- United States

- /

- Entertainment

- /

- NYSE:SPOT

3 Growth Companies With Insider Ownership Up To 29%

Reviewed by Simply Wall St

As the United States market grapples with renewed U.S.-China trade tensions and significant weekly losses across major indexes, investors are seeking stability in growth companies with substantial insider ownership. Such stocks can offer a unique appeal, as high insider ownership often signals confidence from those closest to the company's operations, aligning well with current market conditions that demand cautious yet optimistic investment strategies.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 29.4% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Underneath we present a selection of stocks filtered out by our screen.

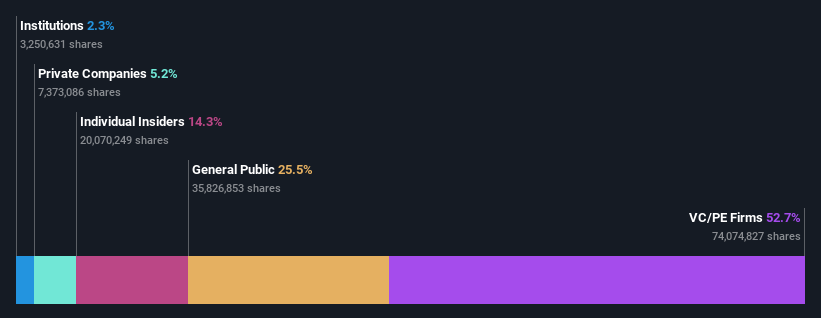

Niagen Bioscience (NAGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Niagen Bioscience, Inc. is a bioscience company focused on developing healthy aging products, with a market cap of $597.80 million.

Operations: The company's revenue is derived from three main segments: Ingredients ($28.21 million), Consumer Products ($84.97 million), and Analytical Reference Standards and Services ($3.12 million).

Insider Ownership: 29.5%

Niagen Bioscience is experiencing significant earnings growth, forecasted at 25.5% annually over the next three years, outpacing the broader US market. The company's recent profitability and increased sales guidance for 2025 underscore its growth trajectory. Despite trading below estimated fair value, Niagen's revenue is expected to grow faster than the market but slower than its earnings rate. Recent product innovations and strategic partnerships enhance its market presence, although no substantial insider trading activity has been reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Niagen Bioscience.

- The valuation report we've compiled suggests that Niagen Bioscience's current price could be quite moderate.

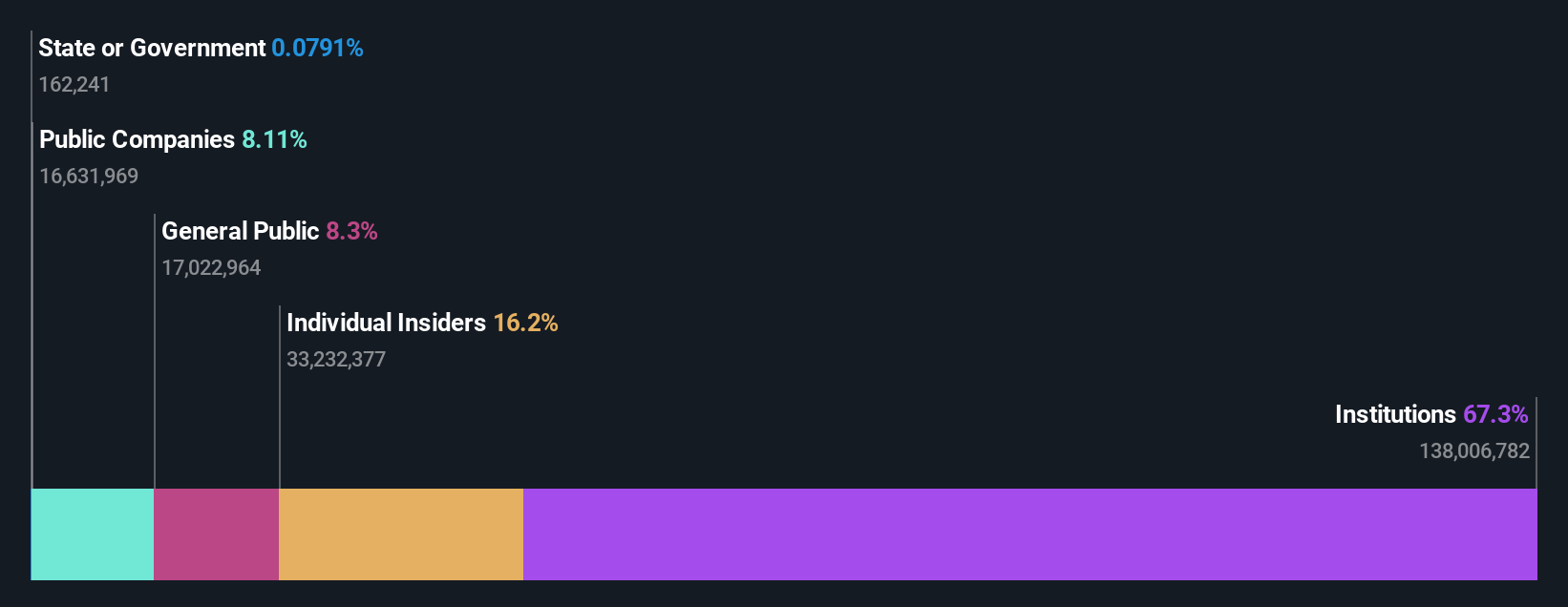

Karman Holdings (KRMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Karman Holdings Inc., through its subsidiary, focuses on designing, testing, manufacturing, and selling mission-critical systems in the United States with a market cap of $9.89 billion.

Operations: The company's revenue segment includes $392.43 million from the Space and Defense Industry.

Insider Ownership: 17.8%

Karman Holdings' revenue is expected to grow at 20.1% annually, surpassing the US market rate of 9.9%, despite a recent decline in profit margins from 4.1% to 2%. The company raised its full-year revenue guidance to between US$452 million and US$458 million, following Q2 sales of US$115.1 million, up from US$85.04 million last year. However, insider activity shows significant selling over the past quarter amid financial challenges with interest coverage by earnings remaining weak.

- Unlock comprehensive insights into our analysis of Karman Holdings stock in this growth report.

- The analysis detailed in our Karman Holdings valuation report hints at an inflated share price compared to its estimated value.

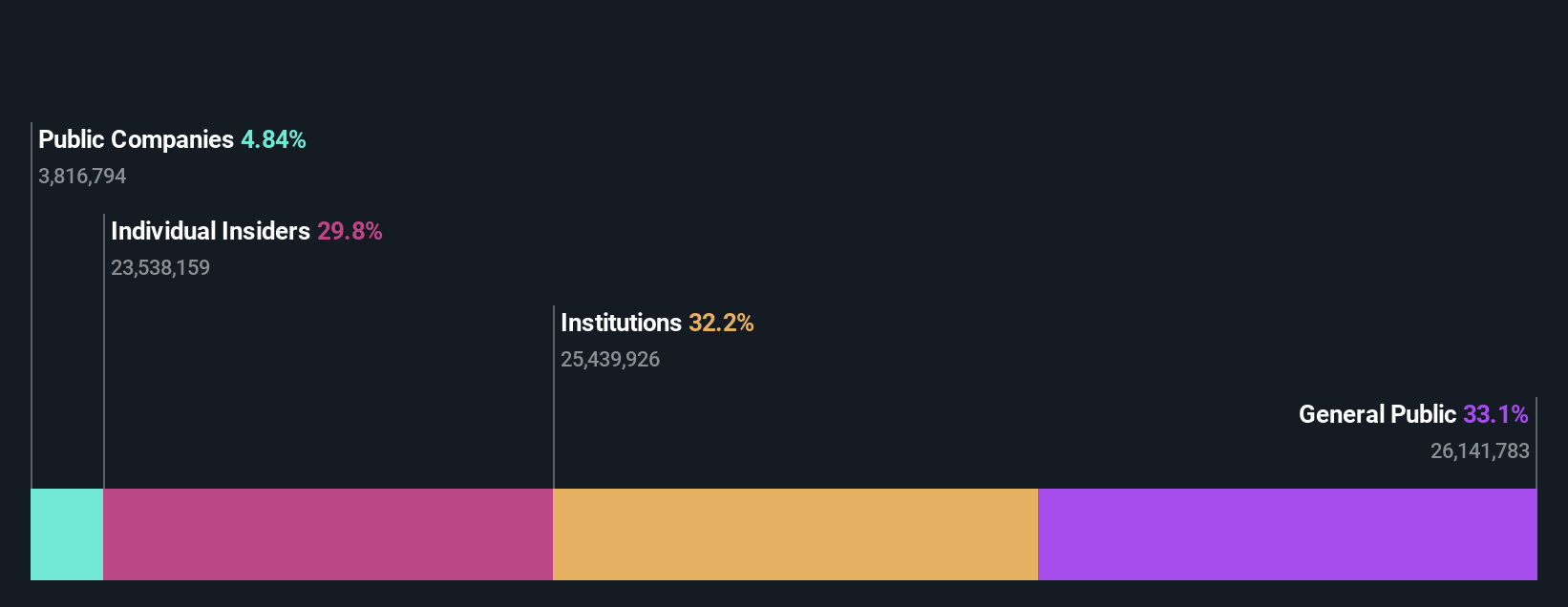

Spotify Technology (SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market capitalization of approximately $141.02 billion.

Operations: Spotify Technology S.A. generates revenue through its Premium segment, which accounts for €14.73 billion, and its Ad-Supported segment, contributing €1.88 billion.

Insider Ownership: 16.1%

Spotify Technology is poised for robust growth, with earnings projected to rise significantly at 34.1% annually, outpacing the US market's 15.4%. Revenue is also set to grow faster than the market, despite a recent net loss in Q2 due to increased sales of €4.19 billion. The company's strategic leadership shift sees Founder Daniel Ek transitioning to Executive Chairman in 2026, potentially enhancing long-term capital allocation and strategic direction while maintaining substantial insider ownership stability.

- Take a closer look at Spotify Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Spotify Technology's current price could be inflated.

Make It Happen

- Click through to start exploring the rest of the 195 Fast Growing US Companies With High Insider Ownership now.

- Ready For A Different Approach? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives