- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

L3Harris Technologies (NYSE:LHX) Partners With Shield AI For Advanced Electronic Warfare Demonstration

Reviewed by Simply Wall St

L3Harris Technologies (NYSE:LHX) recently announced a collaboration with Shield AI to enhance electronic warfare capabilities, integrating their DiSCO system with AI technology. This move aligns with broader trends in defense innovation and could partly explain the company's share price increase of nearly 4% over the past week. Additionally, the establishment of a $2.5 billion credit facility may have strengthened investor confidence by showcasing financial flexibility. Market conditions were mixed, with major indices showing disparate movements amid subdued semiconductor performance and tariff concerns. Despite this, LHX's focus on technological advancement and financial stability appears to have countered broader market declines, as evidenced by its positive week against a 3.6% market drop. This resilience reflects the company's ability to capitalize on emerging opportunities even as broader economic uncertainties persist. LHX's proactive approach in its sector may position it well amidst evolving market landscapes.

See the full analysis report here for a deeper understanding of L3Harris Technologies.

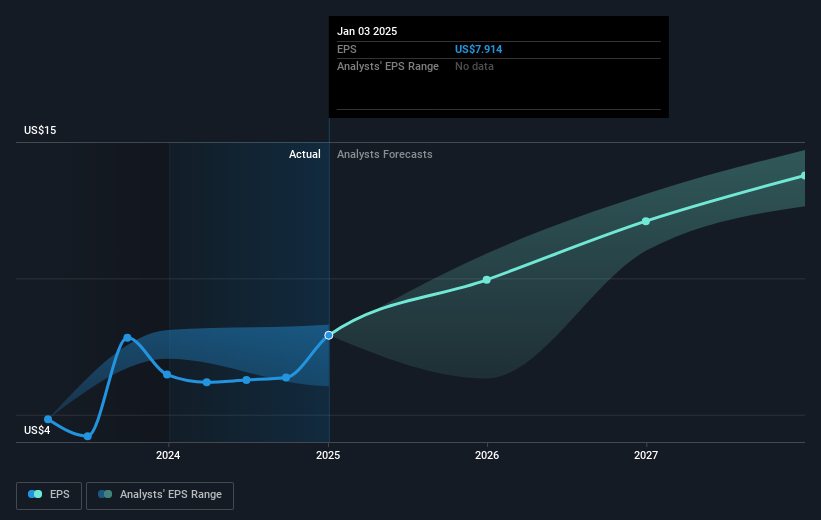

The last five years have seen L3Harris Technologies experience a total shareholder return of 5.72%, which is modest when compared to broader market or industry trends over the same period. Despite LHX underperforming the US market and the Aerospace & Defense industry over the past year, the company has been making strides in enhancing its product offerings and expanding its market presence. Significant achievements include Q4 2024 earnings results demonstrating financial growth, with net income rising to US$1.50 billion. Additionally, the strategic collaboration with Shield AI and advancements like the launch of AMORPHOUS™ have contributed to strengthening the company’s market position.

L3Harris has consistently focused on maintaining financial health, exemplified by the establishment of a US$2.5 billion revolving credit facility, enhancing financial flexibility. Furthermore, the US$5.6 billion share repurchase program underscores the company’s commitment to returning value to shareholders. New initiatives, such as the groundbreaking for rocket propulsion facilities and continued dividend declarations, reflect L3Harris's concerted efforts to be a formidable player in aerospace and defense sectors amidst evolving market landscapes.

- Discover whether L3Harris Technologies is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the potential risks impacting L3Harris Technologies' growth trajectory—explore our risk evaluation report.

- Are you invested in L3Harris Technologies already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives