered growth.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that keep cash flowing even when markets get choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)