- United States

- /

- Building

- /

- NYSE:CARR

Carrier Global (NYSE:CARR) Partners With Google Cloud For Smarter Energy Management And Grid Flexibility

Reviewed by Simply Wall St

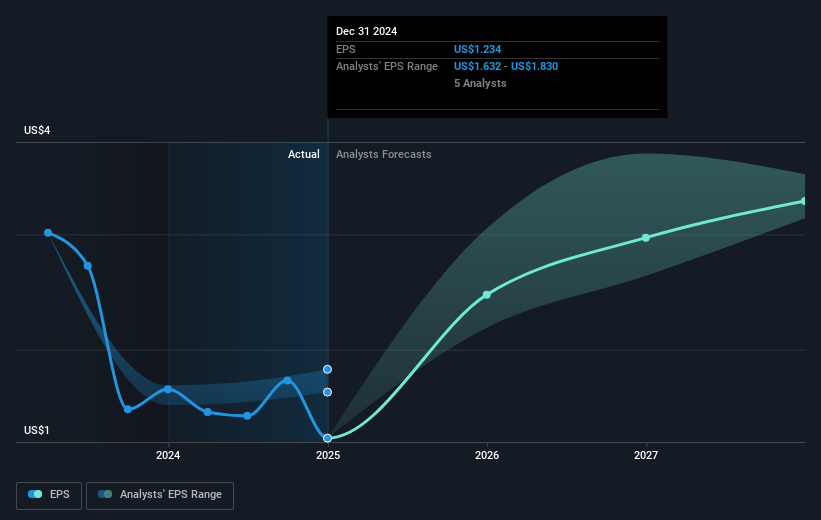

Carrier Global (NYSE:CARR) recently announced a partnership with Google Cloud to enhance grid flexibility and smarter energy management, which aligns with the company's long-term environmental goals. This collaboration could have supported the company's share price increase of 2.72% over the past month by showcasing its commitment to innovation and technological integration. Additionally, the company's positive fourth-quarter results, with substantial revenue and net income growth, likely bolstered investor confidence. While Carrier's market moves occurred amid broader market declines driven by tariff concerns, its strategic initiatives and strong financial performance may have helped it maintain a positive trajectory. Despite the tech sector experiencing sell-offs, Carrier's positioning in both energy and sustainable technology may have favored its resilience. Such factors suggest the company's recent price movements could be linked to investor optimism surrounding its growth prospects and strategic steps.

Take a closer look at Carrier Global's potential here.

Carrier Global's total shareholder return of 52.06% over the past three years reflects a strong performance. Contributing to this was the significant revenue and net income improvement recently reported for Q4 2024. With revenue increasing from $4.32 billion to $5.15 billion and a net income surging to a very large amount, these financial results underscore the company's operational strength. Another factor is the extensive share buyback program, which saw the repurchase of over 70 million shares since its initiation in February 2021, supporting shareholder value.

Additionally, the launch of Carrier QuantumLeap, aimed at enhancing data center cooling efficiency, signals the company's commitment to innovation—a key component of its long-term growth strategy. Despite Carrier being more expensive compared to peers based on its price-to-earnings ratio, its stock returns have aligned with the broader US market over the last year, reflecting a balanced investor perspective on its future prospects.

- Analyze Carrier Global's fair value against its market price in our detailed valuation report—access it here.

- Assess the potential risks impacting Carrier Global's growth trajectory—explore our risk evaluation report.

- Already own Carrier Global? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Moderate growth potential with imperfect balance sheet.