- United States

- /

- Construction

- /

- NYSE:FIX

3 Stocks Estimated To Be 24.1% To 35.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the United States stock market hits record highs, driven by a tame inflation reading and expectations of a Federal Reserve rate cut, investors are keenly eyeing opportunities for value amidst the bullish sentiment. In such an environment, identifying stocks that are estimated to be significantly below their intrinsic value can offer potential for long-term growth and portfolio diversification.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.81 | $13.53 | 49.7% |

| Old National Bancorp (ONB) | $21.05 | $42.09 | 50% |

| McGraw Hill (MH) | $12.70 | $25.38 | 50% |

| GeneDx Holdings (WGS) | $128.87 | $248.76 | 48.2% |

| First Busey (BUSE) | $23.48 | $45.91 | 48.9% |

| Fifth Third Bancorp (FITB) | $42.63 | $82.74 | 48.5% |

| Dime Community Bancshares (DCOM) | $27.84 | $55.36 | 49.7% |

| Corpay (CPAY) | $284.38 | $545.71 | 47.9% |

| Constellium (CSTM) | $16.90 | $32.35 | 47.8% |

| Brunswick (BC) | $71.91 | $138.84 | 48.2% |

We're going to check out a few of the best picks from our screener tool.

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a provider of superapps across Southeast Asia, including countries like Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam; it has a market capitalization of approximately $23.85 billion.

Operations: The company's revenue segments include Mobility at $1.13 billion, Deliveries at $1.64 billion, and Financial Services at $297 million.

Estimated Discount To Fair Value: 24.1%

Grab Holdings is trading at 24.1% below its estimated fair value of US$7.71, suggesting it may be undervalued based on cash flows. The company recently turned profitable, reporting a net income of US$35 million for Q2 2025, reversing a previous loss. With earnings forecasted to grow significantly at 37.5% annually over the next three years, Grab's strategic partnership with May Mobility could enhance its ecosystem and expand its market reach in autonomous vehicle services across Southeast Asia.

- The growth report we've compiled suggests that Grab Holdings' future prospects could be on the up.

- Dive into the specifics of Grab Holdings here with our thorough financial health report.

Comfort Systems USA (FIX)

Overview: Comfort Systems USA, Inc. offers mechanical and electrical installation, renovation, maintenance, repair, and replacement services across the United States with a market cap of $34.55 billion.

Operations: The company's revenue segments include Electrical Services, generating $2.02 billion, and Mechanical Services, contributing $6.30 billion.

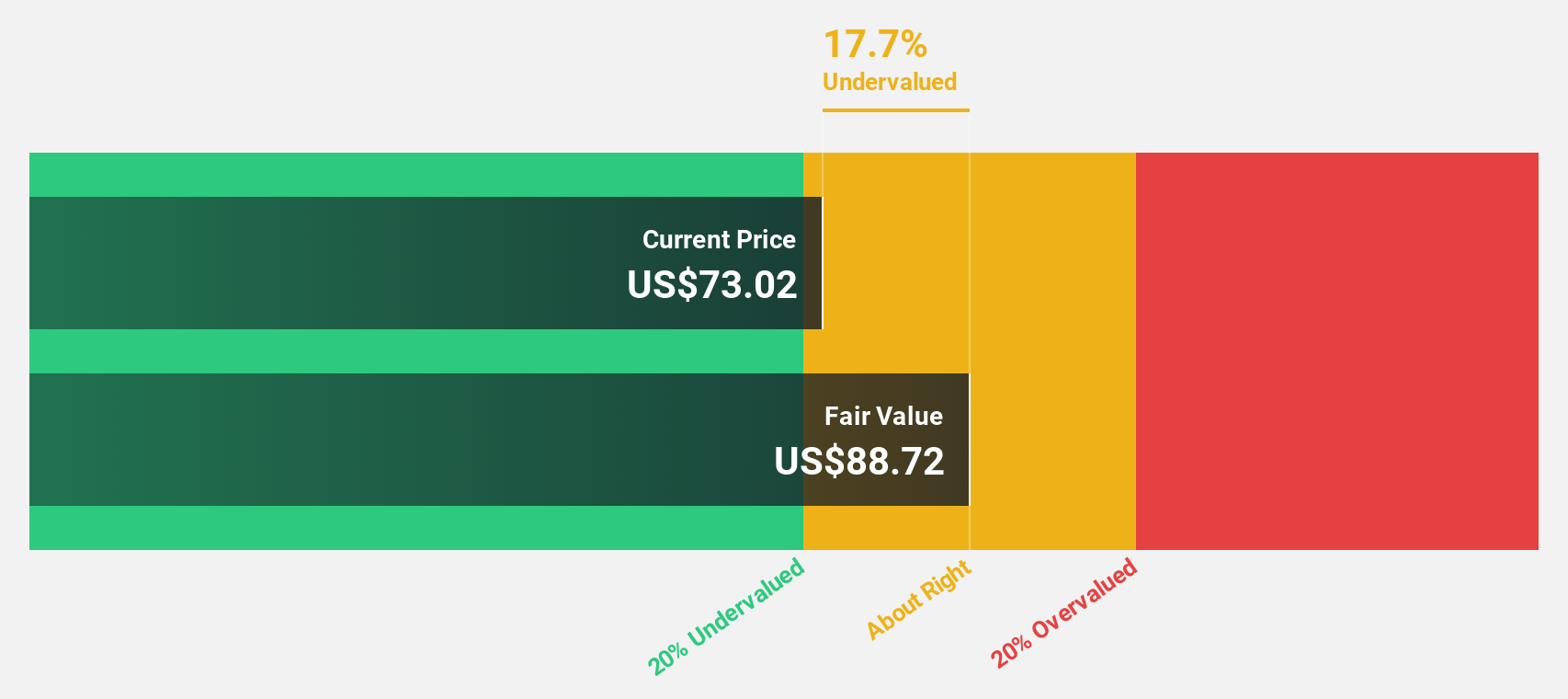

Estimated Discount To Fair Value: 35.5%

Comfort Systems USA is trading at 35.5% below its estimated fair value of US$1,522.86, highlighting potential undervaluation based on cash flows. The company's earnings grew by a substantial 78.9% over the past year and are forecasted to grow at 18.4% annually, surpassing the US market average growth rate of 15.5%. Despite significant insider selling recently, Comfort Systems USA's strong revenue performance and increased dividend reflect robust financial health and operational efficiency amidst an expanded credit facility to US$1.1 billion.

- Our expertly prepared growth report on Comfort Systems USA implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Comfort Systems USA with our detailed financial health report.

Hexcel (HXL)

Overview: Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials for commercial aerospace, space and defense, and industrial applications with a market cap of approximately $5.79 billion.

Operations: Hexcel's revenue is primarily derived from its Composite Materials segment, which generated $1.58 billion, and its Engineered Products segment, which contributed $381.70 million.

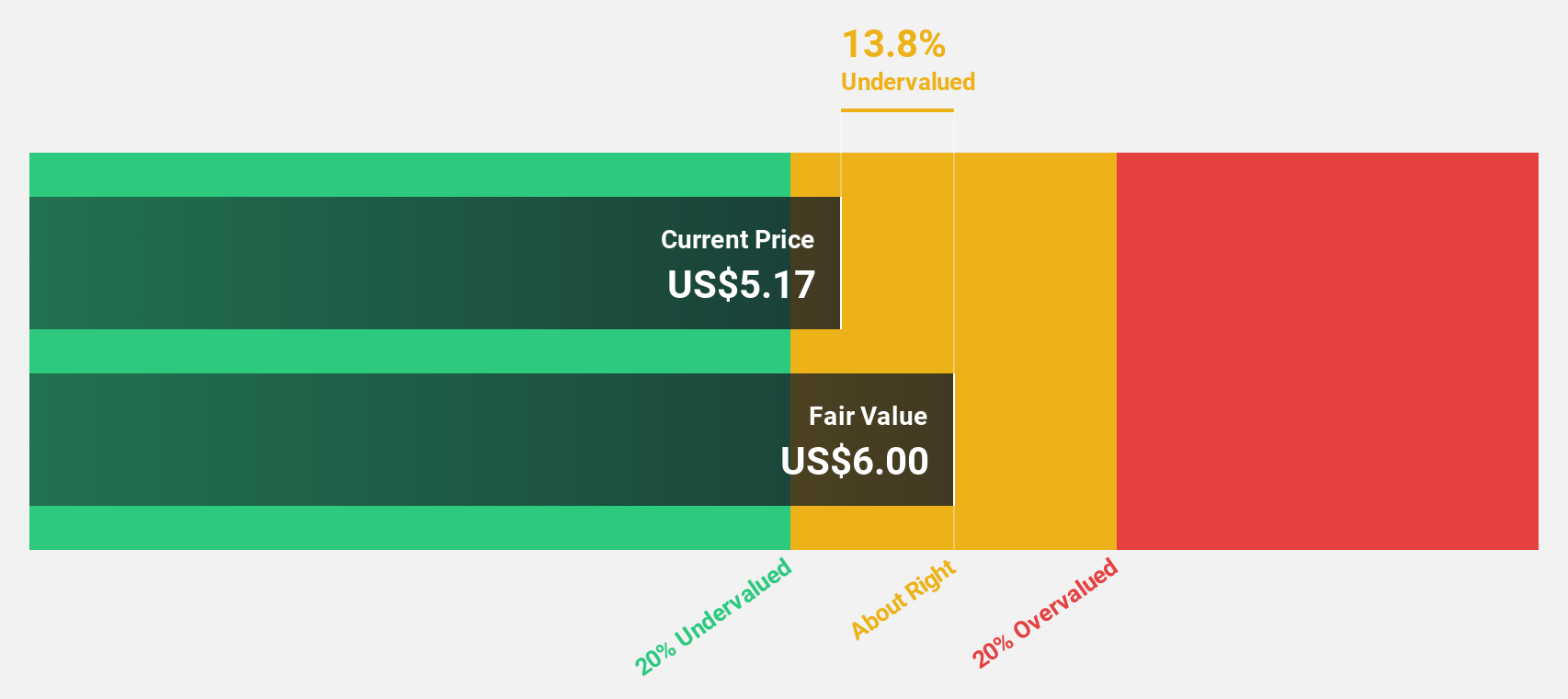

Estimated Discount To Fair Value: 24.6%

Hexcel is trading 24.6% below its fair value estimate of US$96.5, suggesting potential undervaluation based on cash flows despite high debt levels and recent earnings decline. Earnings are projected to grow significantly at 34.7% annually, outpacing the US market's average growth rate of 15.5%. However, recent guidance revisions and executive changes could impact investor sentiment in the short term while long-term growth prospects remain strong due to expected profit increases.

- Insights from our recent growth report point to a promising forecast for Hexcel's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Hexcel.

Make It Happen

- Delve into our full catalog of 182 Undervalued US Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives