- United States

- /

- Machinery

- /

- NYSE:CNH

3 Stocks Estimated To Be Trading At Discounts Of Up To 18.7%

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 1.8% in the last week and up 9.5% over the past year, with earnings projected to grow by 14% annually. In this environment, identifying stocks that are estimated to be trading at a discount can present opportunities for investors seeking value in fundamentally strong companies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | $18.20 | $34.93 | 47.9% |

| ConnectOne Bancorp (NasdaqGS:CNOB) | $22.75 | $45.38 | 49.9% |

| Lantheus Holdings (NasdaqGM:LNTH) | $105.92 | $204.25 | 48.1% |

| Ready Capital (NYSE:RC) | $4.48 | $8.65 | 48.2% |

| Curbline Properties (NYSE:CURB) | $23.18 | $44.84 | 48.3% |

| Tenable Holdings (NasdaqGS:TENB) | $30.74 | $59.71 | 48.5% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.22 | $10.35 | 49.6% |

| StoneCo (NasdaqGS:STNE) | $13.89 | $27.47 | 49.4% |

| Verra Mobility (NasdaqCM:VRRM) | $21.71 | $42.94 | 49.4% |

| Viking Holdings (NYSE:VIK) | $40.93 | $80.03 | 48.9% |

Let's uncover some gems from our specialized screener.

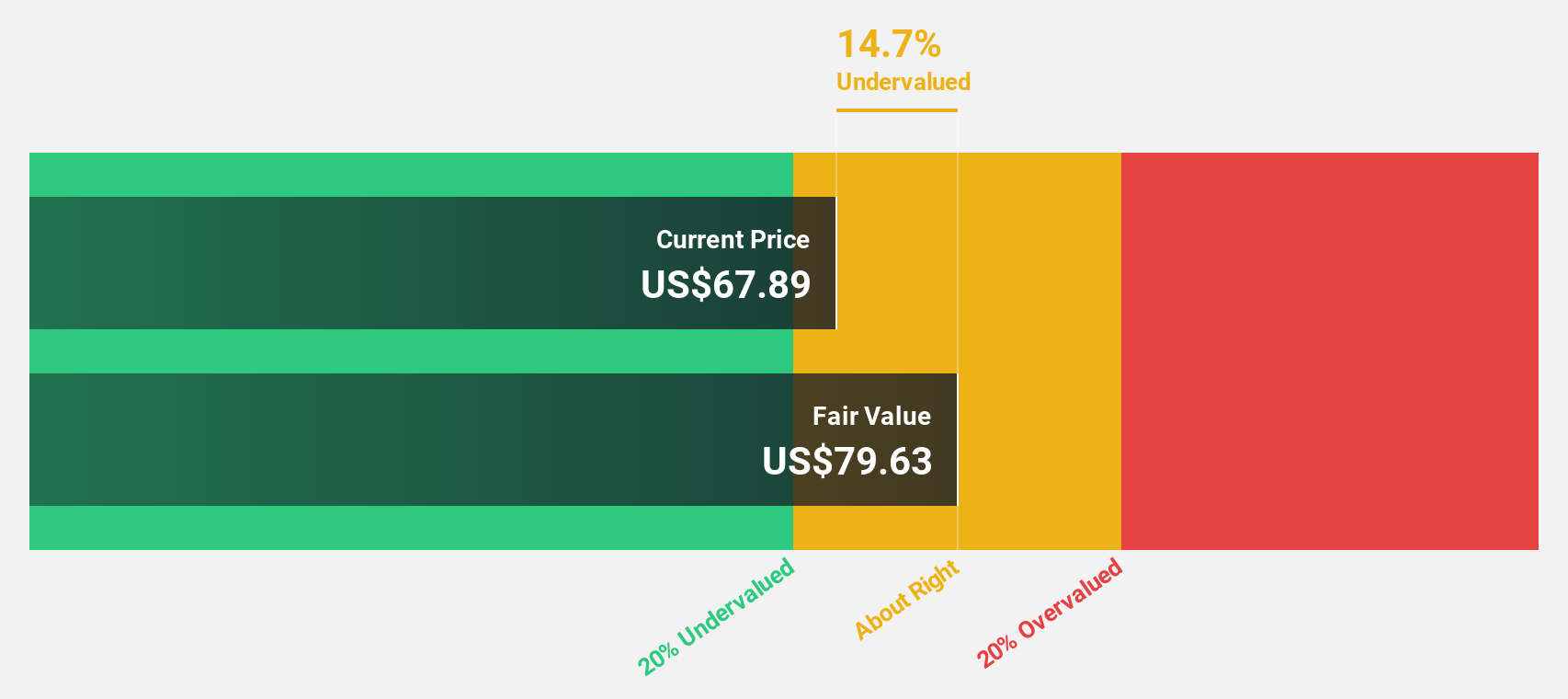

Oddity Tech (NasdaqGM:ODD)

Overview: Oddity Tech Ltd. is a consumer tech company focused on creating digital-first brands in the beauty and wellness sectors, with a market cap of $3.43 billion.

Operations: Revenue segments for Oddity Tech Ltd. include its digital-first brands in the beauty and wellness industries, serving both the United States and international markets.

Estimated Discount To Fair Value: 17.6%

Oddity Tech is trading at US$63.89, below its estimated fair value of US$77.54, suggesting potential undervaluation. Recent guidance indicates revenue growth between 22% and 23% for 2025, surpassing prior expectations and highlighting strong cash flow prospects. Earnings are forecast to grow significantly at 21.53% annually over the next three years, with a high return on equity projected in three years (28.9%). However, the stock has experienced high volatility recently.

- According our earnings growth report, there's an indication that Oddity Tech might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Oddity Tech.

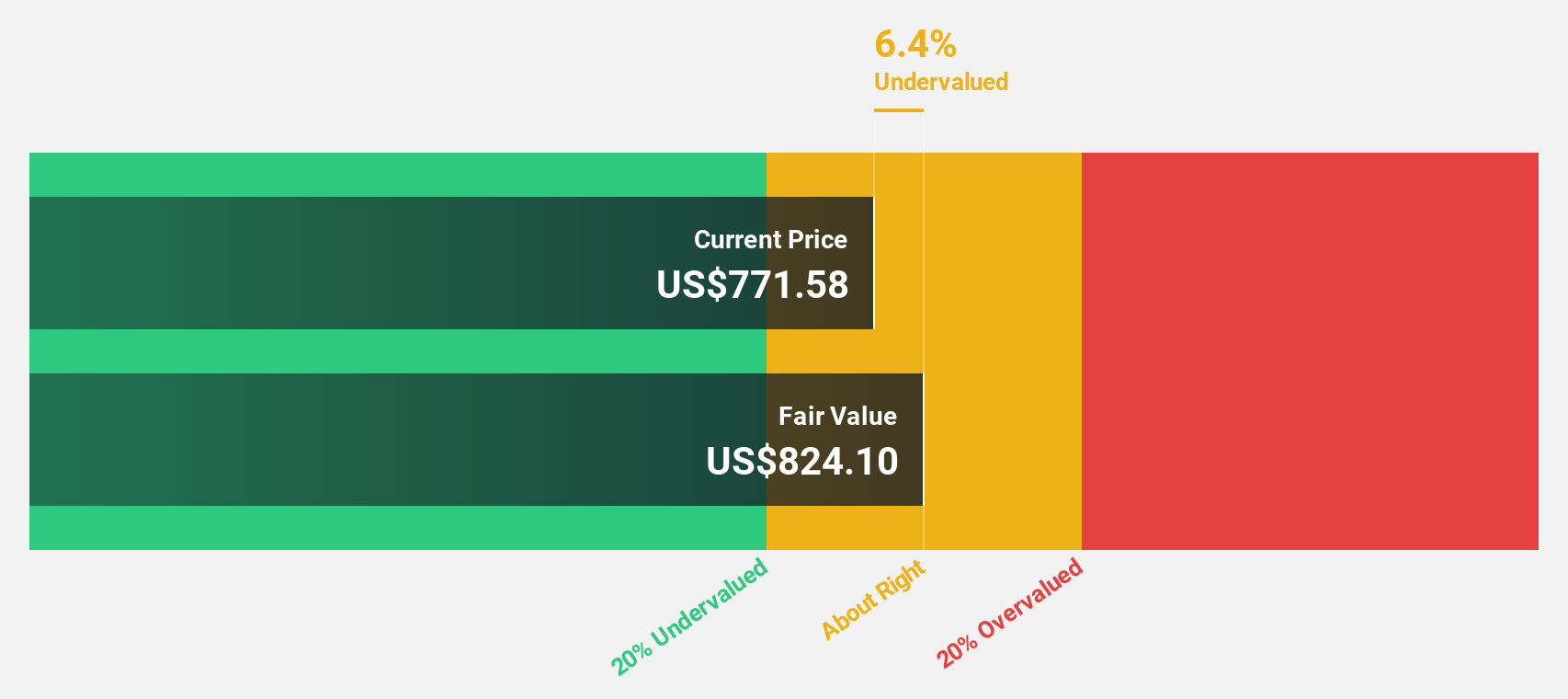

Intuit (NasdaqGS:INTU)

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services in the United States with a market cap of approximately $175.42 billion.

Operations: Intuit's revenue is derived from four main segments: Pro-Tax ($594 million), Consumer ($4.45 billion), Credit Karma ($1.96 billion), and Global Business Solutions ($10.16 billion).

Estimated Discount To Fair Value: 18.7%

Intuit is trading at US$623.19, below its estimated fair value of US$766.97, indicating undervaluation based on cash flows. Despite modest earnings growth forecasts of 16.3% annually, revenue is expected to outpace the market at 11.3% per year. Recent product enhancements like Tap to Pay on iPhone bolster QuickBooks' offerings and address small business cash flow challenges, enhancing Intuit's value proposition amidst insider selling concerns and completed share buybacks worth US$7.72 billion since August 2018.

- The growth report we've compiled suggests that Intuit's future prospects could be on the up.

- Navigate through the intricacies of Intuit with our comprehensive financial health report here.

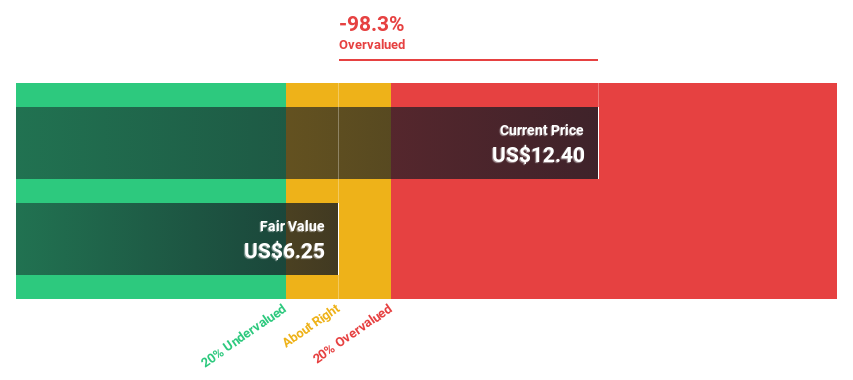

CNH Industrial (NYSE:CNH)

Overview: CNH Industrial N.V. is an equipment and services company involved in the design, production, marketing, sale, and financing of agricultural and construction equipment across various global regions, with a market cap of approximately $14.44 billion.

Operations: CNH Industrial generates revenue through its agricultural and construction equipment operations, which include design, production, marketing, sales, and financing services across North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

Estimated Discount To Fair Value: 15.9%

CNH Industrial is currently trading at US$12.41, below its fair value estimate of US$14.75, reflecting undervaluation based on cash flows. Despite slower revenue growth projections compared to the market, CNH's earnings are expected to grow significantly at 20.3% annually over the next three years. Recent financial results show a decline in sales and net income year-over-year, while debt coverage by operating cash flow remains a concern amidst leadership changes and strategic acquisitions focus.

- Upon reviewing our latest growth report, CNH Industrial's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in CNH Industrial's balance sheet health report.

Taking Advantage

- Discover the full array of 179 Undervalued US Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CNH Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNH

CNH Industrial

An equipment and services company, engages in the design, production, marketing, sale, and financing of agricultural and construction equipment in North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives