- United States

- /

- Machinery

- /

- NYSE:FSS

Will Margin Gains and Earnings Growth Change Federal Signal’s (FSS) Investment Narrative?

Reviewed by Sasha Jovanovic

- Recent analysis highlights that Federal Signal has expanded its operating margin by 4.4 percentage points over the past five years, achieved annual earnings per share growth of 28.5% over two years, and improved its free cash flow margin by 4.1 percentage points.

- This operational progress indicates that Federal Signal is becoming more efficient and profitable, positioning itself with increased resources to pursue growth opportunities or shareholder returns.

- We'll examine how Federal Signal's improved profitability and cash flow margins could reshape its investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Federal Signal Investment Narrative Recap

To be a shareholder in Federal Signal, you need to believe in the company’s continued ability to drive operational improvements and sustain margin expansion through efficiency, thoughtful capital allocation, and capturing opportunities in municipal and industrial infrastructure markets. The recent analysis on margin and cash flow gains does not materially affect the primary catalyst, the order backlog and visibility into 2026 remain intact, nor does it offset the risk that prolonged municipal budget constraints could impact growth prospects in the near term.

Among several notable company updates, Federal Signal’s announcement of share repurchases, 280,893 shares for US$19.99 million last quarter, with a recently expanded buyback plan, stands out. While operational improvements boost resources for such initiatives, this buyback activity ties directly to the near-term catalyst of enhanced shareholder returns and underlines management’s confidence in the ongoing earnings progression, even as sector headwinds persist.

By contrast, investors should also be mindful that sustained dependence on publicly funded municipal customers leaves Federal Signal exposed to...

Read the full narrative on Federal Signal (it's free!)

Federal Signal's outlook anticipates $2.6 billion in revenue and $336.9 million in earnings by 2028. This scenario requires annual revenue growth of 9.2% and a $115.3 million increase in earnings from the current $221.6 million.

Uncover how Federal Signal's forecasts yield a $132.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

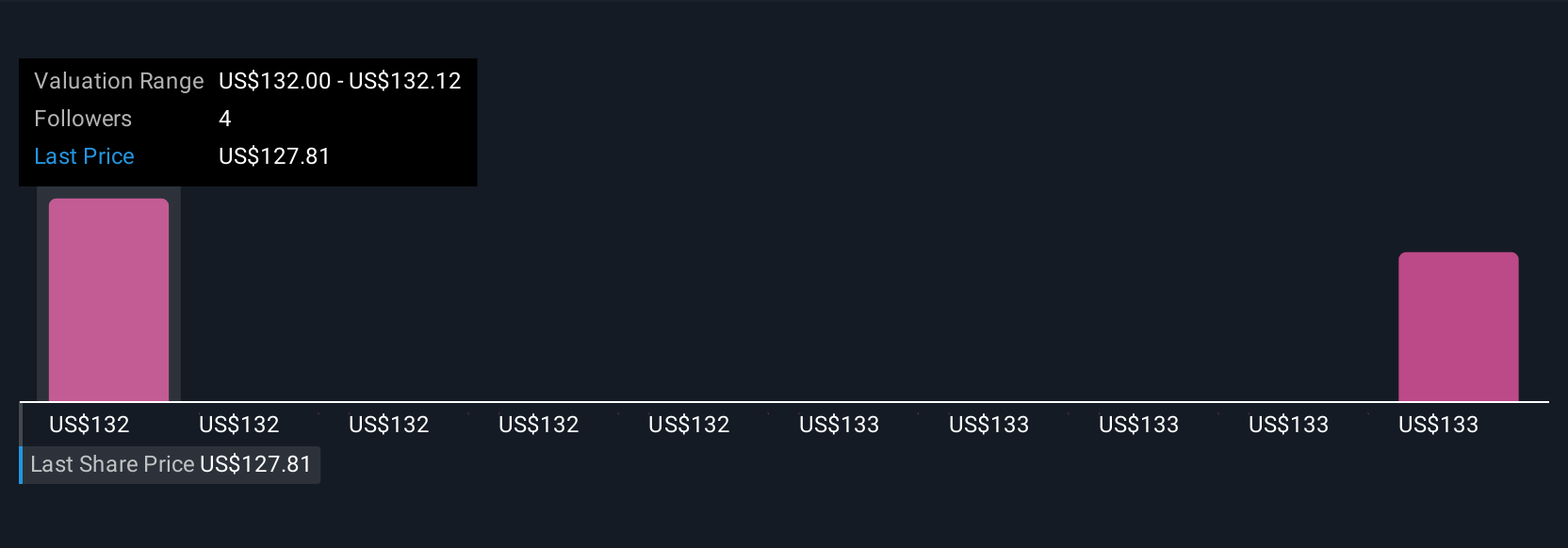

Two members of the Simply Wall St Community placed fair value estimates for Federal Signal between US$132 and US$133.72. The primary growth catalyst remains the strong order book and margin expansion, but budget pressures among public sector customers could test assumptions behind these valuations. Consider exploring several perspectives on what could impact outcomes for Federal Signal going forward.

Explore 2 other fair value estimates on Federal Signal - why the stock might be worth as much as 13% more than the current price!

Build Your Own Federal Signal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Signal research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Federal Signal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Signal's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FSS

Federal Signal

Designs, manufactures, and supplies a suite of products and integrated solutions for municipal, governmental, industrial, and commercial customers in the United States, Canada, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives