- United States

- /

- Banks

- /

- NYSE:EQBK

September 2025's Top Growth Companies With Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a boost from tech giants leading the S&P 500 and Nasdaq higher, investors are closely watching economic indicators like job data and potential interest rate cuts by the Federal Reserve. In this context, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best, potentially offering resilience in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 31.1% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.6% | 74.3% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 21.2% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.4% | 36.4% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 36.8% |

Let's uncover some gems from our specialized screener.

LendingTree (TREE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States with a market cap of $924 million.

Operations: The company's revenue segments include Home at $143.68 million, Consumer at $233.66 million, and Insurance at $634.57 million.

Insider Ownership: 18.8%

Earnings Growth Forecast: 58.5% p.a.

LendingTree has recently undertaken a $475 million debt financing to refinance existing facilities and support corporate purposes, indicating strategic financial management. Despite slower forecasted revenue growth compared to the market, its earnings are expected to grow significantly at 58.51% annually. The company raised its annual revenue guidance, reflecting confidence in future performance. While there was significant insider selling recently, LendingTree remains valued favorably against peers and industry standards.

- Navigate through the intricacies of LendingTree with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, LendingTree's share price might be too pessimistic.

Equity Bancshares (EQBK)

Simply Wall St Growth Rating: ★★★★☆☆

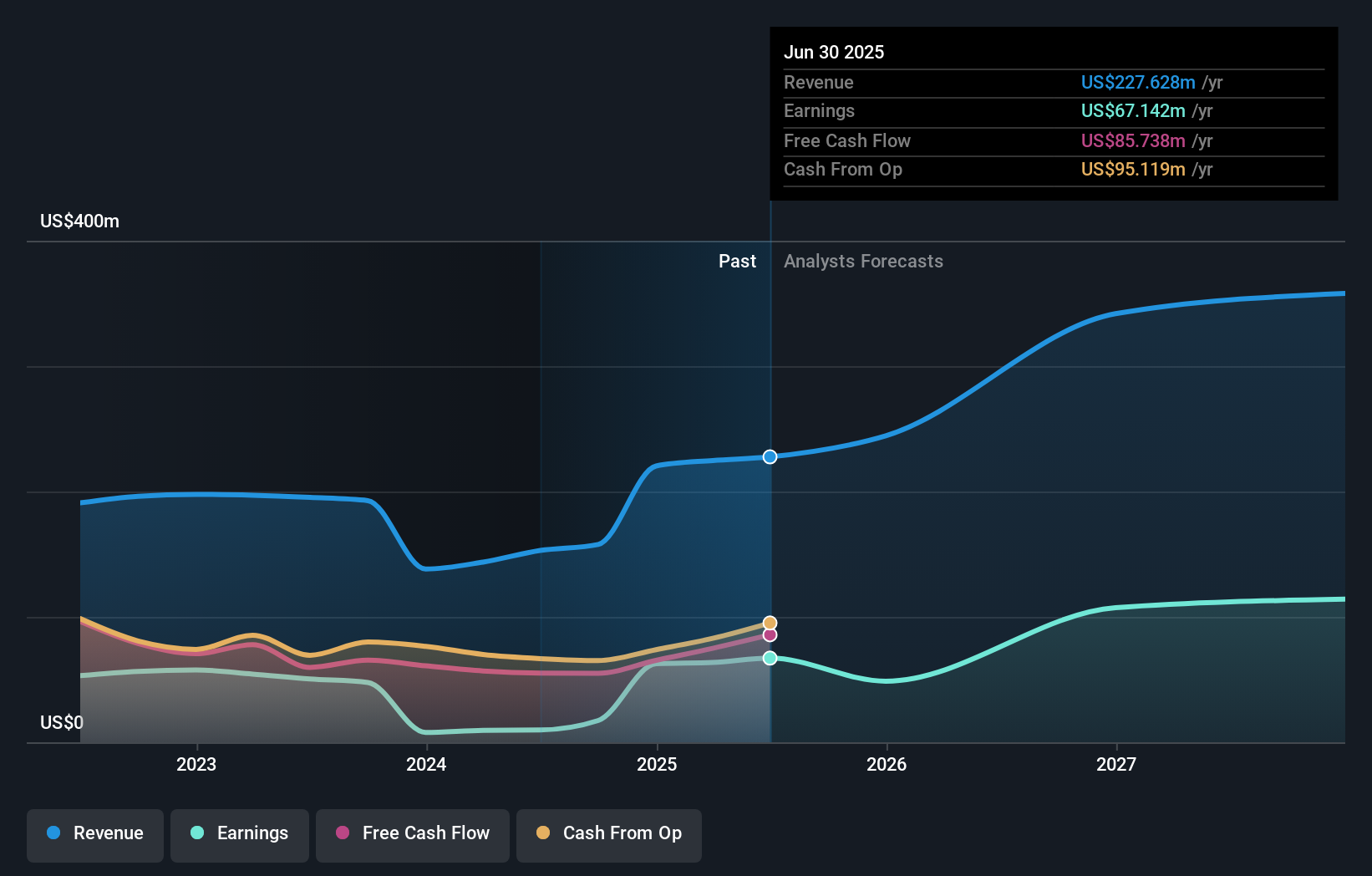

Overview: Equity Bancshares, Inc. is the bank holding company for Equity Bank, offering a variety of banking and financial services to individuals and businesses, with a market cap of approximately $773.53 million.

Operations: Equity Bancshares generates revenue primarily through its subsidiary, Equity Bank, which accounted for $233.88 million in its latest financial reporting.

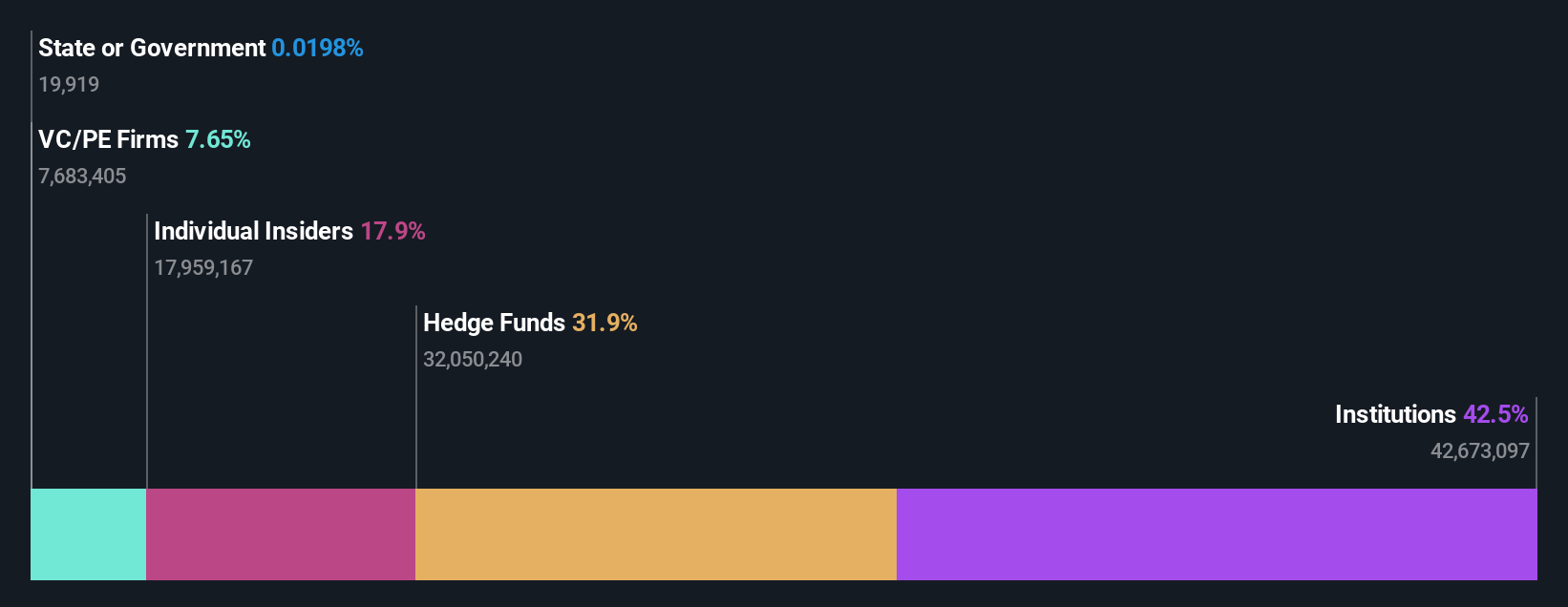

Insider Ownership: 14.4%

Earnings Growth Forecast: 23.8% p.a.

Equity Bancshares is experiencing robust earnings growth, forecasted at 23.8% annually, outpacing the US market. Despite trading significantly below its estimated fair value and recent insider buying activity, insider transactions have not been substantial. The company recently engaged in strategic financial maneuvers including a $75 million fixed-income exchange offer and completed a merger with NBC Corp., enhancing its board with new leadership. However, it faces challenges like low future return on equity forecasts and dilution concerns.

- Click here and access our complete growth analysis report to understand the dynamics of Equity Bancshares.

- Our expertly prepared valuation report Equity Bancshares implies its share price may be lower than expected.

Loar Holdings (LOAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loar Holdings Inc. designs, manufactures, and markets aerospace and defense components for aircraft and systems globally, with a market cap of $6.69 billion.

Operations: The company generates revenue of $451.74 million from its aerospace and defense segment, focusing on components for aircraft and systems both domestically and internationally.

Insider Ownership: 17.9%

Earnings Growth Forecast: 27% p.a.

Loar Holdings demonstrates strong growth potential with earnings projected to grow 27% annually, surpassing the US market average. Recent financial results show significant improvement, with Q2 sales at US$123.12 million and net income rising to US$16.71 million from the previous year. The company raised its full-year guidance, indicating confidence in continued performance improvements. However, despite high insider ownership, insider trading activity has been minimal recently and future return on equity is expected to remain low at 7%.

- Take a closer look at Loar Holdings' potential here in our earnings growth report.

- The analysis detailed in our Loar Holdings valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Reveal the 201 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Want To Explore Some Alternatives? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Equity Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQBK

Equity Bancshares

Operates as the bank holding company for Equity Bank that provides a range of banking, mortgage banking, and financial services to individual and corporate customers.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives