- United States

- /

- Construction

- /

- NYSE:AGX

3 US Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a period of uncertainty with the Dow Jones Industrial Average facing its longest losing streak since 1978, investors are keenly watching for signals from the Federal Reserve's upcoming rate decision. Amidst this backdrop, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for those looking to navigate these volatile conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $26.67 | $53.13 | 49.8% |

| Microchip Technology (NasdaqGS:MCHP) | $58.29 | $113.86 | 48.8% |

| Afya (NasdaqGS:AFYA) | $15.13 | $29.38 | 48.5% |

| West Bancorporation (NasdaqGS:WTBA) | $23.39 | $46.42 | 49.6% |

| Live Oak Bancshares (NYSE:LOB) | $42.99 | $83.98 | 48.8% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.49 | $63.31 | 48.7% |

| U.S. Physical Therapy (NYSE:USPH) | $94.98 | $187.03 | 49.2% |

| Constellium (NYSE:CSTM) | $10.91 | $21.69 | 49.7% |

| Equifax (NYSE:EFX) | $273.67 | $534.78 | 48.8% |

| AirSculpt Technologies (NasdaqGM:AIRS) | $6.29 | $12.46 | 49.5% |

Let's review some notable picks from our screened stocks.

Datadog (NasdaqGS:DDOG)

Overview: Datadog, Inc. operates an observability and security platform for cloud applications globally, with a market cap of approximately $52.94 billion.

Operations: The company's revenue is primarily derived from its IT Infrastructure segment, which generated $2.54 billion.

Estimated Discount To Fair Value: 15.1%

Datadog is trading at US$156.91, below its estimated fair value of US$184.74, suggesting it's undervalued based on cash flows despite significant insider selling recently. The company became profitable this year with third-quarter sales reaching US$690 million and net income at US$51.7 million. Revenue growth is forecasted at 18% annually, outpacing the broader U.S. market's 9.1%, while earnings are expected to grow significantly over the next three years.

- The growth report we've compiled suggests that Datadog's future prospects could be on the up.

- Navigate through the intricacies of Datadog with our comprehensive financial health report here.

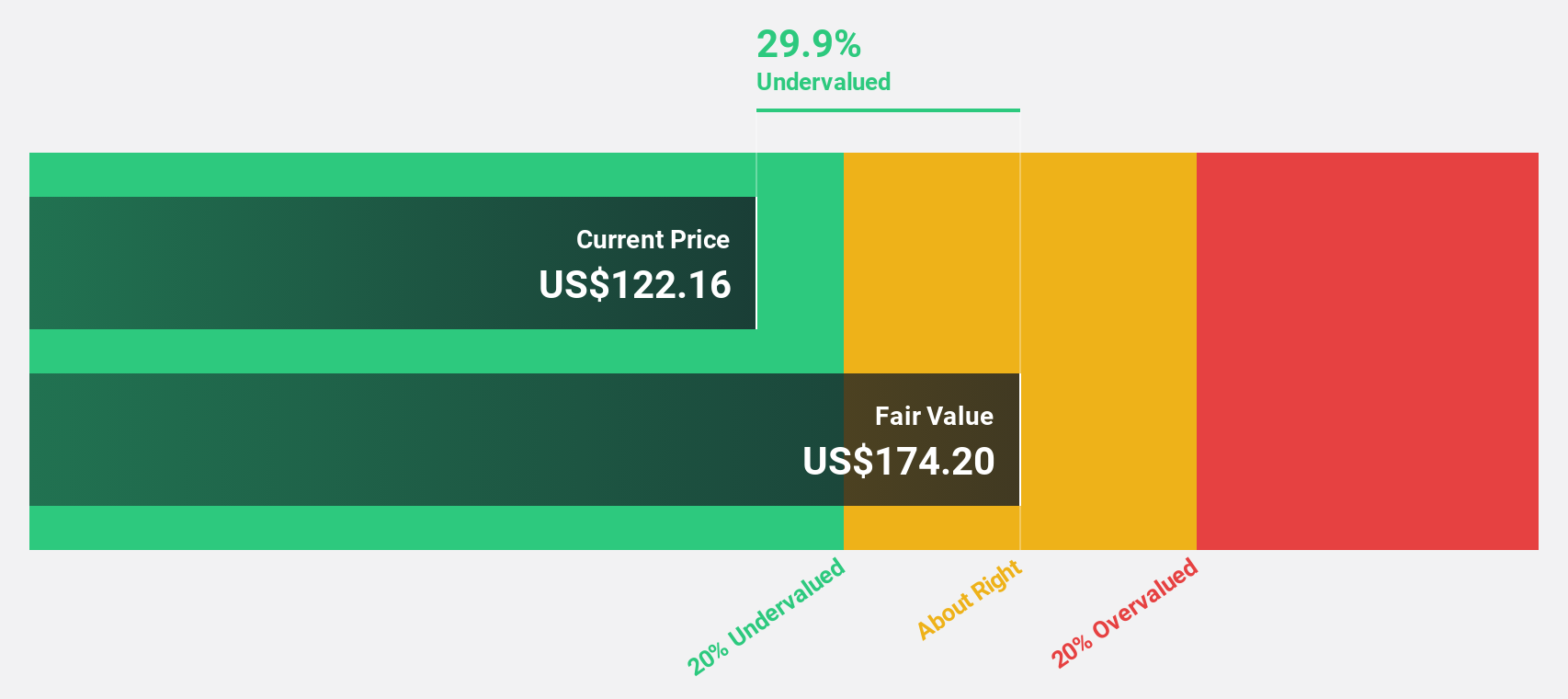

Palomar Holdings (NasdaqGS:PLMR)

Overview: Palomar Holdings, Inc. is a specialty insurance company offering property and casualty insurance to residential and business clients in the United States, with a market cap of $2.97 billion.

Operations: The company's revenue is primarily derived from its Earthquake, Wind, and Flood Insurance Products, totaling $503.50 million.

Estimated Discount To Fair Value: 35.3%

Palomar Holdings, trading at US$111.15, is significantly undervalued with a fair value estimate of US$171.72. Recent earnings reports show strong performance with third-quarter revenue rising to US$148.5 million and net income at US$30.5 million, reflecting robust growth compared to the previous year. Despite these positives, insider selling and past shareholder dilution could be concerns for investors evaluating its cash flow valuation advantages amidst expected high revenue and earnings growth rates surpassing market averages.

- In light of our recent growth report, it seems possible that Palomar Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Palomar Holdings' balance sheet health report.

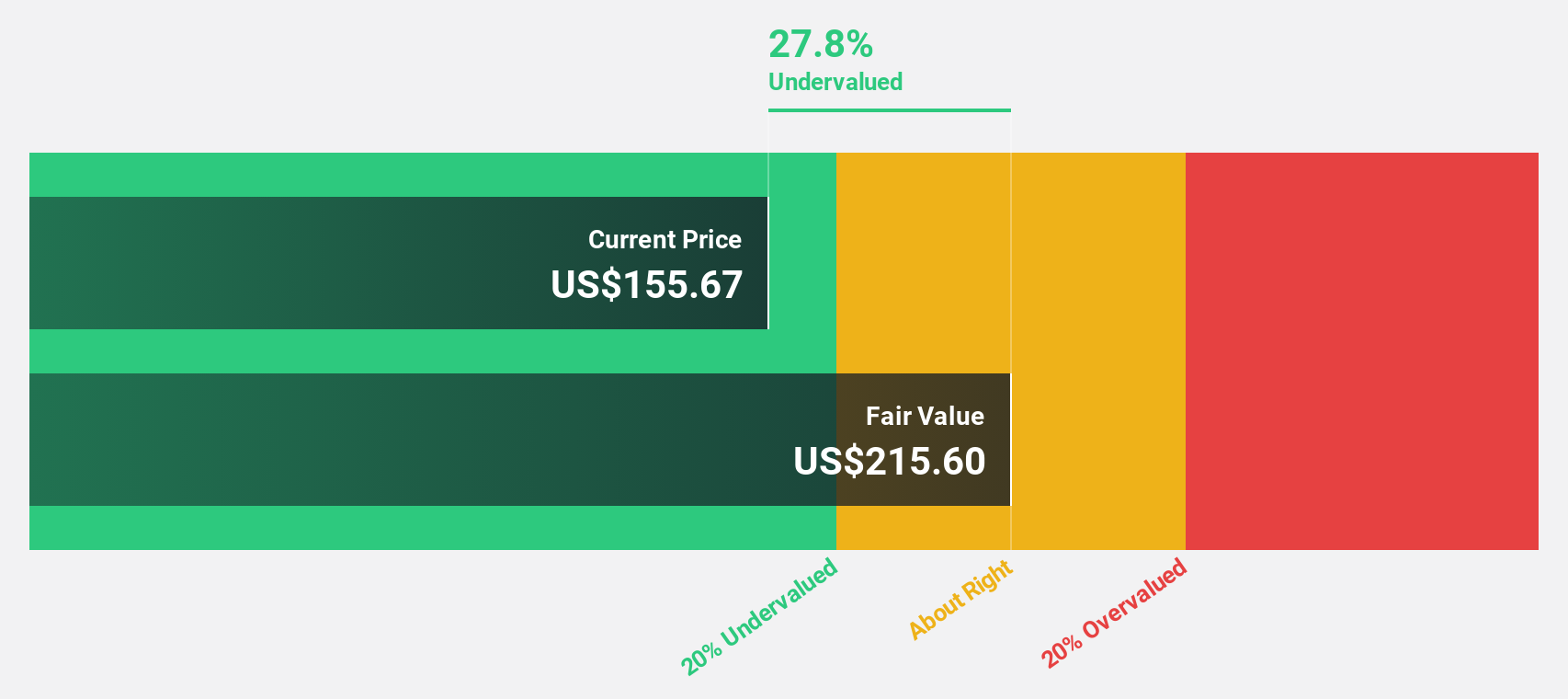

Argan (NYSE:AGX)

Overview: Argan, Inc., with a market cap of $1.99 billion, operates through its subsidiaries to offer engineering, procurement, construction, commissioning, maintenance, project development and technical consulting services primarily for the power generation market.

Operations: Revenue segments for the company include Power Services at $615.58 million, Telecom Services at $14.70 million, and Industrial Services at $175.98 million.

Estimated Discount To Fair Value: 47.3%

Argan, Inc., trading at US$146.66, is significantly undervalued with a fair value estimate of US$278.25. The company reported strong third-quarter results with sales of US$257.01 million and net income of US$28.01 million, marking substantial improvement from the previous year. Earnings are expected to grow at 21.2% annually, outpacing the market average, while recent dividend affirmations and buybacks highlight shareholder-friendly policies amidst its solid cash flow position.

- Our expertly prepared growth report on Argan implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Argan with our detailed financial health report.

Key Takeaways

- Explore the 185 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGX

Argan

Through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market.

Outstanding track record with flawless balance sheet and pays a dividend.