- United States

- /

- Commercial Services

- /

- NasdaqGS:TILE

Exploring American Coastal Insurance And 2 Other Promising Small Caps In The US Market

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the last week, yet it has seen a significant rise of 25% over the past 12 months, with earnings projected to grow by 15% annually. In such an environment, identifying promising small-cap stocks like American Coastal Insurance can offer unique opportunities for investors seeking growth potential beyond the well-trodden paths of larger companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

American Coastal Insurance (NasdaqCM:ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance Corporation, operating through its subsidiaries, focuses on providing commercial and personal property and casualty insurance in the United States, with a market cap of $636.31 million.

Operations: American Coastal Insurance generates revenue primarily from its commercial and personal property and casualty insurance offerings in the U.S. The company has a market capitalization of $636.31 million, indicating its valuation in the financial markets.

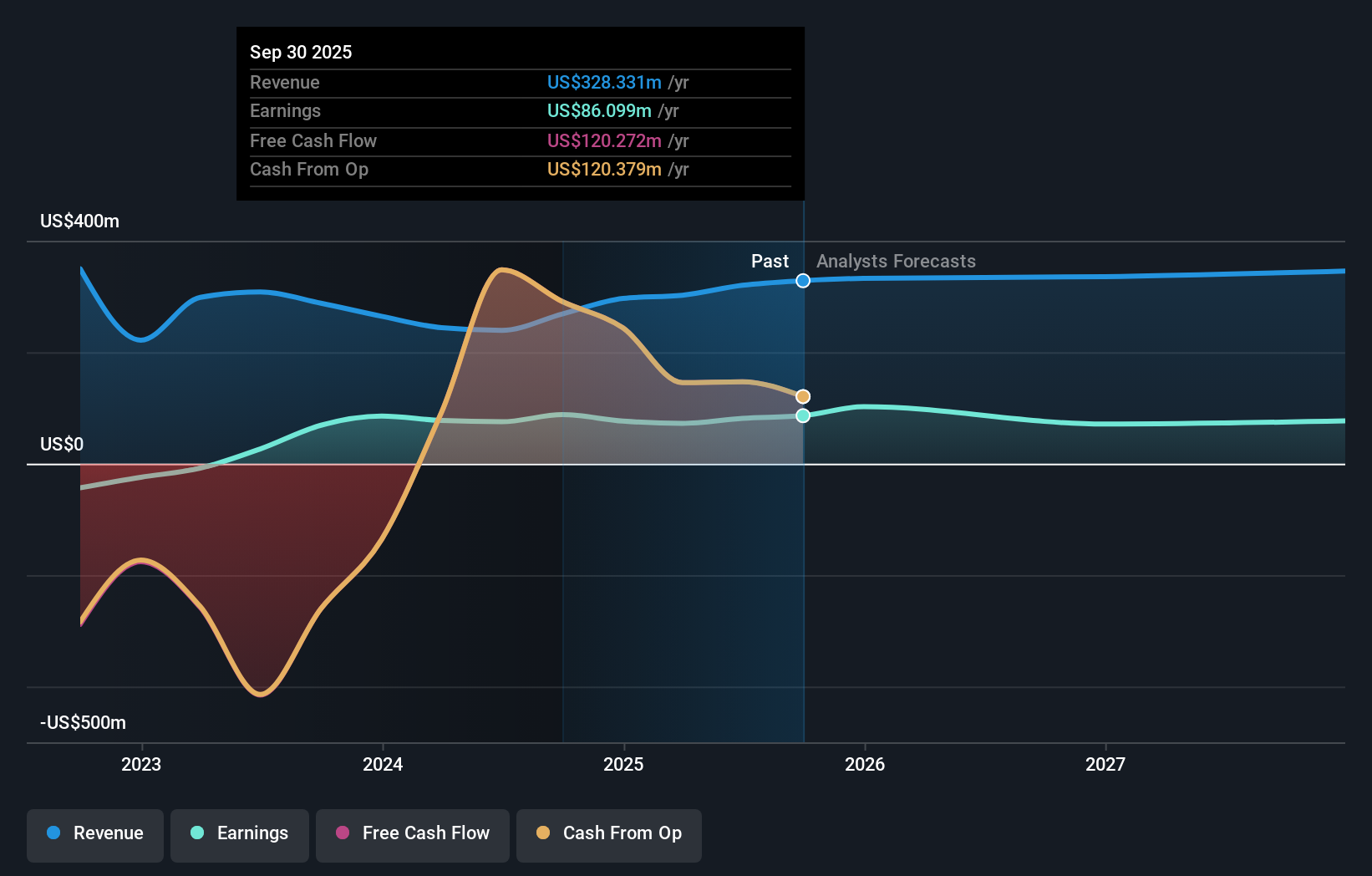

American Coastal Insurance, a promising player in the insurance sector, has demonstrated significant earnings growth of 54% annually over the past five years. The company boasts a strong position with interest payments well covered by EBIT at 9.9 times and maintains high-quality earnings despite facing industry challenges. Recent financials reveal Q3 revenue jumped to US$82 million from US$53 million year-on-year, while net income rose to US$28 million from US$11 million. Although the debt-to-equity ratio increased to 57% over five years, American Coastal's strategic initiatives aim for long-term value amidst potential hurricane risks and rising reinsurance costs.

Interface (NasdaqGS:TILE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Interface, Inc. designs, produces, and sells modular carpet products primarily worldwide with a market cap of $1.47 billion.

Operations: Interface generates revenue from two primary segments: Americas, contributing $783.32 million, and Europe, Africa, Asia, and Australia (EAAA), adding $522.45 million.

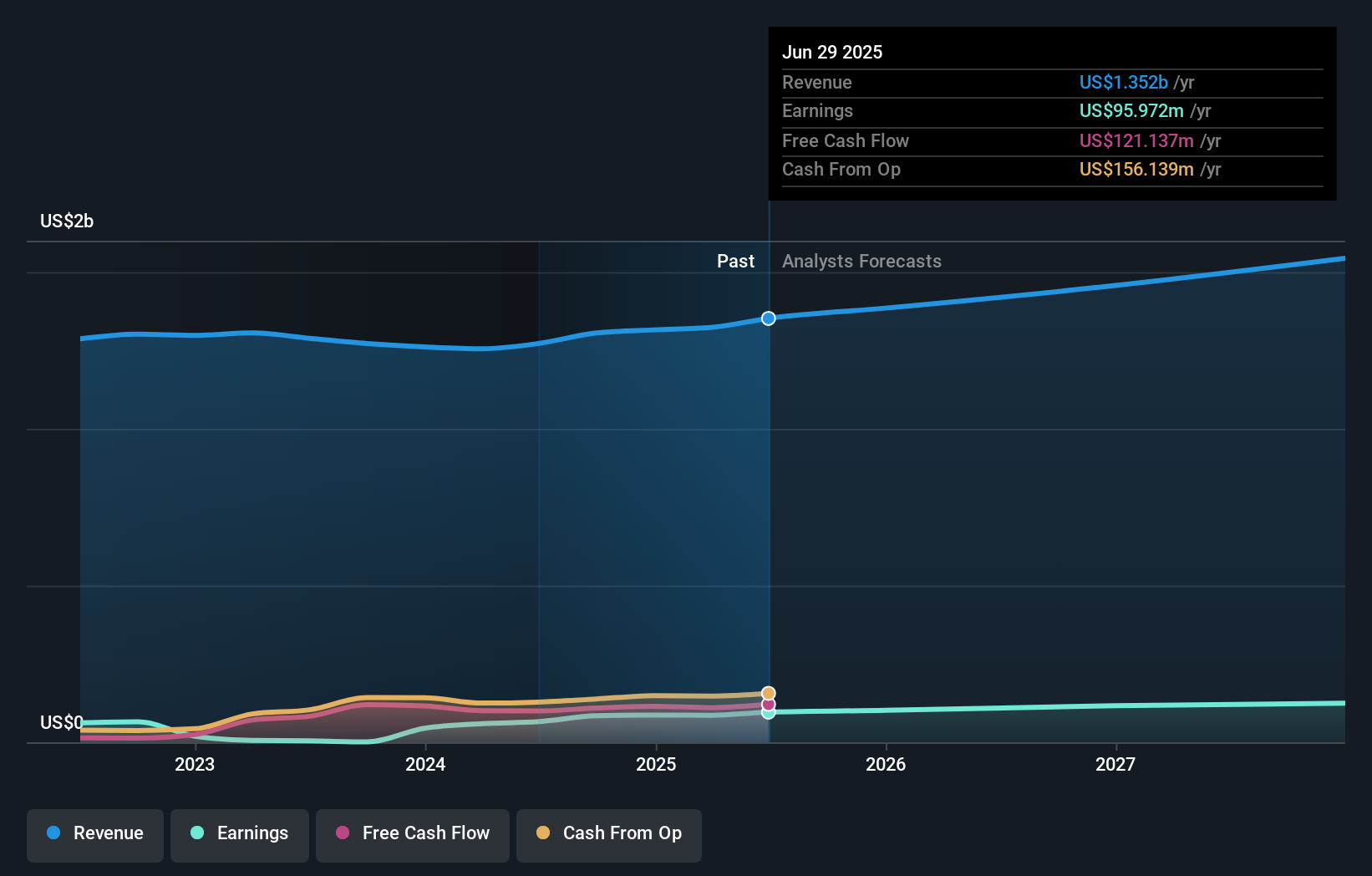

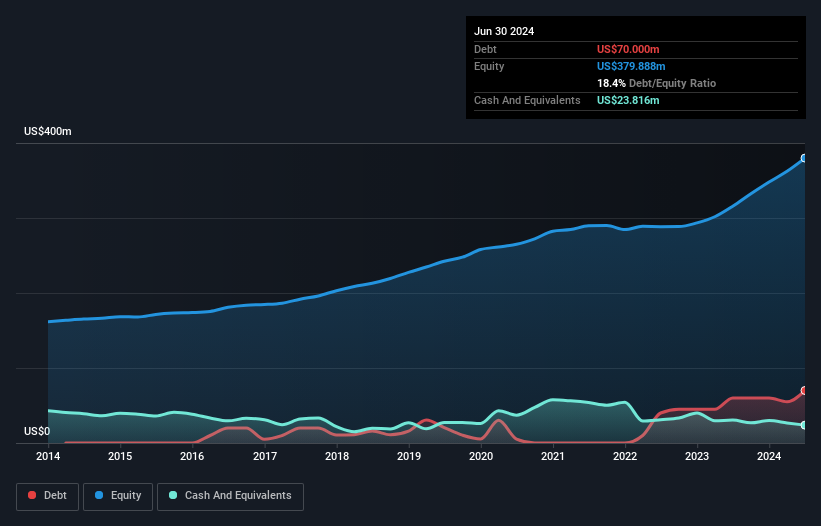

Interface's recent performance showcases a compelling growth narrative driven by strategic initiatives and product innovation. Over the past year, earnings surged from US$9.88 million to US$28.44 million, reflecting strong operational execution. The company has effectively reduced its debt to equity ratio from 177% to 67% over five years, enhancing financial stability. Interface's focus on sustainability and innovative products like the norament 926 satura flooring line positions it well in high-traffic sectors such as education and healthcare. Despite challenges like flat international sales, analysts remain optimistic about its projected annual revenue growth of 4.2%.

Miller Industries (NYSE:MLR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Miller Industries, Inc. manufactures and sells towing and recovery equipment, with a market cap of $772.72 million.

Operations: The company generates revenue primarily from its auto manufacturers segment, amounting to $1.33 billion.

Miller Industries, a smaller player in the machinery sector, has shown impressive earnings growth of 36.9% over the past year, outpacing the industry's 14.6%. The company trades at a significant discount to its estimated fair value by about 36%, presenting potential upside for investors. Despite an increase in its debt to equity ratio from 4.2% to 16.4% over five years, it remains satisfactory at 6.2%. Recent financials reveal sales of US$314 million for Q3 and net income of US$15 million, with ongoing share buybacks totaling US$2.9 million enhancing shareholder value amidst consistent dividend payouts.

Make It Happen

- Get an in-depth perspective on all 243 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TILE

Interface

Designs, produces, and sells modular carpet products primarily worldwide.

Solid track record with excellent balance sheet.