- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

Undiscovered Gems In The US Featuring Three Promising Small Caps

Reviewed by Simply Wall St

Despite a recent 2.2% dip in the last week, the United States market has shown robust growth with a 24% increase over the past year and earnings projected to grow by 15% annually. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to capitalize on potential growth beyond the well-trodden paths of larger companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

National Energy Services Reunited (NasdaqCM:NESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Energy Services Reunited Corp. offers oilfield services in the Middle East and North Africa region and has a market capitalization of approximately $786.49 million.

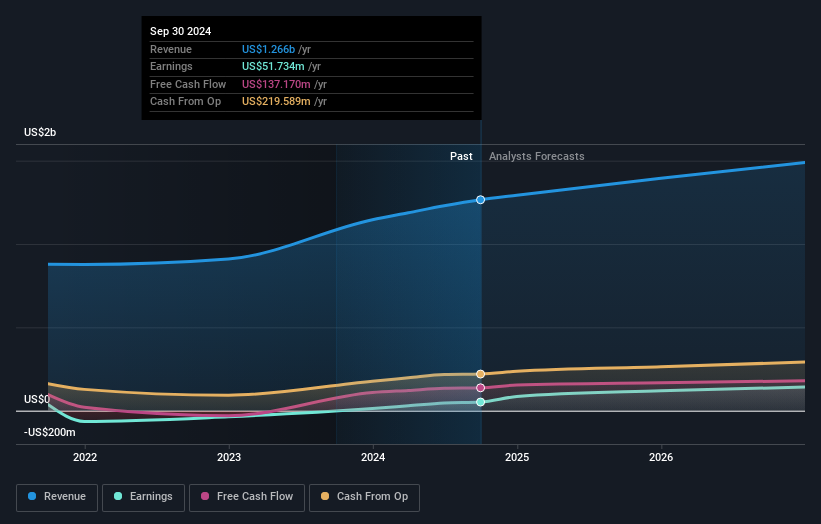

Operations: NESR generates revenue primarily through its Production Services and Drilling and Evaluation Services, with Production Services contributing $853.86 million and Drilling and Evaluation Services adding $411.68 million.

National Energy Services Reunited (NESR) showcases a remarkable earnings growth rate of 22,460% over the past year, significantly outpacing the broader energy services industry. Trading at 71% below its estimated fair value, NESR presents an intriguing investment opportunity. The company's net debt to equity ratio stands at a satisfactory 33.6%, although interest coverage by EBIT is slightly under optimal levels at 2.9x. Recent achievements include securing directional drilling contracts valued over $200 million in key regions like Saudi Arabia and Kuwait, highlighting its strategic expansion efforts and technological advancements in drilling solutions.

Global Industrial (NYSE:GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company is an industrial distributor specializing in maintenance, repair, and operation (MRO) products across North America, with a market cap of $963.41 million.

Operations: Global Industrial generates revenue primarily through its Industrial Products Group, which reported $1.33 billion in sales.

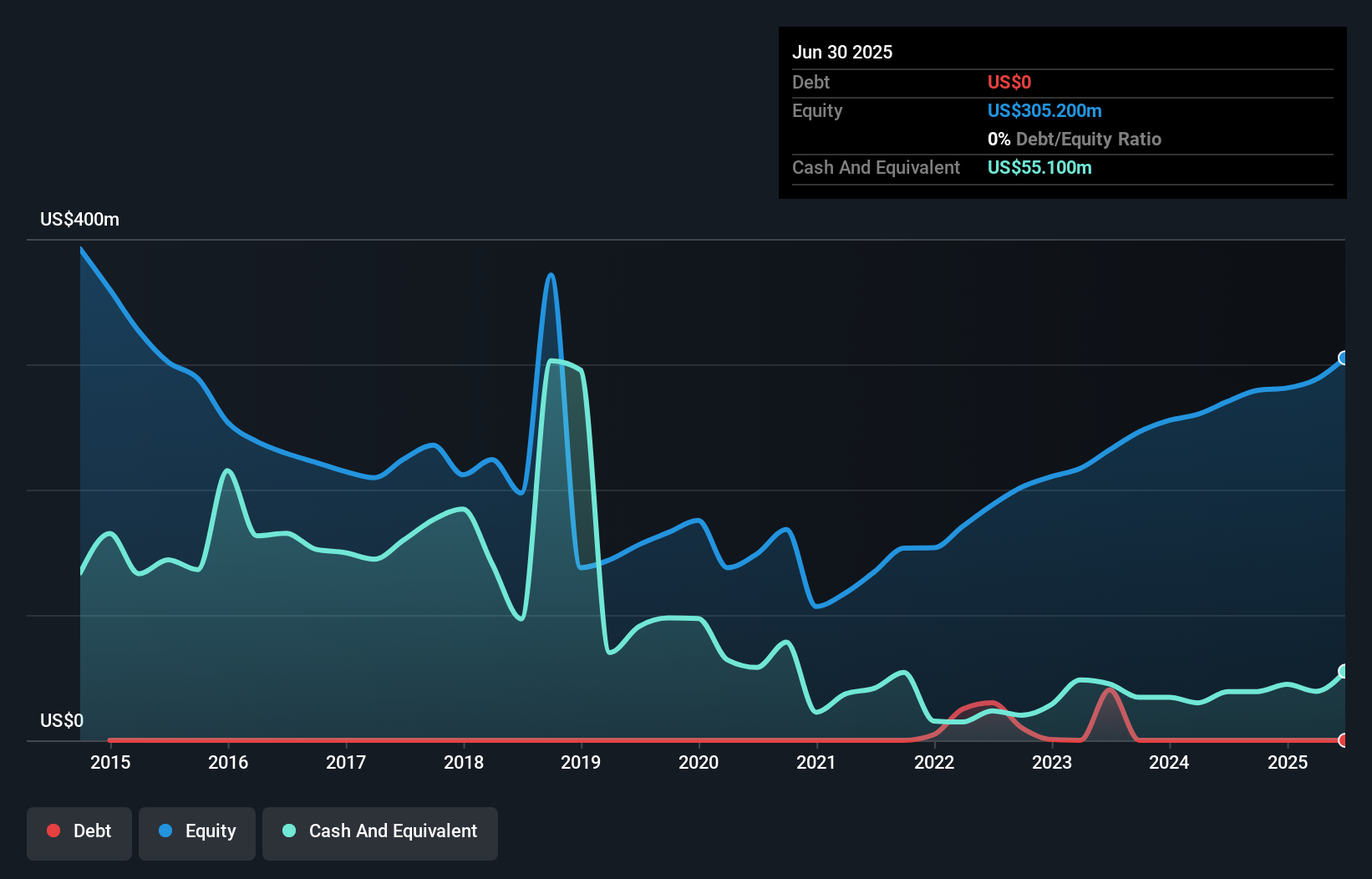

Global Industrial, a nimble player in the trade distributors sector, is navigating challenges with strategic initiatives such as implementing Salesforce to enhance customer engagement and operational efficiency. Despite recent earnings showing sales at US$342 million for Q3 2024 compared to US$355 million last year and net income dipping to US$16.8 million from US$20.7 million, the company remains debt-free with strong liquidity. Analysts forecast revenue growth of 3.4% annually over three years, targeting a share price of $40 against its current $26.17, though risks like rising costs could impact these projections.

La-Z-Boy (NYSE:LZB)

Simply Wall St Value Rating: ★★★★★★

Overview: La-Z-Boy Incorporated is involved in the manufacturing, marketing, importing, exporting, distribution, and retailing of upholstery furniture products across the United States, Canada, and internationally with a market capitalization of approximately $1.77 billion.

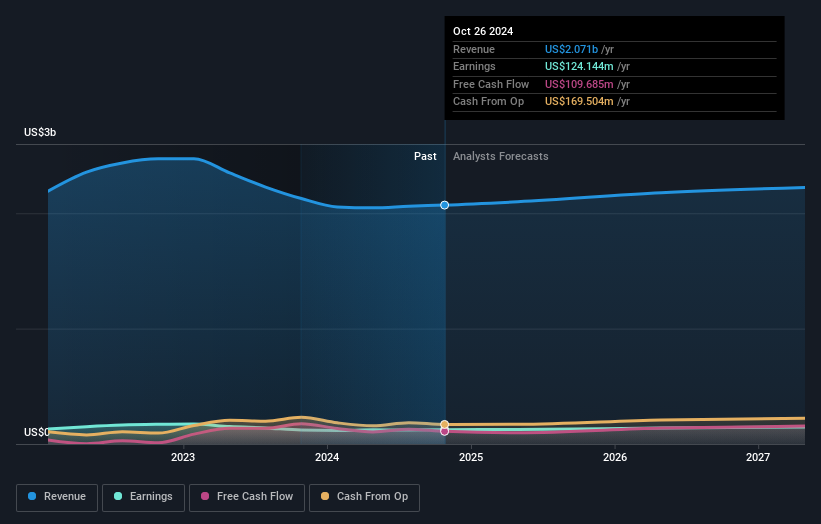

Operations: La-Z-Boy generates revenue primarily from its retail and wholesale segments, with retail contributing $856.51 million and wholesale $1.46 billion. The company also incurs eliminations of $407.91 million related to inter-segment transactions and reports additional corporate-related revenues of $158.27 million.

La-Z-Boy, a well-regarded name in the furniture industry, is navigating its path without debt and has outpaced the Consumer Durables sector with a 2.4% earnings growth over the past year. Trading at 37% below its estimated fair value, it offers potential upside for investors. Recent strategic moves include opening a new retail experience store in Chicago and repurchasing 467,000 shares for US$19.47 million within three months. The company also reported second-quarter sales of US$521 million and net income of US$30 million, reflecting steady financial health despite market challenges like high mortgage rates impacting demand.

Key Takeaways

- Click this link to deep-dive into the 239 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Good value with proven track record.

Market Insights

Community Narratives