- United States

- /

- Machinery

- /

- NYSE:IEX

IDEX (IEX): A Fresh Look at Valuation as Shares Lag This Year

Reviewed by Kshitija Bhandaru

IDEX (IEX) has caught investors’ attention after a recent stretch of underperformance, with shares trending lower over the past month and quarter. Many are now looking at key valuation metrics to gauge where the stock might go next.

See our latest analysis for IDEX.

Shares of IDEX have lost momentum this year, with a year-to-date share price return of -21.79% and a one-year total shareholder return of -23.30%. While the drop reflects some near-term concerns, it also resets expectations and could signal room for a shift if sentiment turns.

If you’re curious what other opportunities are out there, now is a smart time to broaden your scope and discover fast growing stocks with high insider ownership

With shares lagging but valuation metrics suggesting a meaningful discount to both analyst targets and potential intrinsic value, the question stands: is IDEX offering a rare entry point, or is the market already pricing in future gains?

Most Popular Narrative: 17.2% Undervalued

The most widely followed narrative values IDEX at $194.62, offering a substantial premium over the last close of $161.16. Here is what is driving that number and what could change the outlook.

The company is implementing proactive cost-saving measures, targeting $20 million in savings on top of previous initiatives. This focus on platform optimization and organizational delayering may improve net margins by reducing operating expenses.

Curious how bold cost measures and expansion plans shape a premium valuation? One critical future projection is all about higher margins and scaling up. Ready to discover which growth assumptions make this number possible? Find out what is fueling the most popular viewpoint by digging deeper into the numbers behind the narrative.

Result: Fair Value of $194.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent policy uncertainty, volatile sector demand, and tariff impacts could still limit IDEX's margin improvements and challenge the bullish narrative.

Find out about the key risks to this IDEX narrative.

Another View: Is the Discount Real?

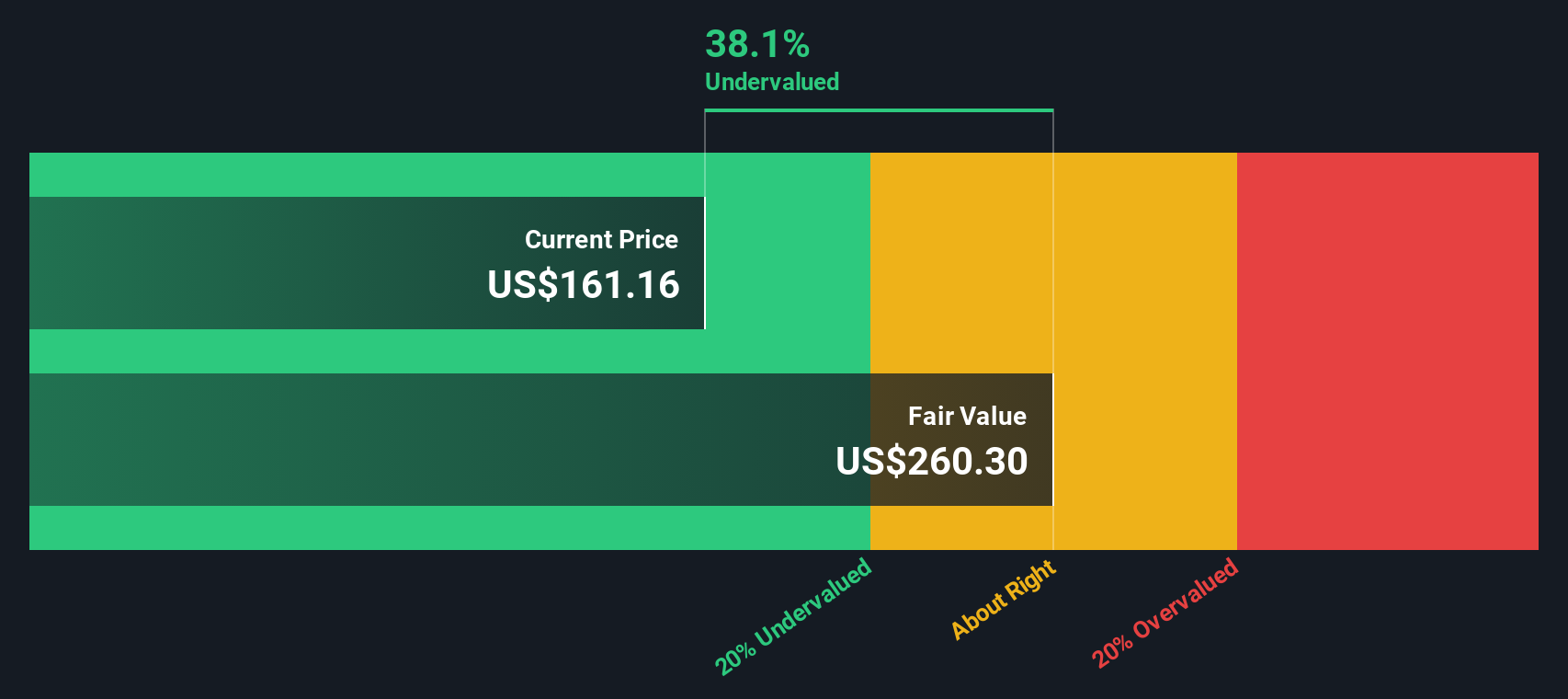

While analyst targets and earnings growth fuel optimism, our DCF model points to a much higher intrinsic value of $260.30 for IDEX. This suggests shares could be even more deeply undervalued than traditional ratios imply. However, will the market agree with this long-range estimate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IDEX Narrative

If you want to challenge these conclusions or arrive at a unique perspective, you can quickly build your own data-driven view in under three minutes, then Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding IDEX.

Looking for more investment ideas?

Make your next move count by checking out stocks that are turning heads for their innovation, value, and income potential. Don’t let unique opportunities pass you by. Use these curated screens before the market notices:

- Profit from fast-changing tech trends and tap into breakthrough opportunities with these 25 AI penny stocks making headlines in artificial intelligence.

- Maximize your portfolio’s returns by targeting these 19 dividend stocks with yields > 3% offering reliable yields above 3%. This is a favorite for steady income seekers.

- Position yourself ahead of the curve and target growth possibilities with these 897 undervalued stocks based on cash flows trading below their real worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IEX

IDEX

Provides applied solutions in the United States, rest of North America, Europe, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives