- United States

- /

- Machinery

- /

- NYSE:CYD

How China Yuchai’s S&P Global BMI Index Addition Could Shape the Future for CYD Investors

Reviewed by Simply Wall St

- China Yuchai International Limited (NYSE:CYD) was recently added to the S&P Global BMI Index, highlighting its growing footprint in the global equity landscape.

- This development coincides with the company's strong earnings momentum, improved analyst sentiment, and ongoing insider confidence in future prospects.

- We'll explore how China Yuchai's index inclusion and robust profitability performance may shape its future investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

China Yuchai International Investment Narrative Recap

Owning shares of China Yuchai International means believing in the company’s ability to maintain outperformance, driven by strong earnings growth, expanding international partnerships, and increasing industry recognition. The recent inclusion in the S&P Global BMI Index enhances visibility but does not materially change the short-term catalyst, which remains centered on sustaining robust profitability and managing evolving demand for diesel and alternative fuel engines. The primary risk continues to be whether this elevated growth is sustainable as market and regulatory conditions shift.

Among recent announcements, China Yuchai’s latest earnings report stands out, reflecting sales growth to CN¥13,806.17 million and net income of CN¥365.79 million for the half-year ended June 2025. This sustained financial momentum aligns with the major catalysts of ongoing global expansion and reinforces the company’s operational strengths following its index recognition.

However, investors should be aware that, in contrast to recent index-driven optimism, sustained growth could face future challenges if...

Read the full narrative on China Yuchai International (it's free!)

China Yuchai International's outlook anticipates CN¥30.3 billion in revenue and CN¥509.0 million in earnings by 2028. This projection is based on a 10.2% annual revenue growth rate and reflects a CN¥60.5 million increase in earnings from the current CN¥448.5 million.

Uncover how China Yuchai International's forecasts yield a $33.91 fair value, a 17% downside to its current price.

Exploring Other Perspectives

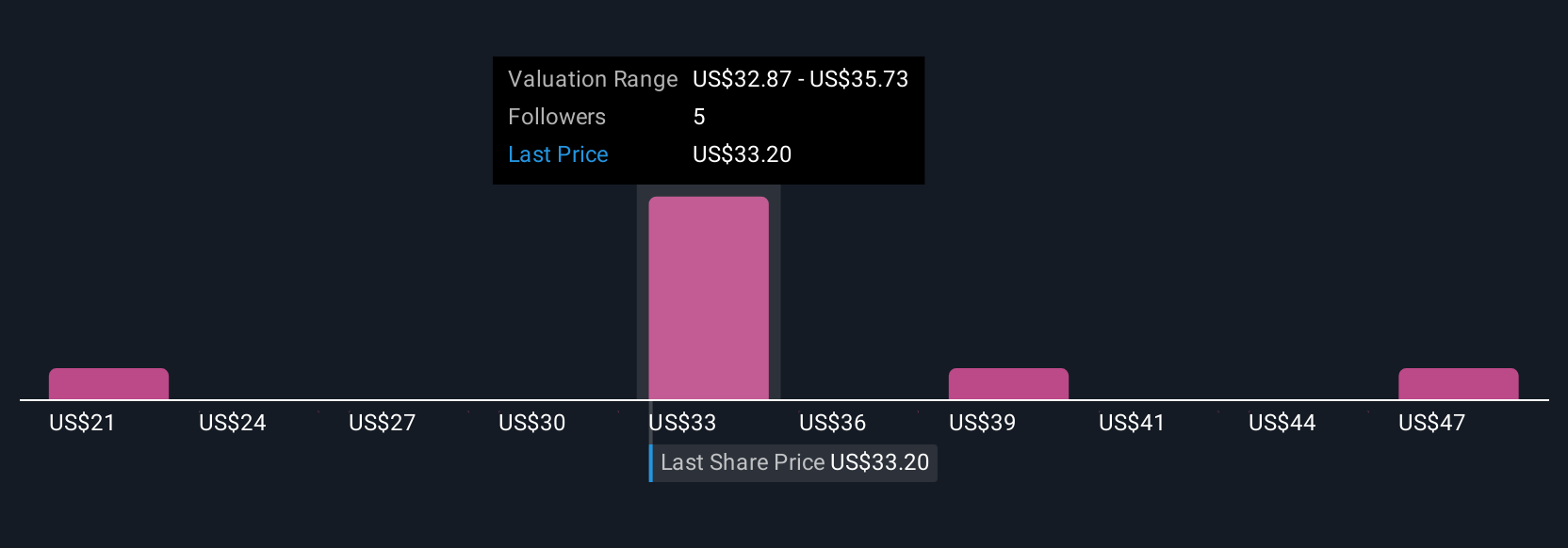

Seven fair value estimates from the Simply Wall St Community range widely, from CN¥21.69 to CN¥55 per share. Even as some see significant upside, concerns about the sustainability of recent growth continue to shape expectations across the market, explore diverse viewpoints for a fuller picture.

Explore 7 other fair value estimates on China Yuchai International - why the stock might be worth 47% less than the current price!

Build Your Own China Yuchai International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Yuchai International research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free China Yuchai International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Yuchai International's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYD

China Yuchai International

Manufactures, assembles, and sells diesel and natural gas engines for trucks, buses, pickups, construction and agricultural equipment, and marine and power generation applications.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)