- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin (NYSE:LMT) Unveils Advanced Anomaly Detection for ISR Platforms

Reviewed by Simply Wall St

Lockheed Martin (NYSE:LMT) saw a stock price increase of 10% last week, potentially buoyed by its collaboration with Arquimea to enhance anomaly detection for Intelligence, Surveillance, and Reconnaissance platforms. The partnership, announced on April 14, aims to improve threat identification and related applications, reflecting the company's ongoing innovation in advanced technologies. The broader market also experienced a positive trend, with major indices like the Dow Jones and S&P 500 registering their largest weekly gains since late 2023, fueled by tariff exemptions and strong performances from tech stocks, which may have supported Lockheed Martin's share price appreciation.

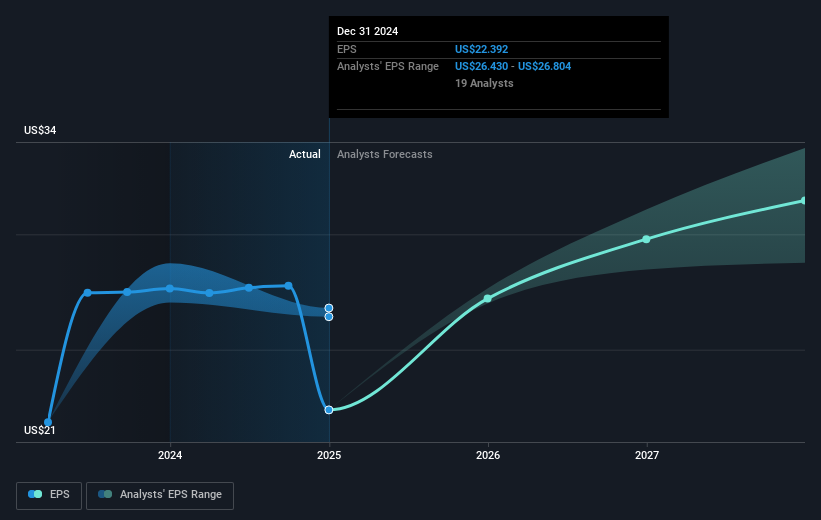

The recent collaboration between Lockheed Martin and Arquimea in anomaly detection for Intelligence, Surveillance, and Reconnaissance platforms could bolster Lockheed Martin's future revenue and earnings forecasts by enhancing its technological capabilities. This development aligns with the company's ongoing strategic investments in R&D, potentially leading to higher-margin revenue streams and operational efficiencies. Such advancements may mitigate some of the risks associated with reliance on classified programs, where unexpected costs have historically introduced volatility. However, challenges in converting backlog to sales due to supply chain issues remain a concern that could impact near-term cash flow.

Over the last five years, Lockheed Martin's total return, including share price and dividends, was 41.81%. In comparison, recent one-year performance showed a matching return of 4.8% with the broader US market, yet it underperformed against the US Aerospace & Defense industry's return of 19.9%. This discrepancy indicates a potential lag in sector performance despite a past record backlog worth $176 billion indicating sustained demand.

The recent 10% weekly increase in Lockheed Martin's share price is a positive move towards the consensus analyst price target of US$520.53, which stands 14.8% higher than the current share price of US$443.36. However, it remains important for potential investors to evaluate their own assumptions and expectations regarding the company’s forecasted earnings growth and industry trends to reach informed conclusions.

Evaluate Lockheed Martin's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives