- United States

- /

- Banks

- /

- NasdaqGS:WABC

3 Reliable Dividend Stocks Yielding Up To 11%

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, with major indices like the Dow Jones and S&P 500 retreating from recent highs, investors are shifting their focus towards sectors showing resilience, such as energy. In this climate of fluctuating valuations and economic uncertainty, dividend stocks can offer a stable income stream and potential long-term growth, making them an attractive option for those seeking reliability amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 11.03% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.41% | ★★★★★☆ |

| PACCAR (PCAR) | 4.46% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.57% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.69% | ★★★★★★ |

| Ennis (EBF) | 5.46% | ★★★★★★ |

| Employers Holdings (EIG) | 3.04% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.51% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.62% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.34% | ★★★★★☆ |

Click here to see the full list of 129 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

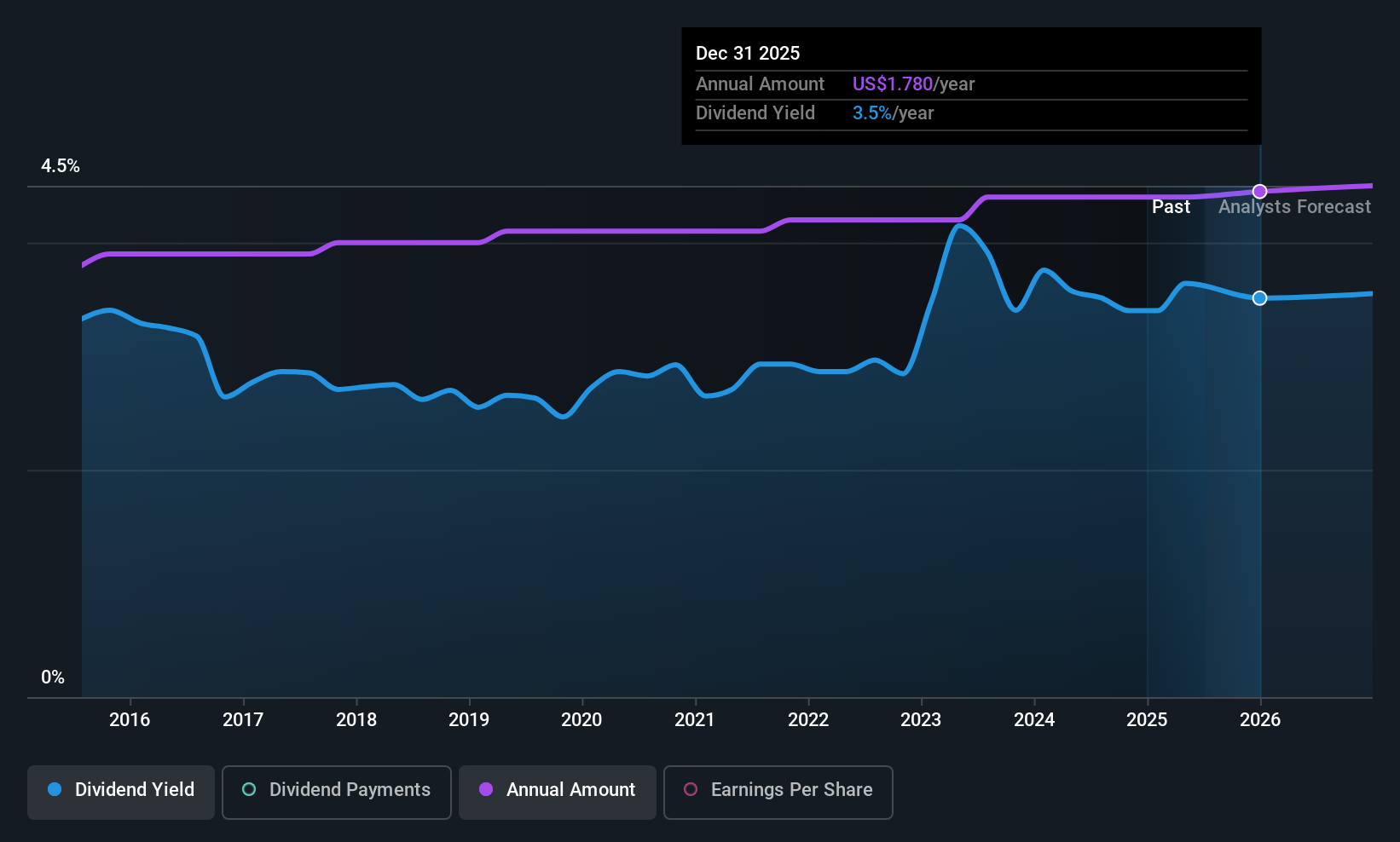

Westamerica Bancorporation (WABC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Westamerica Bancorporation is a bank holding company for Westamerica Bank, offering a range of banking products and services to individual and commercial customers in the United States, with a market cap of approximately $1.25 billion.

Operations: Westamerica Bancorporation generates revenue primarily through its banking segment, which accounts for $274.79 million.

Dividend Yield: 3.7%

Westamerica Bancorporation offers a stable dividend, with payments increasing over the past decade and currently yielding 3.72%. Despite recent declines in earnings, its dividend remains well-covered by a low payout ratio of 37.2%. The company's stock trades at 58% below estimated fair value, presenting potential value for investors. Recent activities include a $35.90 million shelf registration filing and share buybacks totaling $56.31 million, indicating active capital management strategies amidst executive board changes.

- Navigate through the intricacies of Westamerica Bancorporation with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Westamerica Bancorporation shares in the market.

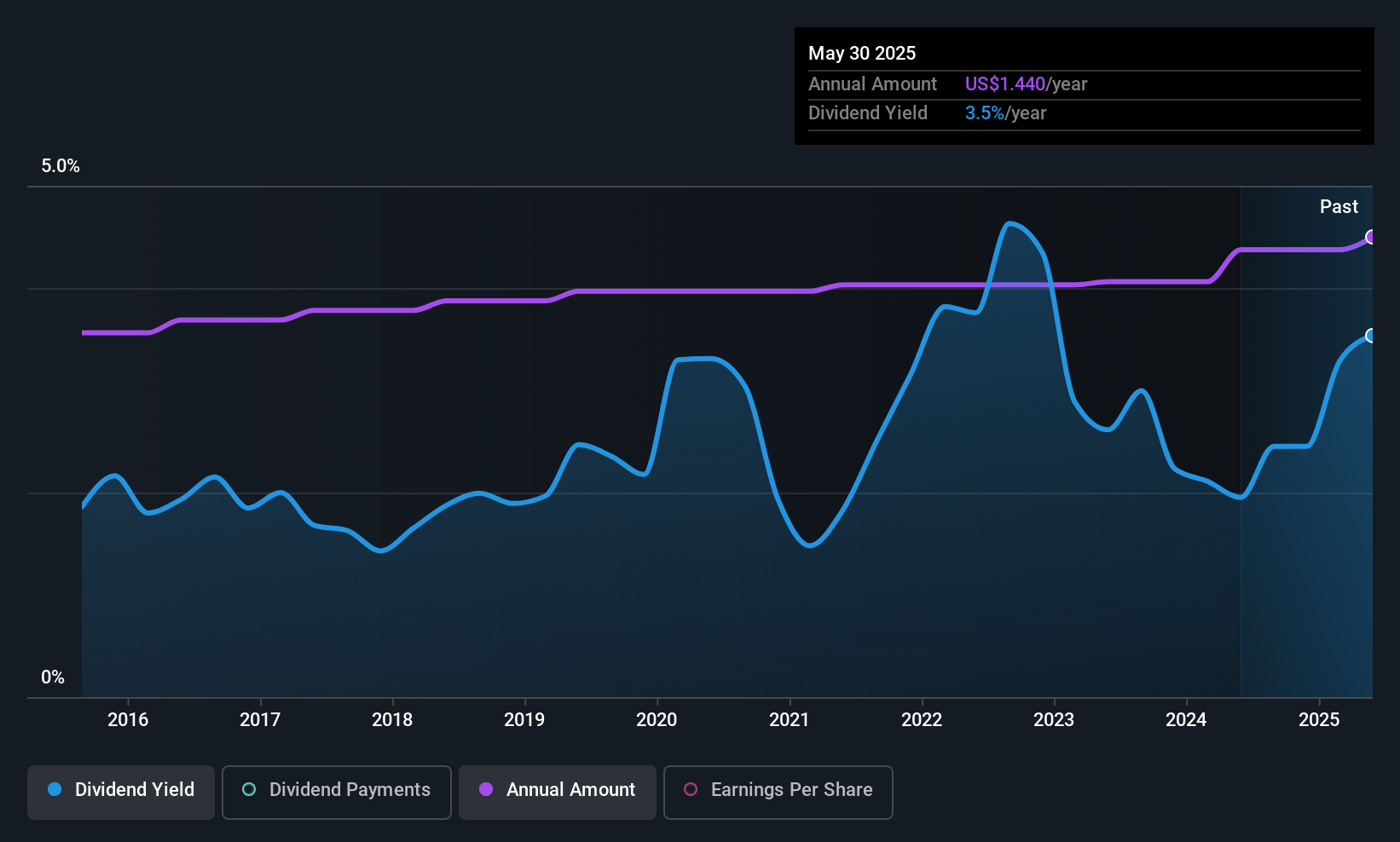

Hyster-Yale (HY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyster-Yale, Inc. operates globally through its subsidiaries by designing, engineering, manufacturing, selling, and servicing lift trucks and related products, with a market cap of $661.69 million.

Operations: Hyster-Yale generates revenue from its Lift Truck Business in the Americas ($2.98 billion), EMEA ($586.90 million), and JAPIC ($193 million), as well as from its Bolzoni segment ($351.40 million).

Dividend Yield: 3.9%

Hyster-Yale's dividend yield of 3.88% is below the top tier in the US, and its high payout ratio of 111.5% suggests dividends aren't well covered by earnings, although cash flow coverage is reasonable at 28.1%. Despite stable and growing dividends over the past decade, recent financial performance shows a net loss with declining sales and profit margins. Additionally, Hyster-Yale was dropped from several Russell growth indexes, which may impact investor perception.

- Click here to discover the nuances of Hyster-Yale with our detailed analytical dividend report.

- Our expertly prepared valuation report Hyster-Yale implies its share price may be lower than expected.

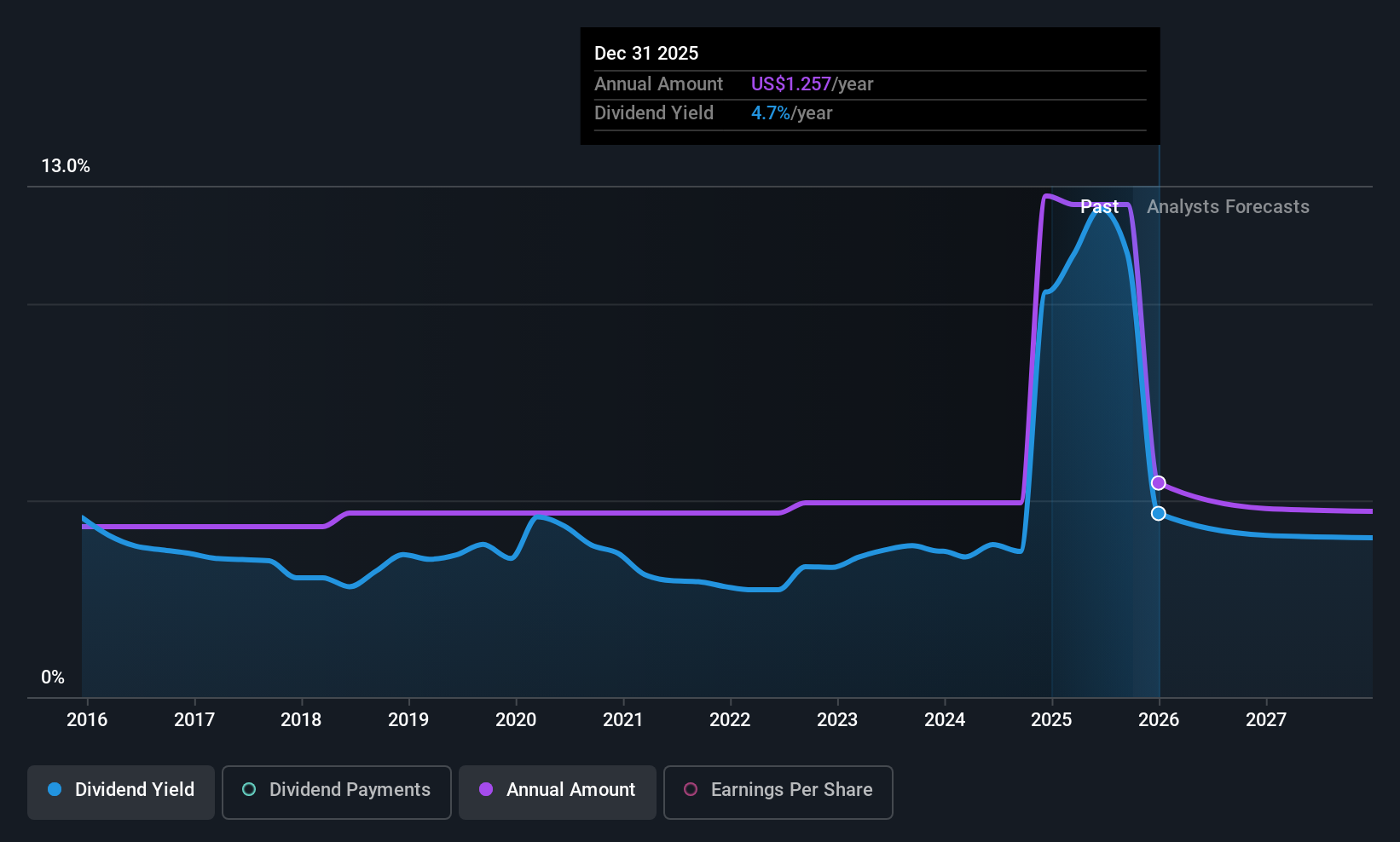

Rayonier (RYN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rayonier is a prominent timberland real estate investment trust with assets in key softwood timber regions in the United States and New Zealand, and it has a market cap of approximately $4.04 billion.

Operations: Rayonier generates revenue through its key segments: Trading ($27.90 million), Real Estate ($652.33 million), Southern Timber ($225.39 million), and Pacific Northwest Timber ($95.10 million).

Dividend Yield: 11%

Rayonier's dividend yield of 11.03% ranks in the top 25% of US payers, though it's not well covered by free cash flow, with a high cash payout ratio of 308%. Despite this, dividends have been stable and growing over the past decade. Recent earnings surged to US$408.7 million for Q2 2025 from US$1.9 million a year ago, but future earnings are forecasted to decline significantly. The company also secured an amended credit agreement for $800 million in August 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Rayonier.

- The analysis detailed in our Rayonier valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Navigate through the entire inventory of 129 Top US Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives