- United States

- /

- Machinery

- /

- NYSE:PRLB

Proto Labs (NYSE:PRLB) earnings and shareholder returns have been trending downwards for the last five years, but the stock rises 6.3% this past week

Proto Labs, Inc. (NYSE:PRLB) shareholders will doubtless be very grateful to see the share price up 49% in the last quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 60% during that time. So we're hesitant to put much weight behind the short term increase. Of course, this could be the start of a turnaround.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Proto Labs

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Proto Labs became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Revenue is actually up 2.8% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

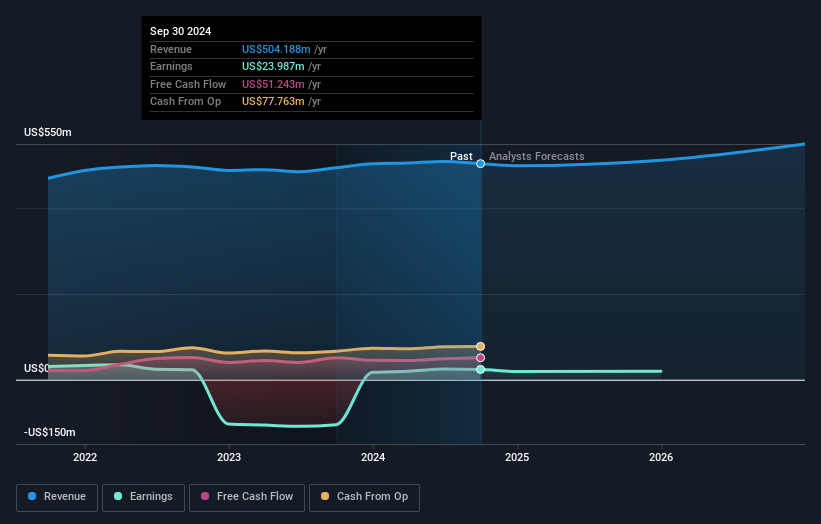

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Proto Labs has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Proto Labs in this interactive graph of future profit estimates.

A Different Perspective

Proto Labs shareholders gained a total return of 9.8% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Proto Labs better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Proto Labs (of which 1 shouldn't be ignored!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives