- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (NYSE:RDW) Sees 7% Price Rise As SentinelCam Tech Deployed On Lunar Mission

Reviewed by Simply Wall St

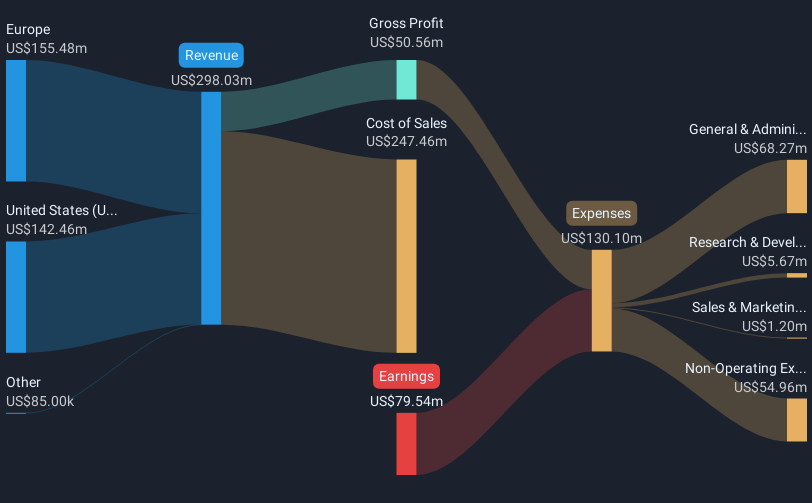

Redwire (NYSE:RDW) recently announced the deployment of its SentinelCam technology on Intuitive Machines' Nova-C lunar lander, highlighting its prowess in navigation and imaging for space missions. This, alongside securing a European Space Agency contract to design the ARRAKIHS mission and collaborating with Virgin Galactic on manufacturing research payload lockers, underscores Redwire's growing influence in the aerospace sector. During the last quarter, Redwire's share price moved up by 7.49%, reflecting investor enthusiasm for its innovative projects and strategic collaborations. This robust performance contrasts with the broader market, which saw mixed results and a decline in tech stocks amid economic uncertainties. While the Dow Jones experienced fluctuations following Nvidia's earnings report and tariff announcements, Redwire's focus on expanding its technological and international footprint may have attracted investor attention, propelling its shares upward despite broader market volatility. This performance signals strong interest in Redwire's contributions to the space industry.

Dig deeper into the specifics of Redwire here with our thorough analysis report.

Over the last year, Redwire's total shareholder return surged an impressive 331.55%, significantly outperforming both the US Aerospace & Defense industry, which returned 21.3%, and the broader US market return of 16.7%. This remarkable performance can be attributed to several factors. Firstly, Redwire's inclusion in major indices like the S&P Global BMI and Russell 2000 boosted its visibility and attractiveness amongst institutional investors. Additionally, securing a $45M contract from the AFRL for space mission technologies in December 2024 underscored its competitive edge and growth potential in the space domain.

Further bolstering its market position, Redwire's collaboration with Virgin Galactic to manufacture research payload lockers highlighted its commitment to expanding capabilities within the aerospace sector. The consistent sales growth, evidenced by Q2 2024's revenue of US$78.11M, also played a crucial role in driving shareholder value despite ongoing net losses. This financial momentum underscores Redwire's ambitious growth trajectory and reinforces investor confidence in its long-term prospects.

- See how Redwire measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting Redwire's growth trajectory—explore our risk evaluation report.

- Are you invested in Redwire already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives