- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Boeing (BA) Unveils 3D-Printed Solar Array Tech With 50% Production Improvement

Reviewed by Simply Wall St

Boeing (BA), with its recent unveiling of a 3D-printed solar array substrate, is set to enhance production efficiency and reduce costs, which aligns well with recent market trends. Over the past quarter, Boeing's share price rose by 12%, reflecting broader gains seen in major indices as rate cut hopes boosted stock prices. The company's client announcements, including large jet orders from WestJet and Macquarie AirFinance, and strategic deliveries in its commercial and defense sectors, likely added momentum to its positive price movement, while market optimism over potential Fed rate cuts further supported this gain.

Every company has risks, and we've spotted 1 weakness for Boeing you should know about.

The unveiling of Boeing's 3D-printed solar array substrate could potentially solidify its position as an innovative leader in the aerospace industry. This technological advancement may enhance production efficiency and cost reduction, aligning with the narrative of strong demand and backlog primarily driven by global air travel expansion. Over the longer term, Boeing has seen its shares achieve a total return of 52.43% over the past three years, reflecting positive investor sentiment amidst evolving market conditions. Compared to the robust 19.1% return of the US market over the last year, Boeing's performance outpaced market averages, underscoring its resilience.

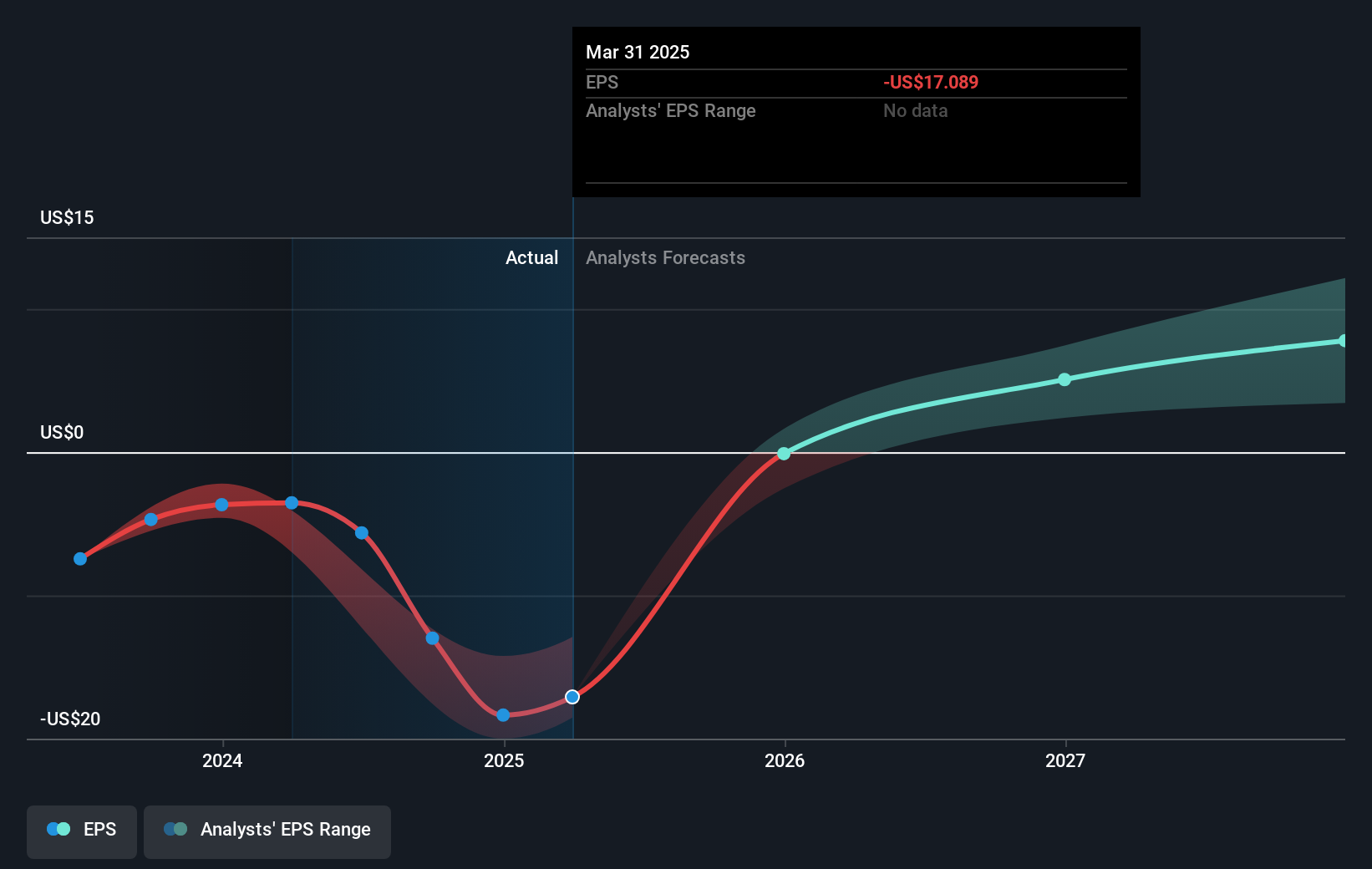

The recent announcements of large jet orders and strategic industry activities might positively impact Boeing's revenue and earnings forecasts. Analysts project the company to grow revenues at an annual pace of 12.1% while becoming profitable within three years. These developments might bolster analyst optimism reflected in the US$252.57 price target. The current share price of US$227.52 presents a modest 11% discount to this target, indicating potential investor confidence in Boeing's strategies to achieve projected earnings growth. The success of new technologies and expanding orders could reinforce its growth, although risks such as ongoing production delays and financial strain remain.

Review our historical performance report to gain insights into Boeing's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026