Some WillScot Holdings Corporation (NASDAQ:WSC) shareholders may be a little concerned to see that the Executive VP, Hezron Lopez, recently sold a substantial US$788k worth of stock at a price of US$39.38 per share. That sale reduced their total holding by 26% which is hardly insignificant, but far from the worst we've seen.

See our latest analysis for WillScot Holdings

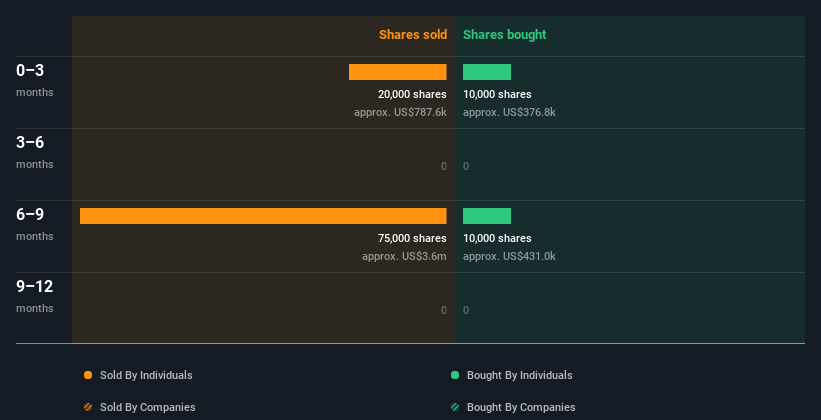

WillScot Holdings Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Independent Director, Jeffrey Sagansky, for US$3.6m worth of shares, at about US$47.50 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$36.96. So it may not shed much light on insider confidence at current levels.

In total, WillScot Holdings insiders sold more than they bought over the last year. They sold for an average price of about US$45.79. Insider selling doesn't make us excited to buy. But the selling was at much higher prices than the current share price (US$36.96), so it probably doesn't tell us a lot about the value on offer today. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Does WillScot Holdings Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. WillScot Holdings insiders own about US$184m worth of shares (which is 2.6% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The WillScot Holdings Insider Transactions Indicate?

Unfortunately, there has been more insider selling of WillScot Holdings stock, than buying, in the last three months. Despite some insider buying, the longer term picture doesn't make us feel much more positive. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To help with this, we've discovered 4 warning signs (1 is a bit concerning!) that you ought to be aware of before buying any shares in WillScot Holdings.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if WillScot Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WSC

WillScot Holdings

Provides turnkey temporary space solutions in the United States, Canada, and Mexico.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives