- United States

- /

- Machinery

- /

- NYSE:DOV

Dover (DOV) Valuation Check After Q3 Beat, Margin Strength and Upgraded Earnings Guidance

Reviewed by Simply Wall St

Dover (DOV) is back on investors radar after its third quarter update showed steady revenue gains, faster earnings growth, and a guidance bump that points to more confidence from management heading into year end.

See our latest analysis for Dover.

The upbeat third quarter has clearly shifted sentiment, with the recent earnings pop and guidance raise helping drive a 7.47% 1 month share price return and reinforcing Dover’s strong 3 year total shareholder return of 44.28% despite a modest 1 year dip.

If Dover’s renewed momentum has you thinking more broadly about industrial resilience, it could be worth scanning for other aerospace and defense stocks that might benefit from similar demand tailwinds.

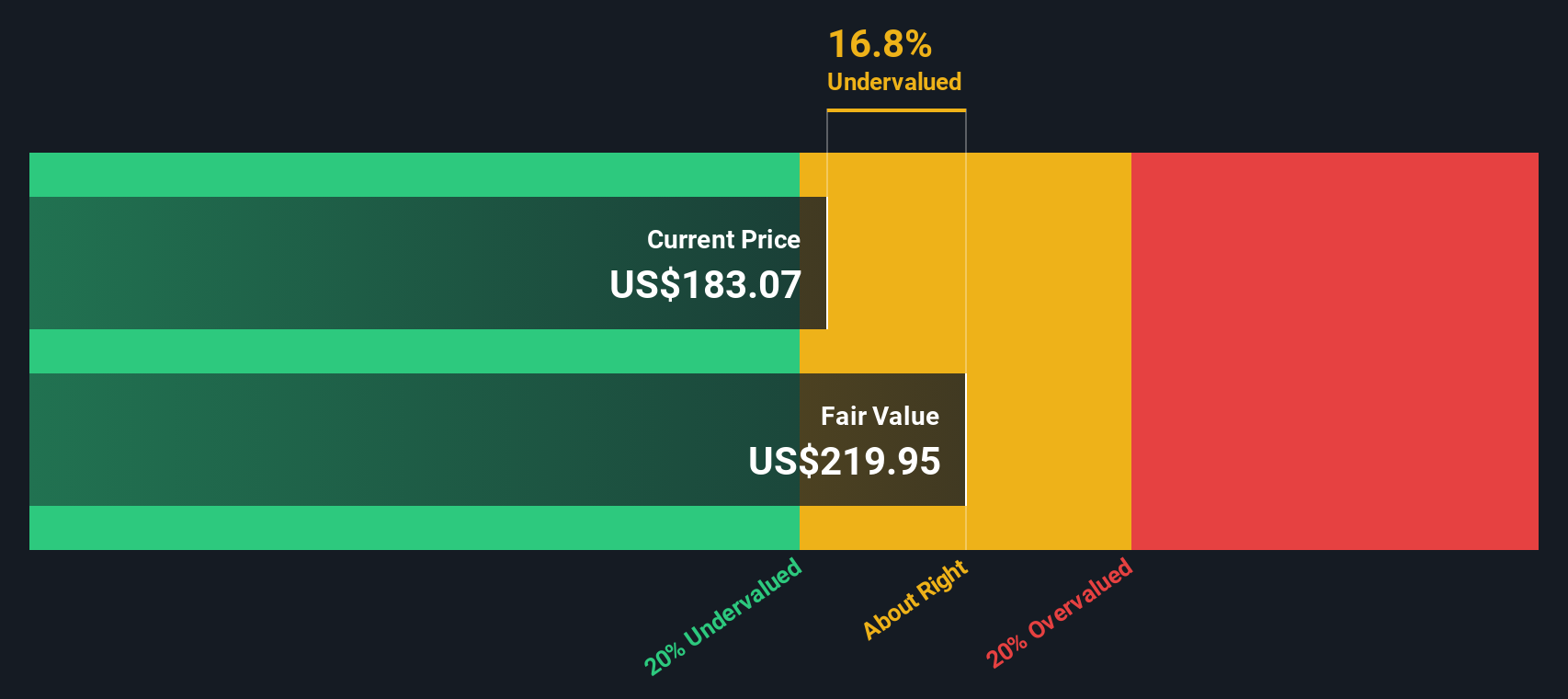

With earnings running ahead of revenue, a modest intrinsic discount, and shares still just below analyst targets, the key question now is whether Dover remains mispriced or if the latest rally already reflects its next leg of growth.

Most Popular Narrative Narrative: 9% Undervalued

With Dover last closing at $195.70 against a narrative fair value of $215.06, the story leans toward upside if its margin blueprint holds.

Execution of operational excellence initiatives, including large-scale restructuring, rooftop consolidations, and productivity projects, is yielding annual run-rate cost savings (e.g. $30M+ each year), directly driving margin expansion and enhancing net earnings predictability into 2026 and beyond.

Want to see how steady, modest growth assumptions can still justify a richer multiple than the sector average? The real twist is in how margins, earnings stability, and future valuation multiples all intersect. Curious which earnings path and profitability profile are used to back into that higher fair value, and how long the market is assumed to wait for it?

Result: Fair Value of $215.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower organic growth and project delays in key end markets could quickly undermine the margin story and pressure Dover’s premium valuation.

Find out about the key risks to this Dover narrative.

Another Angle on Valuation

While the narrative fair value suggests upside, our DCF model is even more optimistic, putting Dover’s value closer to $231.71, around 15.5 percent above today’s price. If both stories point higher, is the market still underestimating how durable these margins really are?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dover Narrative

If this outlook does not quite match your own, or you prefer digging into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dover.

Ready for your next investing move?

If you stop with Dover, you may miss out on other compelling setups. Let Simply Wall Street’s powerful screener surface your next smart idea today.

- Capture potential bargains early by targeting mispriced opportunities through these 907 undervalued stocks based on cash flows that pair solid cash flow support with room for sentiment to catch up.

- Position ahead of transformational breakthroughs by scanning these 28 quantum computing stocks that could benefit as real world applications turn hype into revenue.

- Strengthen your income strategy by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with balance sheets built to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026