- United States

- /

- Electrical

- /

- NYSE:EMR

Emerson Electric (NYSE:EMR) Announces Board Change as Leticia Gonçalves Lourenco Resigns

Reviewed by Simply Wall St

Emerson Electric (NYSE:EMR) experienced a 4% decline in its share price over the past week, amid its announcement that board member Leticia Gonçalves Lourenco resigned due to changes in her principal occupation. This event may have influenced shareholder sentiment, contributing to the recent dip. Additionally, this price movement occurred against a backdrop of broader market trends where major indices, including the Dow Jones and S&P 500, have also experienced declines of similar magnitudes due to economic uncertainties related to policy implementations, sluggish economic data, and faltering tech stocks. As the S&P 500 fell by 1.2%, the negativity surrounding tech stocks weighed heavily on market sentiment, likely exacerbating the pressure on Emerson Electric's share price. While the broader market lost 4.4% during the same period, Emerson's performance is consistent with current market challenges, reflecting investor caution as policy and economic factors play out.

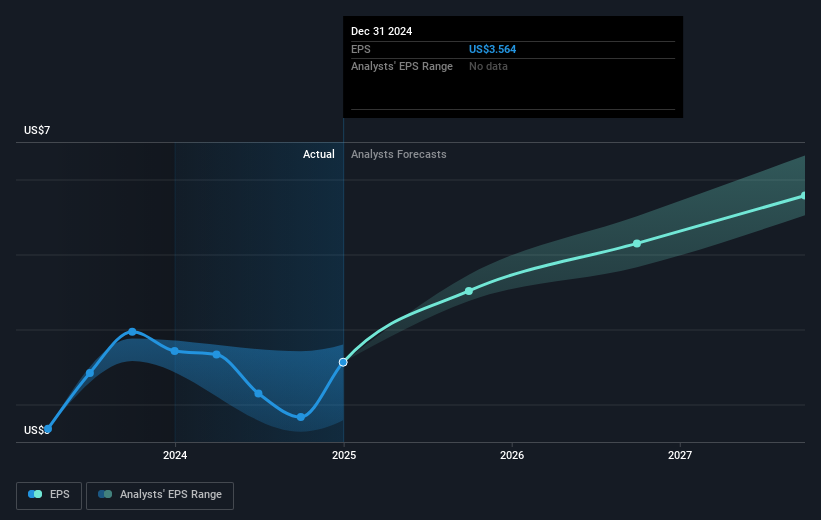

Over the last five years, Emerson Electric has provided a total return of 202.15% for shareholders. This impressive performance comes amid various business developments and strategic actions. The company has maintained shareholder value through consistent dividends, currently yielding 1.9%, alongside a robust share buyback program which saw the repurchase of 38.38 million shares since March 2020. The company's ongoing financial health is evidenced by its reported Q1 2024 earnings, demonstrating US$4.18 billion in sales and a net income of US$585 million, marking a positive trend in earnings per share compared to prior periods.

Emerson's adaptation to market conditions is underscored by recent initiatives, including strategic partnerships with Tata Elxsi aimed at automotive innovation, and significant contracts to supply automation solutions for emerging tech needs like Korea’s hydrogen refueling. While the past year saw the company underperform the U.S. market, it outperformed the U.S. Electrical industry, with returns surpassing the industry average decline of 5.4%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives