- United States

- /

- Banks

- /

- NasdaqCM:COFS

Undiscovered Gems In United States Featuring 3 Promising Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.1%, yet it has shown robust growth of 22% over the past year, with earnings projected to increase by 15% annually. In this dynamic environment, identifying promising stocks often involves uncovering lesser-known companies with strong fundamentals and growth potential that align well with these market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Value Rating: ★★★★★★

Overview: ChoiceOne Financial Services, Inc. is a bank holding company for ChoiceOne Bank, offering banking services to corporations, partnerships, and individuals in Michigan with a market cap of $317.28 million.

Operations: ChoiceOne Financial Services generates revenue primarily through its banking segment, with a total of $87.90 million.

ChoiceOne Financial Services, a smaller financial entity with total assets of US$2.7 billion and total equity of US$247.7 million, demonstrates robust fundamentals. It has a significant deposit base of US$2.2 billion against loans totaling US$1.5 billion, suggesting stability in its funding structure as 89% of liabilities are low-risk customer deposits. The bank's allowance for bad loans is sufficient at 569%, while non-performing loans stand at an appropriate level of 0.2%. Recent earnings growth outpaced the industry by 9.8%, reflecting high-quality past earnings and trading below estimated fair value by 41%.

Omega Flex (NasdaqGM:OFLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Omega Flex, Inc. is a company that manufactures and sells flexible metal hoses and accessories both in North America and internationally, with a market cap of $418.91 million.

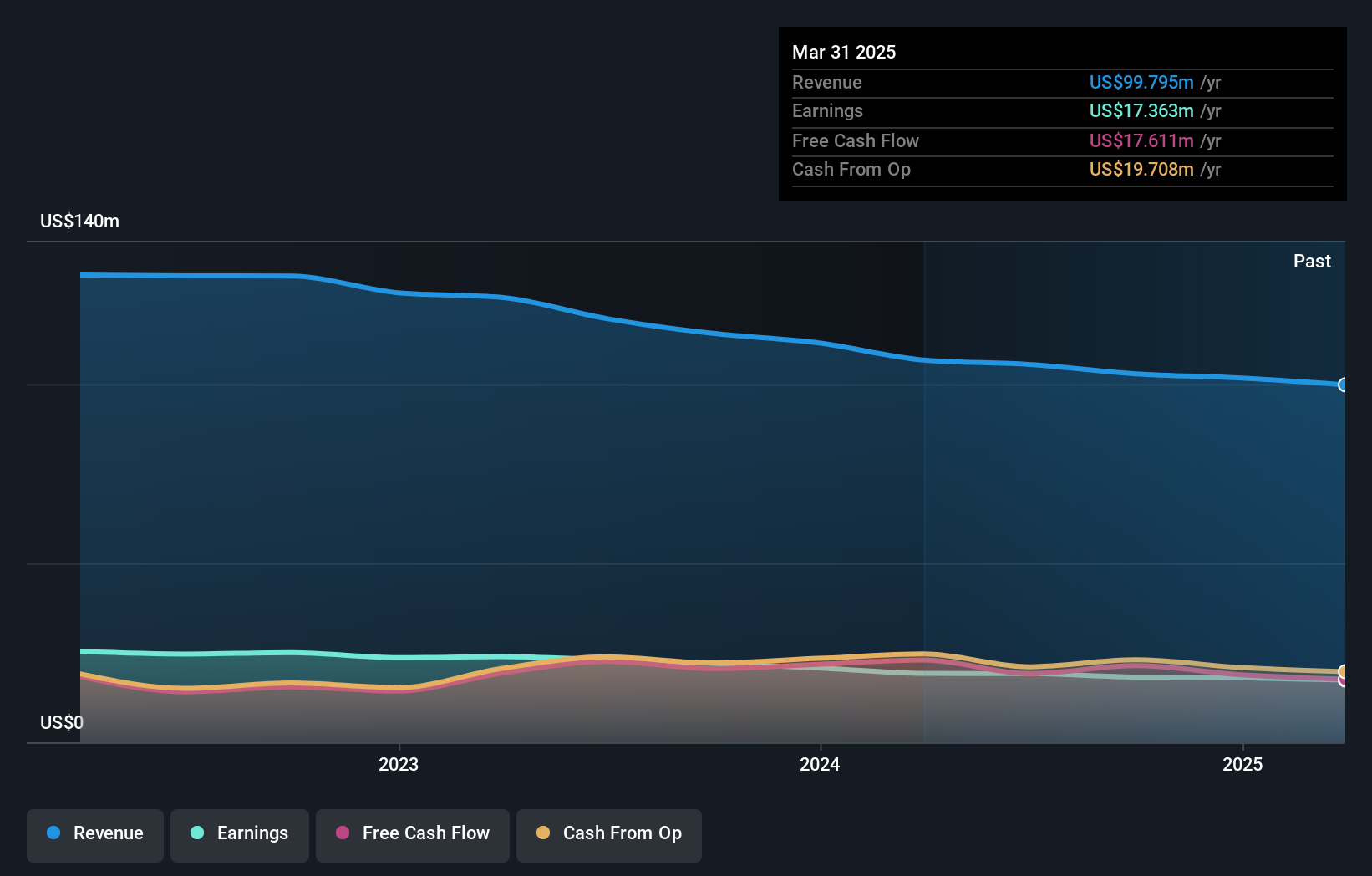

Operations: Omega Flex generates revenue primarily from the manufacture and sale of flexible metal hoses and accessories, amounting to $102.86 million. The company has a market capitalization of $418.91 million.

Omega Flex, a player in the machinery sector, showcases a debt-free balance sheet for the past five years and trades at 23.7% below its estimated fair value, offering potential investment appeal. Despite being profitable with positive free cash flow, recent earnings reveal some challenges; third-quarter sales fell to US$24.88 million from US$27.5 million last year, with net income dropping to US$4.62 million from US$5.58 million previously. The company announced a regular quarterly dividend of $0.34 per share for Q4 2024, reflecting ongoing shareholder returns amidst these mixed results in performance metrics and market positioning.

- Delve into the full analysis health report here for a deeper understanding of Omega Flex.

Gain insights into Omega Flex's past trends and performance with our Past report.

Five Point Holdings (NYSE:FPH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Five Point Holdings, LLC, operates through its subsidiary to own and develop mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County with a market capitalization of approximately $532.04 million.

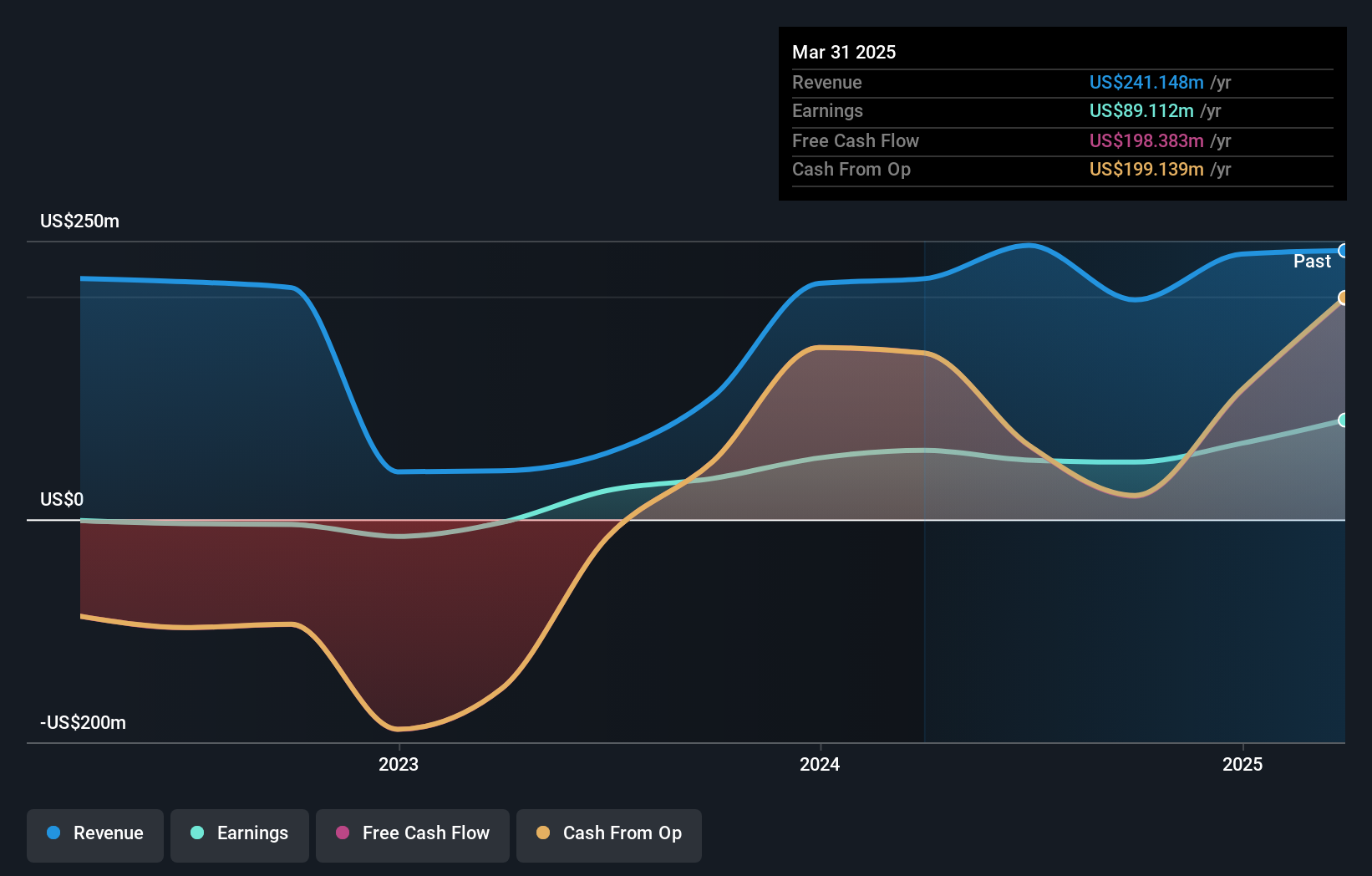

Operations: Five Point Holdings generates revenue primarily from its Great Park and Valencia segments, with Great Park contributing $568.62 million and Valencia adding $103.08 million. The company also records a significant deduction of $475.95 million for the removal of the Great Park Venture from its financials.

Five Point Holdings, a modestly sized player in the real estate sector, has been making waves with its impressive earnings growth of 39.9% over the past year, outpacing the industry's 3.2%. The company's debt to equity ratio has improved significantly from 38% to 28.4% over five years, showcasing better financial health. With a price-to-earnings ratio of just 4.9x compared to the broader US market's 18.3x, it seems attractively valued for investors seeking potential bargains. Recent board changes and strategic shifts might influence future dynamics as they continue navigating industry challenges and opportunities within their niche market space.

- Take a closer look at Five Point Holdings' potential here in our health report.

Evaluate Five Point Holdings' historical performance by accessing our past performance report.

Where To Now?

- Delve into our full catalog of 244 US Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:COFS

ChoiceOne Financial Services

Operates as the bank holding company for ChoiceOne Bank that provides banking services to corporations, partnerships, and individuals in Michigan.

Flawless balance sheet established dividend payer.