- United States

- /

- Machinery

- /

- NYSE:CMI

How Investors May Respond To Cummins (CMI) Natural Gas Truck Partnership with Allison and Kenworth

Reviewed by Sasha Jovanovic

- Earlier this month, Allison Transmission announced the successful integration of its 4500 Rugged Duty Series fully automatic transmission with the Cummins X15N natural gas engine in Kenworth T880 tractors, highlighting a noteworthy step for sustainable heavy-duty transportation.

- This collaboration showcases Cummins' expanding role in enabling cleaner fleet solutions without sacrificing operational performance, further aligning with industry momentum toward sustainable energy alternatives.

- We'll explore how Cummins' advances in natural gas engine technology could influence the company's earnings outlook and sector positioning.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cummins Investment Narrative Recap

For those considering Cummins as a long-term investment, belief in the company's ability to drive profitable growth through cleaner powertrain innovations and reliable earnings from its diversified segments is critical. While the recent integration of Cummins' X15N natural gas engine with Allison's transmission is a strong signal of progress in sustainable transportation, it does not materially change the most immediate short-term catalyst, steady demand in power systems, or mute the largest risk, which remains cyclical weakness in North American truck markets.

The September launch of Pioneer Clean Fleet Solutions, a partnership involving Cummins for leasing low-carbon commercial vehicles, is particularly relevant as it advances adoption of the very technologies highlighted in the latest engine-transmission integration, reinforcing a catalyst for growth amid evolving emissions regulations and energy preferences.

By contrast, investors should keep in mind that ongoing uncertainty over North American heavy-duty truck demand still presents key challenges for Cummins...

Read the full narrative on Cummins (it's free!)

Cummins' outlook anticipates $40.6 billion in revenue and $4.3 billion in earnings by 2028. Achieving this will require annual revenue growth of 6.4% and an increase in earnings of $1.4 billion from the current $2.9 billion.

Uncover how Cummins' forecasts yield a $431.98 fair value, a 5% upside to its current price.

Exploring Other Perspectives

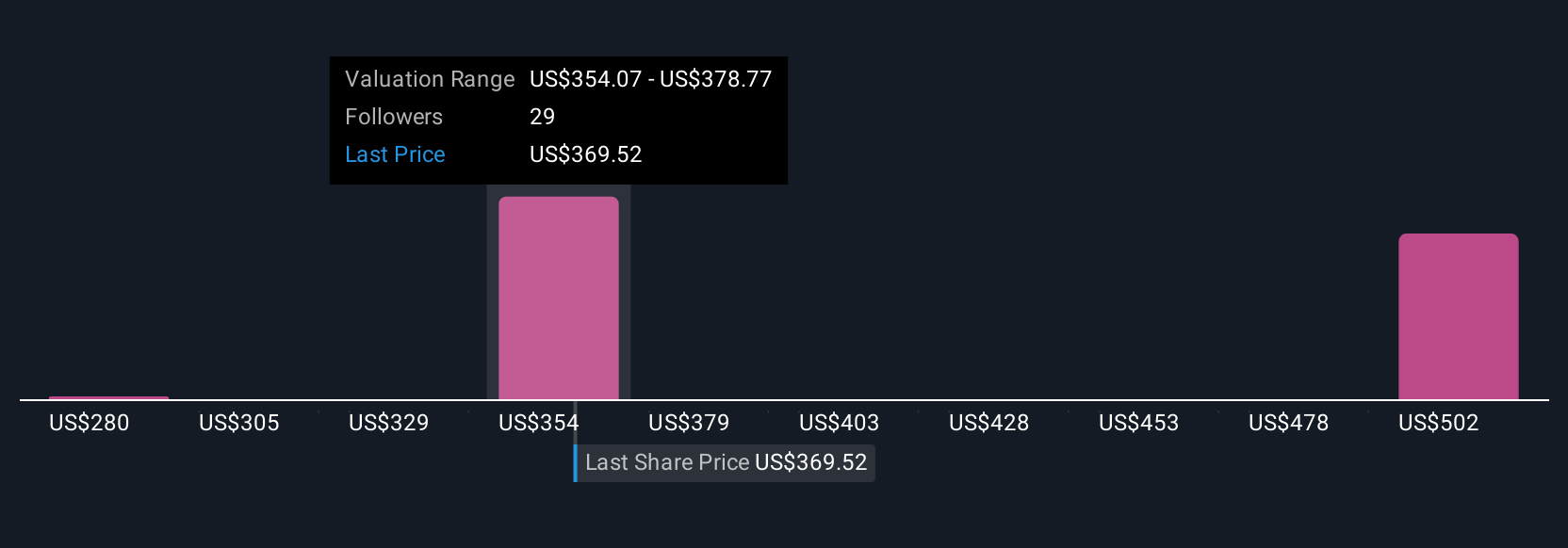

Simply Wall St Community members have fair value estimates for Cummins ranging from US$280 to US$609, with five unique perspectives captured. As product innovation quickens, your view on cyclical risks may shape how you interpret this wide valuation spread, consider how different approaches frame opportunity and risk.

Explore 5 other fair value estimates on Cummins - why the stock might be worth as much as 48% more than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives