- United States

- /

- Machinery

- /

- NasdaqGS:RAIL

FreightCar America, Inc. (NASDAQ:RAIL) Soars 25% But It's A Story Of Risk Vs Reward

FreightCar America, Inc. (NASDAQ:RAIL) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

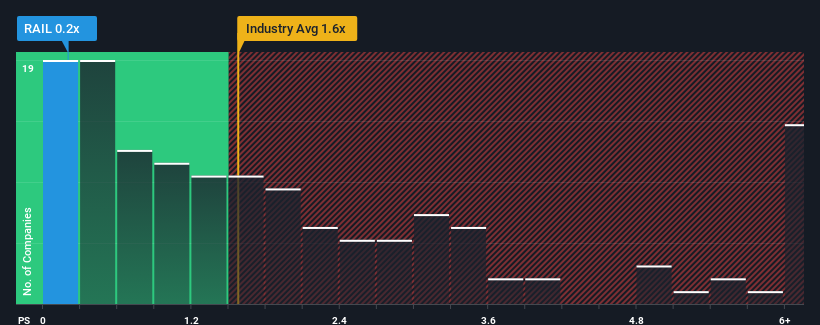

Even after such a large jump in price, FreightCar America may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Machinery industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for FreightCar America

What Does FreightCar America's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, FreightCar America's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on FreightCar America will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like FreightCar America's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.8%. Even so, admirably revenue has lifted 230% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 39% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 1.5%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that FreightCar America's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift FreightCar America's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems FreightCar America currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for FreightCar America you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RAIL

FreightCar America

Through its subsidiaries, engages in design, manufacture, and sale of railcars and railcar components for the transportation of bulk commodities and containerized freight products in the United States and Mexico.

Undervalued with moderate growth potential.