- United States

- /

- Building

- /

- NYSE:CARR

Carrier Global (NYSE:CARR) Invests Additional US$1 Billion in U.S. Expansion and Innovation

Reviewed by Simply Wall St

Carrier Global (NYSE:CARR) recently announced a significant $1 billion investment plan aimed at expanding U.S. manufacturing and workforce, potentially impacting its share price by 26% over the last month. This boost aligns with the company's strategy to enhance R&D and create thousands of jobs, adding weight to the broader market rally where the Dow and Nasdaq rose amid eased U.S.-China tariffs and a positive inflation report. Additionally, Carrier's improved earnings, revised 2025 guidance, and ongoing share buybacks complemented these gains, reflecting a positive investor sentiment in line with the market's upward trend.

The recent $1 billion investment plan by Carrier Global could significantly bolster the company's ongoing strategy to enhance R&D and job creation, potentially increasing its market presence and competitive edge. Over the past five years, Carrier's total return was a very large 349.27%, reflecting strong long-term shareholder benefits. In the past year, Carrier outperformed the US Building industry, which saw a 10.3% return, showcasing its resilience and market capability.

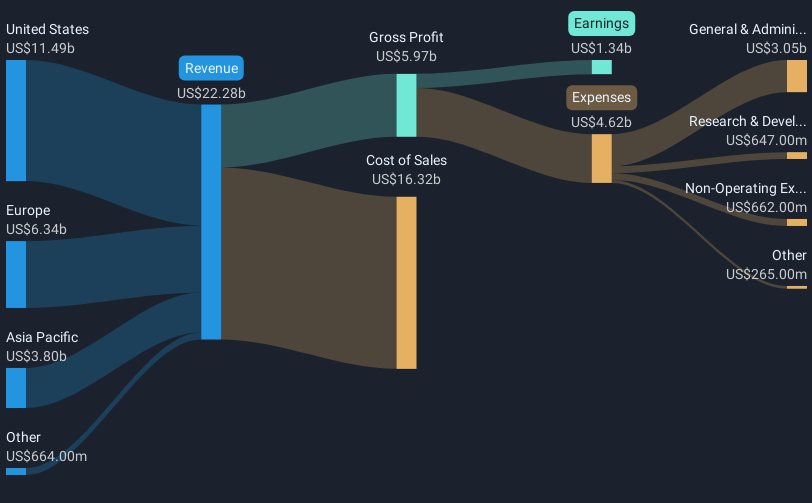

Looking at the company's revenue and earnings forecasts, the strategic expansion into areas like smart energy solutions and data center cooling markets aligns with this investment boost, providing a pathway to capture more market share and improve profitability. Analysts project annual revenue growth of 5.3% over the next three years, supported by operational efficiencies and the Viessmann acquisition. The most recent earnings forecast anticipates a rise to US$2.7 billion by 2028. With a share price of US$70.19, this places it 9.3% below the US$77.4 analyst price target, suggesting room for potential upside based on future growth expectations and strategic initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CARR

Carrier Global

Provides intelligent climate and energy solutions in the United States, Europe, the Asia Pacific, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives