- United States

- /

- Capital Markets

- /

- NYSE:AC

Undiscovered Gems In The US Market Featuring Three Promising Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.6% decline, yet it remains up by 9.1% over the past year with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying stocks that are not only resilient but also poised for growth can be key to uncovering promising opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Power Solutions International (NasdaqCM:PSIX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems across various regions globally with a market cap of $890.65 million.

Operations: The company generates revenue primarily from its Engineered Integrated Electrical Power Generation Systems, amounting to $516.17 million.

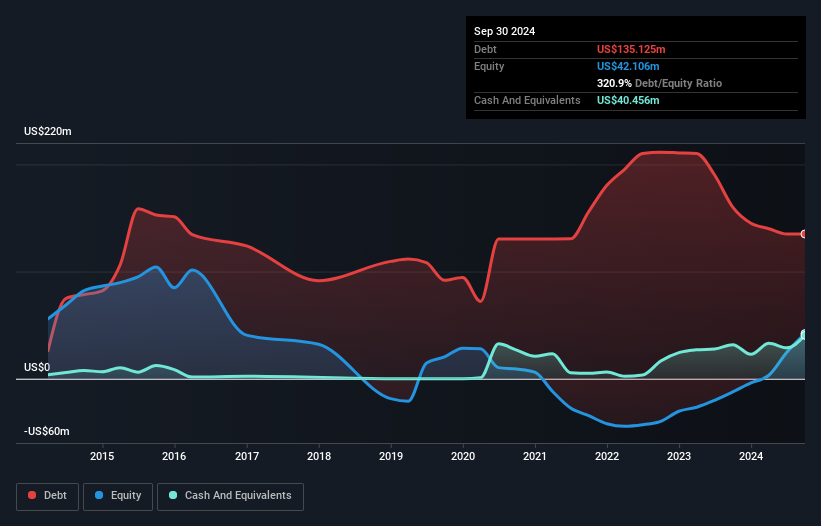

Power Solutions International, a small company in the power systems sector, has seen earnings surge by 173.6% over the past year, outpacing its industry peers who faced an -8.9% change. Despite trading at 24% below its estimated fair value and having a high net debt to equity ratio of 72%, PSI's interest payments are well covered with EBIT at 9.2 times coverage. The company reported US$135 million in sales for Q1 2025 compared to US$95 million last year, but ongoing geopolitical uncertainties cast doubt on future growth projections despite recent strong performance indicators like improved free cash flow and reduced debt levels from five years ago.

Red River Bancshares (NasdaqGS:RRBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Red River Bancshares, Inc. is a bank holding company for Red River Bank, offering a range of banking products and services to commercial and retail customers in the United States, with a market cap of $370.19 million.

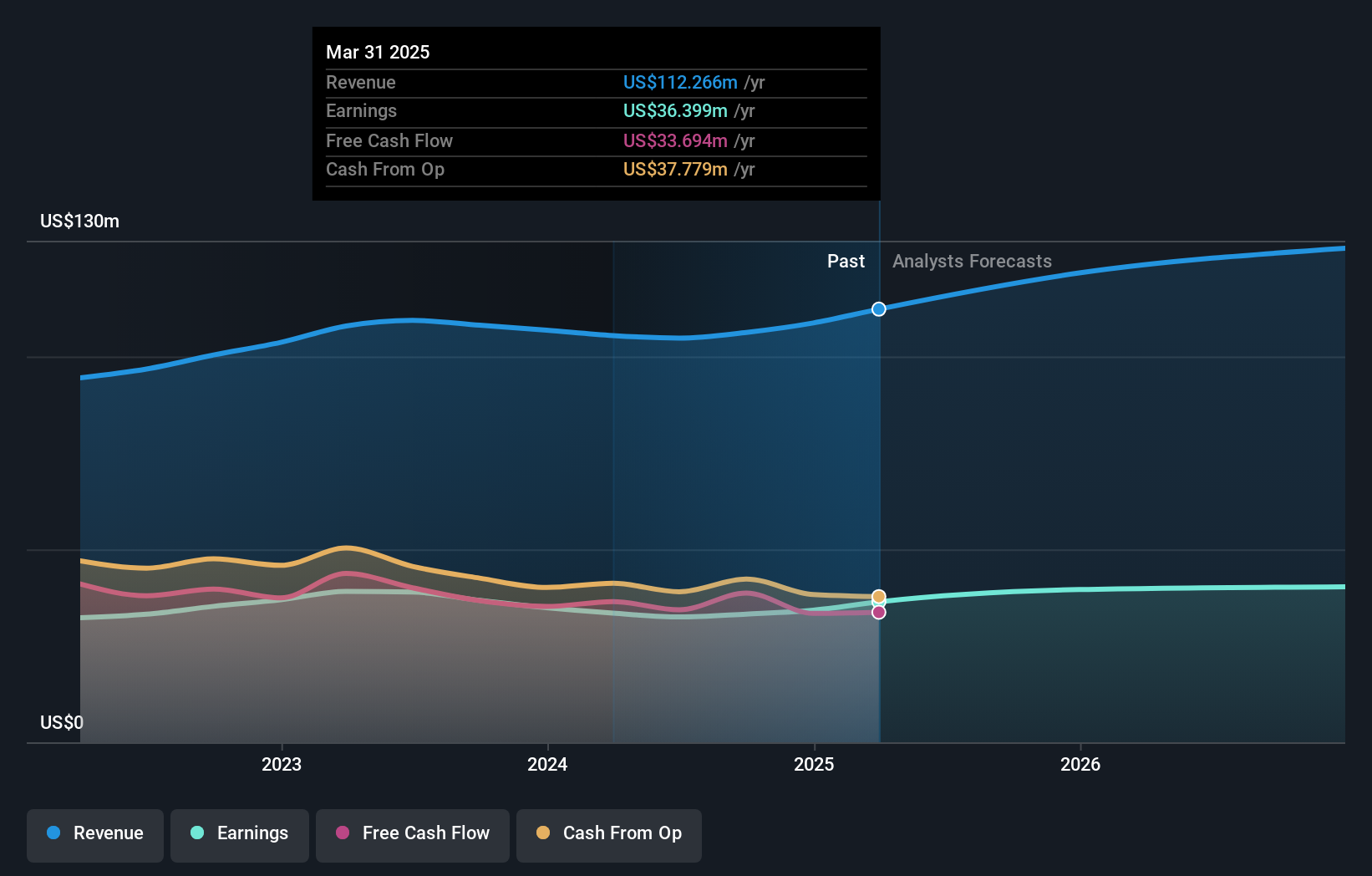

Operations: Red River Bancshares generates revenue primarily through its financial service operations, amounting to $112.27 million. The company's net profit margin is a key indicator of its profitability.

Red River Bancshares, a smaller financial player with total assets of US$3.2 billion and equity of US$333.3 million, stands out for its robust financial health. With total deposits at US$2.8 billion and loans amounting to US$2.1 billion, it operates with a net interest margin of 3%. The bank's allowance for bad loans is notably sufficient at 431%, while non-performing loans are just 0.2%—a reassuringly low figure in the banking sector. Despite trading significantly below its estimated fair value, Red River's earnings grew by 8.8% last year, surpassing industry averages and showcasing high-quality past earnings potential for growth ahead.

- Unlock comprehensive insights into our analysis of Red River Bancshares stock in this health report.

Associated Capital Group (NYSE:AC)

Simply Wall St Value Rating: ★★★★★★

Overview: Associated Capital Group, Inc. operates as an investment advisory firm in the United States, with a market capitalization of approximately $813.80 million.

Operations: AC generates revenue primarily from its investment advisory and asset management services, amounting to $12.29 million.

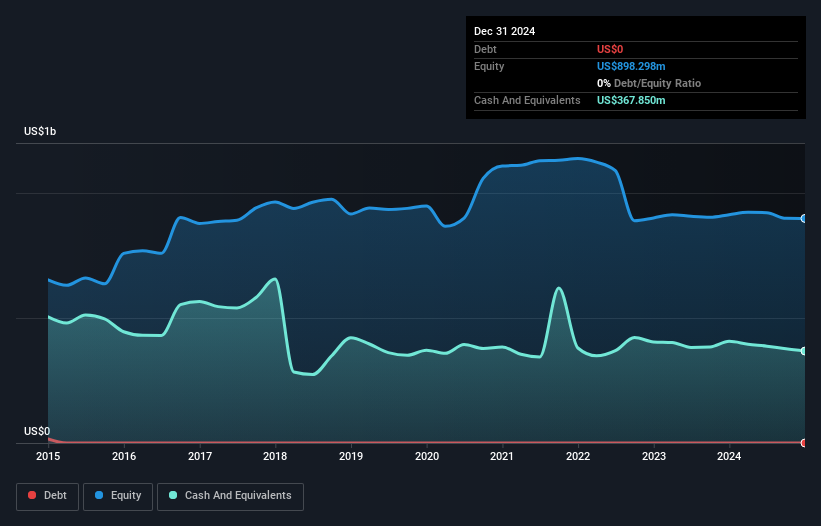

Associated Capital Group, a nimble player in the capital markets, stands out with its debt-free status and a price-to-earnings ratio of 21.3x, which is below the industry average of 28.4x. Despite earnings growth over the past year at 13.9% not keeping pace with the industry's 16%, its five-year annual earnings growth rate of 10.7% reflects steady progress. A significant one-off gain of US$36.9M has impacted recent financial results, highlighting potential volatility in reported figures. Recent executive changes see Patrick Huvane stepping in as Interim CEO following Douglas R. Jamieson's retirement from his executive roles while remaining on the board.

- Click to explore a detailed breakdown of our findings in Associated Capital Group's health report.

Gain insights into Associated Capital Group's past trends and performance with our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 283 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AC

Associated Capital Group

Provides investment advisory services in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives