- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

How Will Carpenter Technology's (CRS) Dividend Consistency and Upgraded Credit Shape Its Investment Story?

Reviewed by Sasha Jovanovic

- Carpenter Technology Corporation's Board of Directors declared a quarterly cash dividend of $0.20 per share of common stock, payable December 4, 2025, to shareholders of record on October 21, 2025.

- The announcement continues Carpenter Technology's 55-year streak of dividend payments and follows a recent Moody’s Ratings upgrade, highlighting confidence in its financial stability and outlook.

- We'll examine how Carpenter Technology's recent dividend affirmation and strong analyst sentiment could influence its longer-term investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carpenter Technology Investment Narrative Recap

To own shares of Carpenter Technology, you need to believe in a multi-year upcycle in aerospace and defense, along with the company’s ability to leverage high-performance alloys and expanded capacity to drive profitability. The recently affirmed dividend, supported by a Moody’s rating upgrade, signals confidence but does not materially change the central catalyst, aerospace demand, and the key risk, which remains the execution of Carpenter’s $400 million capacity expansion against a backdrop of potential end-market volatility.

Among recent developments, Carpenter’s addition to the S&P Aerospace & Defense Select Industry Index stands out as particularly relevant. This inclusion reflects the company’s positioning within its most important end markets and may support investor interest and liquidity, directly tying back to the major catalyst of accelerating aerospace demand.

But while these positives grab headlines, investors should be aware that if end-market demand stumbles amid a large capital expansion...

Read the full narrative on Carpenter Technology (it's free!)

Carpenter Technology’s outlook anticipates $3.6 billion in revenue and $672.3 million in earnings by 2028. This is based on an expected annual revenue growth rate of 7.7% and a $296.5 million increase in earnings from the current $375.8 million level.

Uncover how Carpenter Technology's forecasts yield a $325.72 fair value, a 35% upside to its current price.

Exploring Other Perspectives

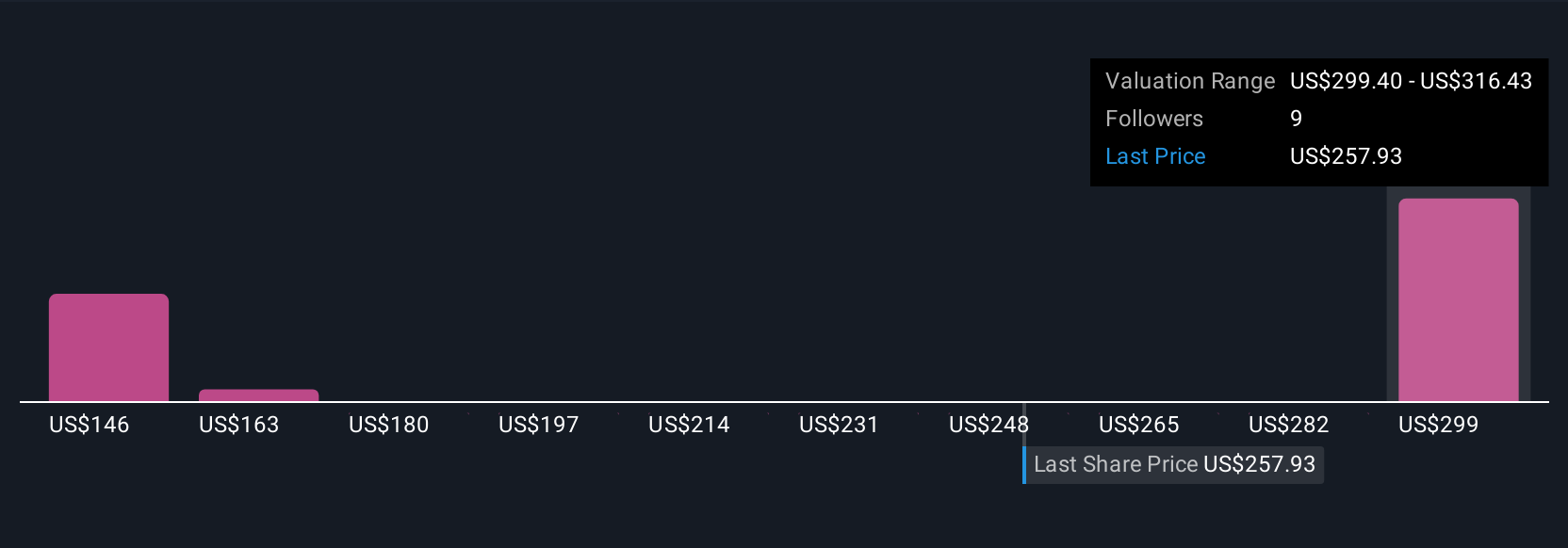

Simply Wall St Community members estimate Carpenter Technology's fair value from as low as US$127.85 to as high as US$325.72, across three unique views. While opinions span a significant range, all eyes remain on how effectively the company can grow profitably as it ramps up high-purity melt capacity for a longer runway.

Explore 3 other fair value estimates on Carpenter Technology - why the stock might be worth as much as 35% more than the current price!

Build Your Own Carpenter Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carpenter Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carpenter Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carpenter Technology's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives