- United States

- /

- Construction

- /

- NYSE:FIX

Comfort Systems USA (NYSE:FIX) Price Dips 11% Despite Earnings Growth

Reviewed by Simply Wall St

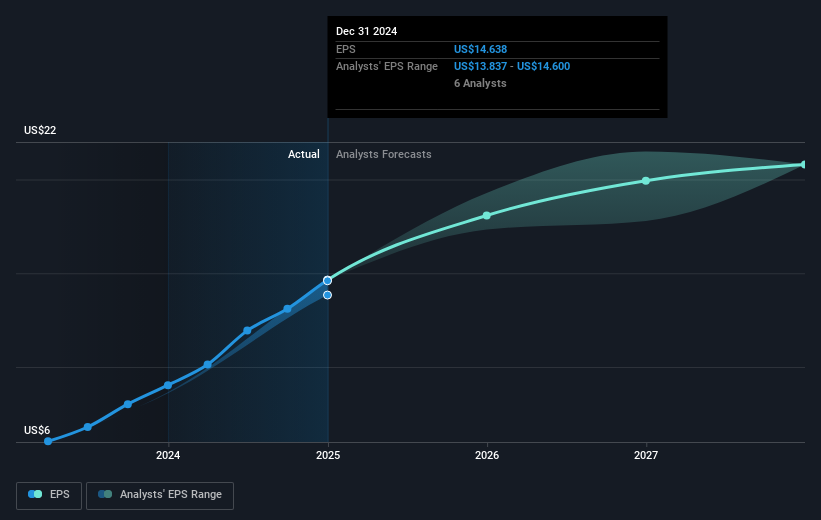

Comfort Systems USA (NYSE:FIX) announced a notable increase in its quarterly dividend and reported substantial growth in its earnings and revenue for both the fourth quarter and full year of 2024. Despite these positive developments, the company's share price decreased by 11% over the past week. This decline comes amidst a general market downturn, with the S&P 500 and Nasdaq both experiencing their worst week since last September, falling by 3% and 4% respectively. Additionally, the broader market reacted to concerns about potential tariff impacts and economic uncertainties despite Federal Reserve comments stating the economy remains stable. The combination of larger market conditions possibly influenced by broader economic concerns, alongside Comfort Systems USA's stock repurchase updates, could have played a role in its recent share price drop. Throughout the tumultuous week, this performance was set against a background of broader market indices experiencing declines and volatility.

Click here to discover the nuances of Comfort Systems USA with our detailed analytical report.

Comfort Systems USA (NYSE:FIX) has achieved a very large total shareholder return of 780.47% over the past five years, driven by robust growth in earnings and strategic financial decisions. The company's recent results highlight strong net income growth, such as a full-year net income of US$522.43 million in 2024, up from US$323.4 million the previous year, reflecting efficient operations and effective management. Additionally, Comfort Systems USA has consistently increased its dividends, most recently declaring a quarterly dividend of US$0.40 per share in February 2025, signaling confidence in its ongoing profitability.

Further enhancing shareholder value, Comfort Systems USA has executed share repurchases, repurchasing shares worth US$16 million in the last quarter of 2024 alone. Despite the recent market fluctuations, the company managed to outperform the US Construction industry over the past year, underlining its resilience and operational effectiveness. These efforts have collectively reinforced investor trust, contributing significantly to the substantial long-term return for shareholders.

- See how Comfort Systems USA measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting Comfort Systems USA's growth trajectory—explore our risk evaluation report.

- Have a stake in Comfort Systems USA? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Comfort Systems USA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Very undervalued with outstanding track record.