- United States

- /

- Machinery

- /

- NYSE:CAT

Is It Time to Reassess Caterpillar After Norway Wealth Fund Divestment?

Reviewed by Bailey Pemberton

Thinking about what to do with Caterpillar stock? You are not alone. After a strong run that has seen shares climb 8.4% in the past week and soar an impressive 22.2% over the last month, a lot of investors are wondering what is next. If you have been holding on, it has been a rewarding ride, with Caterpillar up 46.6% year-to-date and 244.4% over the last five years. That is the kind of performance that tends to get attention, especially when headlines start swirling about the Norway sovereign wealth fund divesting on ethical grounds or speculation about Warren Buffett taking a discreet interest.

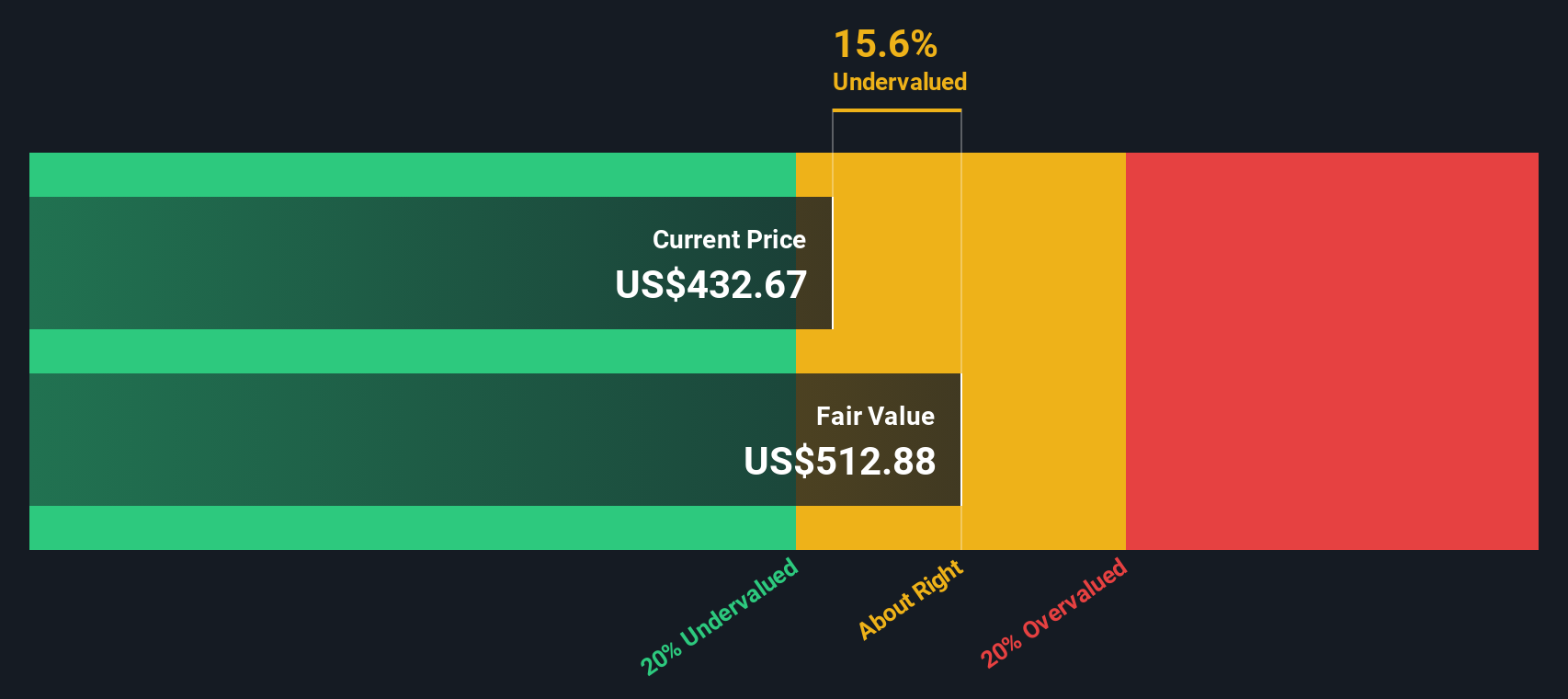

All of this excitement makes it tempting to focus solely on headlines, but a closer look at value can add some much-needed perspective. Based on six key valuation checks, Caterpillar is undervalued in just one of them, giving it a valuation score of 1 out of 6. Is that enough to get bullish, or should we start thinking about risk instead? In the following sections, we will break down Caterpillar’s valuation using different methods, and I will also share a smarter way I think about whether a stock is truly a bargain or not.

Caterpillar scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Caterpillar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today’s value. This method tries to work out what all those future dollars earned are truly worth in today’s terms, offering a grounded look at a company's intrinsic value based on its ability to generate cash.

For Caterpillar, the latest free cash flow sits at approximately $8.28 Billion. Analysts predict steady growth, with projections of free cash flow reaching $13.92 Billion by 2029. While analysts typically look out about five years, projections beyond that are extrapolated using assumptions about future growth rates, as done here by Simply Wall St. These cash flows form the central inputs to the DCF calculation, all measured in US Dollars.

Using this framework, Caterpillar’s estimated intrinsic value per share is $511.60. This figure is only 3.1% higher than its current share price, suggesting the stock is just slightly overvalued according to the DCF model.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Caterpillar's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Caterpillar Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Caterpillar. It indicates how much investors are willing to pay today for a dollar of future earnings. When a business has strong profits, stable growth, and predictable cash generation, the PE ratio provides a quick view of whether a stock is reasonably priced relative to its earnings power.

Of course, not all companies deserve the same PE. Higher growth and lower risk typically justify a higher PE, while slower growth and greater risk require a lower PE. These expectations create a natural range for what can be considered a "fair" PE ratio.

Turning to Caterpillar, its current PE stands at 26.2x. This is higher than both the peer average of 19.5x and the broader Machinery industry average of 23.5x. This premium suggests the market expects either faster growth or less risk for Caterpillar compared to its peers. However, how much of this is justified?

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Caterpillar is 36.0x, which takes into account its earnings growth outlook, profit margins, industry context, company size, and inherent business risks. Unlike a straight comparison with peers or the industry, the Fair Ratio is designed to reflect the true value of the company based on a much broader set of real-world factors.

Comparing Caterpillar’s actual PE of 26.2x with its Fair Ratio of 36.0x, shares appear attractively priced, trading well below what would typically be justified given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Caterpillar Narrative

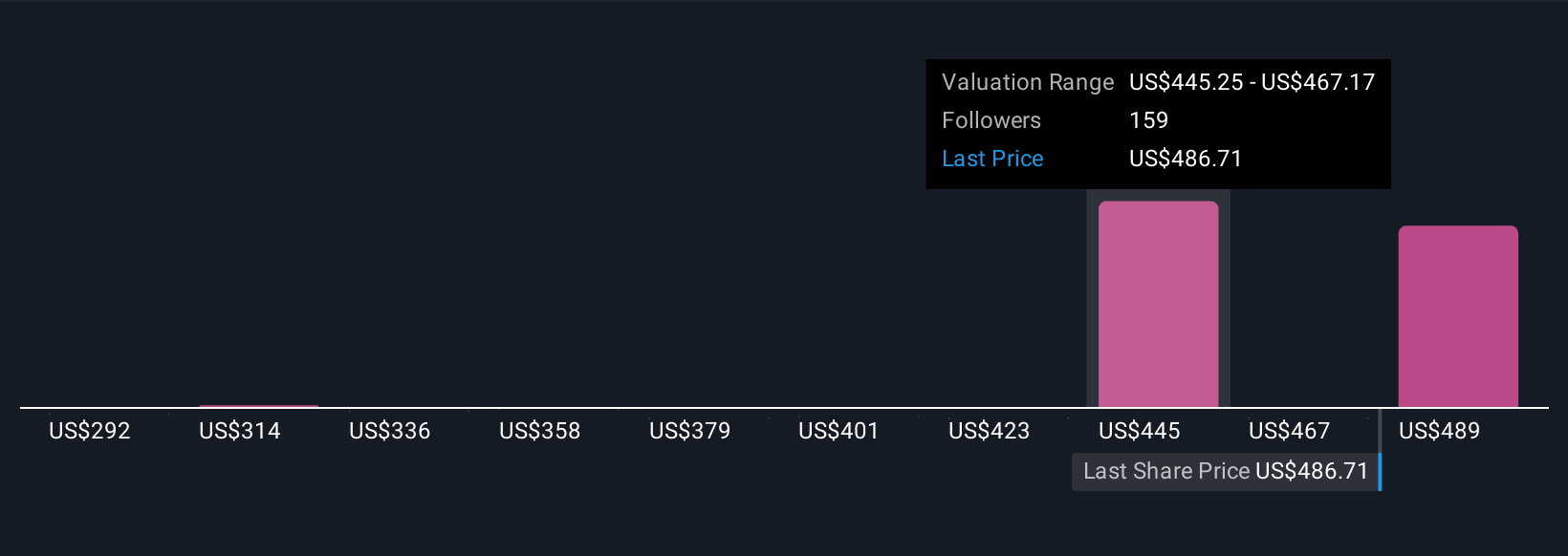

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply a story about a company’s future, reflecting your perspective or belief, expressed clearly and linked directly to your financial forecasts, such as expected revenue, margins, and fair value. Rather than just looking at numbers in isolation, Narratives connect Caterpillar’s business story and recent events to a valuation, allowing you to see how assumptions shape the range of fair values investors might set.

You do not need to be a finance expert. On Simply Wall St’s Community page, millions of investors can easily create or explore Narratives that show their take on a company’s future, all in a structured and visual format. Narratives empower you to make smarter buy or sell decisions by comparing fair value from each story against Caterpillar’s share price, as well as seeing how new earnings, headlines, or events automatically refresh the Narrative and its valuation so you are always up to date.

For example, right now, investors examining Caterpillar’s future have set fair value estimates as high as $507.00 and as low as $350.00, depending on how optimistic or cautious they are about infrastructure demand, margin expansion, and industry risks. Narratives put these perspectives side by side, so you can find the scenario that best fits your own view and decide when value really exists.

Do you think there's more to the story for Caterpillar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives