- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 25% over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies with strong innovation potential and solid financial health that can capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.09% | 42.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Madrigal Pharmaceuticals (NasdaqGS:MDGL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Madrigal Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company dedicated to developing therapeutics for non-alcoholic steatohepatitis (NASH) in the United States, with a market cap of $6.80 billion.

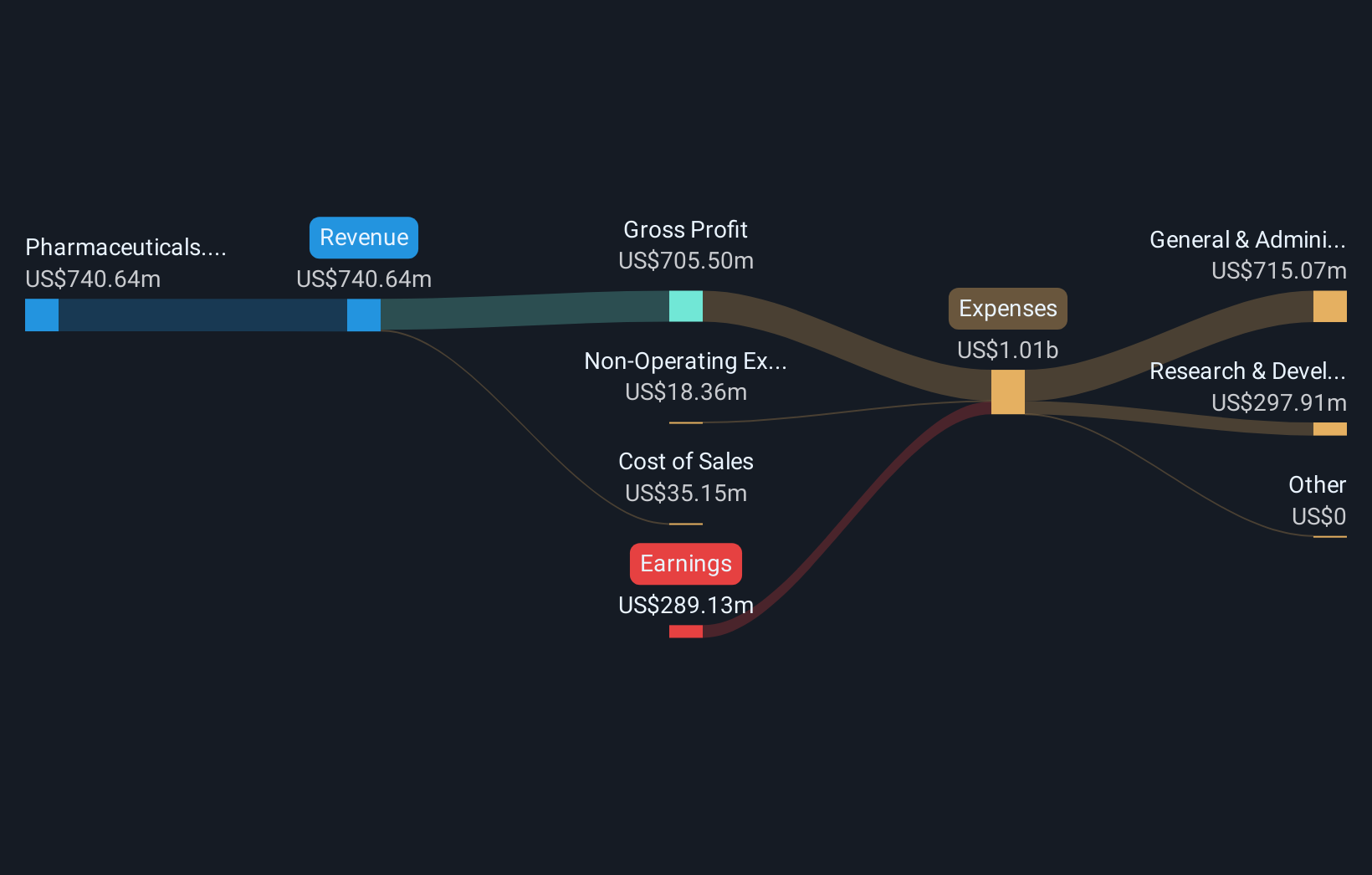

Operations: Madrigal focuses on developing treatments for non-alcoholic steatohepatitis (NASH) in the U.S. As a clinical-stage company, it currently does not report revenue from product sales.

Madrigal Pharmaceuticals has been actively engaging the healthcare community, evidenced by their recent presentations at multiple high-profile conferences. Despite reporting a widening net loss of $106.96 million in Q3 2024, up from $98.74 million year-over-year, they have shown a commitment to innovation through significant R&D investments and the progression of their MAESTRO-NASH OUTCOMES trial. This focus on developing treatments for NASH cirrhosis positions them uniquely within the biotech sector, where they anticipate revenue growth at an impressive rate of 56% per year, outpacing the US market average significantly.

- Take a closer look at Madrigal Pharmaceuticals' potential here in our health report.

Evaluate Madrigal Pharmaceuticals' historical performance by accessing our past performance report.

Corning (NYSE:GLW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corning Incorporated operates in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences sectors globally and has a market capitalization of approximately $41.01 billion.

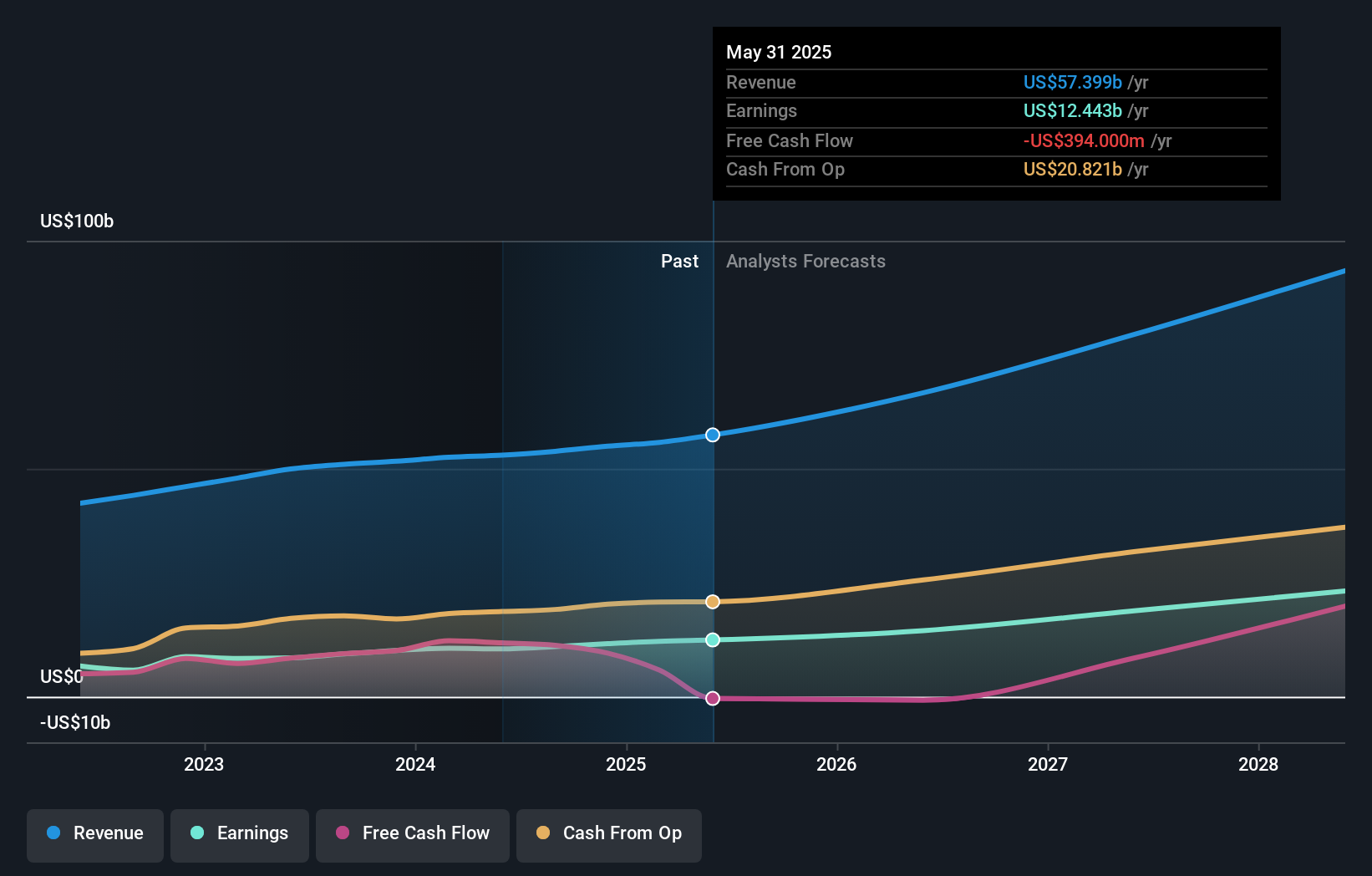

Operations: Corning generates revenue from multiple segments, with optical communications and display technologies being the largest contributors at $4.19 billion and $3.77 billion, respectively. Specialty materials and environmental technologies also play significant roles in its revenue model. The company operates across various sectors both in the United States and internationally, reflecting a diverse business portfolio.

Corning's strategic focus on high-tech innovations is evident from its recent unveiling of EXTREME ULE Glass, tailored for advanced chip manufacturing—a critical component in today’s tech-driven markets. Despite a challenging financial quarter with a net loss of $117 million, Corning's commitment to R&D and strategic partnerships, like the multi-year deal with AT&T for fiber network expansions, positions it uniquely within the tech sector. The company also actively returned value to shareholders by repurchasing shares worth $30.1 million in Q3 2024 alone. With expected revenue growth at 9.9% per year outpacing the US market average and projected earnings growth of 41.9%, Corning is navigating its future with targeted investments in technology that could redefine industry standards.

Oracle (NYSE:ORCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oracle Corporation provides a range of products and services for enterprise information technology environments globally, with a market capitalization of approximately $479.43 billion.

Operations: Oracle generates revenue primarily through its Cloud and License segment, which accounts for $46.68 billion, followed by Services at $5.27 billion, and Hardware at $2.98 billion. The company focuses on offering a comprehensive suite of IT solutions that cater to various enterprise needs worldwide.

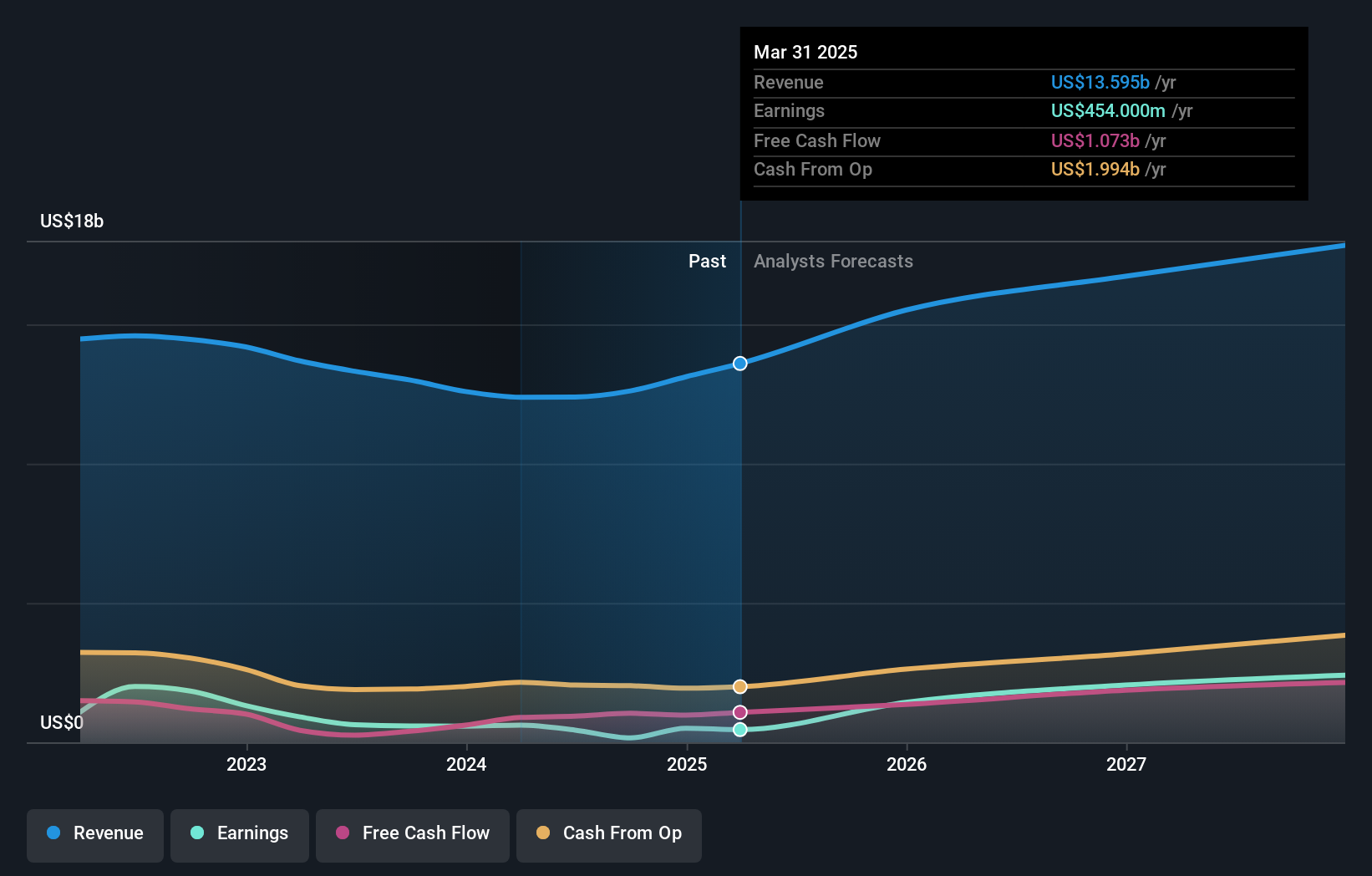

Oracle's recent strategic moves underscore its commitment to integrating advanced technologies across various sectors. With a notable 11.9% annual revenue growth and a robust 16.6% forecast in earnings growth, Oracle is outpacing the general market trends significantly. The company's focus on cloud-based solutions and AI integration, as evidenced by the deployment of Oracle Health CommunityWorks at Nashville General Hospital, highlights its push towards enhancing operational efficiencies and healthcare outcomes through technology. Moreover, Oracle’s R&D expenditure remains pivotal, ensuring continuous innovation and maintaining competitiveness in the fast-evolving tech landscape. This strategy not only strengthens its market position but also promises sustained growth by aligning with emerging technological advancements.

- Click here to discover the nuances of Oracle with our detailed analytical health report.

Review our historical performance report to gain insights into Oracle's's past performance.

Summing It All Up

- Click this link to deep-dive into the 237 companies within our US High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A clinical-stage biopharmaceutical company, focuses on the development of therapeutics for the treatment of non-alcoholic steatohepatitis (NASH) in the United States.

High growth potential with adequate balance sheet.